As competition among Ethereum Layer 2 chains intensifies, Startail Group positions Soneium as a compliance-first platform rooted in Japan. The company aims to blend financial infrastructure with entertainment-driven deployments in collaboration with partners such as SBI and Sony.

CEO Sota Watanabe spoke to BeInCrypto about long-term vision, growth metrics, decentralization, and regulation. This project aims to stand out globally.

Background: Can Japanese-born L2s participate?

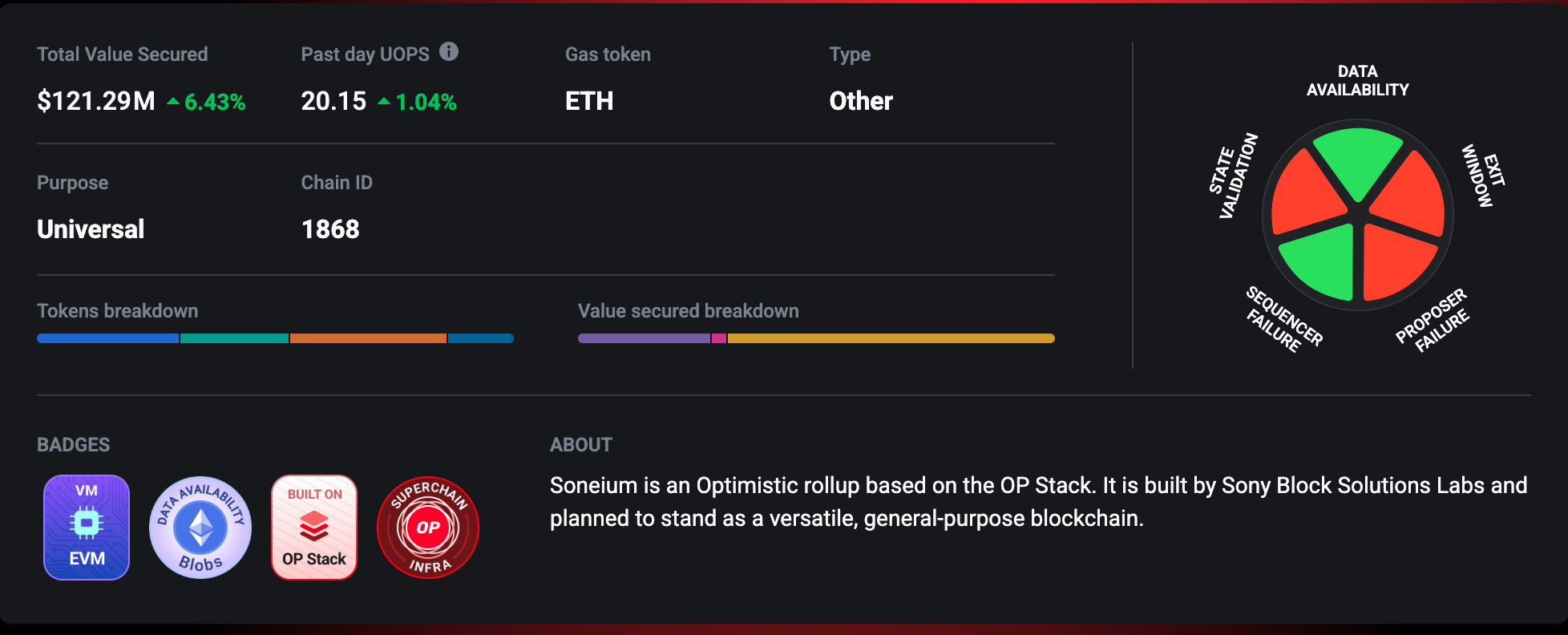

L2BEAT listed Soneium with methodology notes and governance risks. OKLink confirmed high on-chain throughput. Blockscout records ERC-4337 account abstraction operations and provides transparent logging of user-level interactions. Taken together, these signals indicate that Soneium is already operating at real scale with outside oversight. These demonstrate that Japan-born Layer 2 can meet transparency benchmarks set by world leaders.

Sony established a joint venture and incubator in 2023. They announced the development of Soneium in 2024 and launched the mainnet in 2025. Meanwhile, SBI Holdings announced a joint venture plan to link Soneium with capital markets. These partnerships demonstrate how entertainment and finance are converging in Japan's blockchain environment.

Mission and Global Vision: Can Japan Lead?

Startail's medium- and long-term goals are focused on building a global position beyond 2025. The company aims to prove how Japanese-born blockchain can compete at the highest level. With SBI's joint venture Soneium and other initiatives, Startale is expanding its presence in both technology and finance.

However, as the number of projects increases, the vision does not always become clearer. Watanabe said the company was founded to prove that Japan can provide enterprise-grade blockchain infrastructure. Therefore, compliance and reliability, rather than speculation, remain our top priorities.

“We believe that the next Internet will be built on blockchain, and we hope that Japan will take the lead in that regard. That is why we founded Startale. Our aim is to show that Japan can develop a world-class blockchain infrastructure. This is not just for crypto enthusiasts. It is for enterprises. It is for companies like Sony, SBI, and other global conglomerates who demand reliability, compliance, and security.”

Mission: Bring the world on-chain.

How: Leverage distribution channels and traditional assets.

What: Building the chain vertically to apps, starting with Sony and SBI.

Reason: It is easier for existing companies to acquire crypto users than it is for cryptocurrencies to acquire existing users.

That's us.

— Sota Watanabe (@WatanabeSota) September 18, 2025

He added that the long-term vision is for Japan to stand as a global leader in blockchain. Just as countries have exported manufacturing and culture, Startail aims to export blockchain infrastructure. To achieve this, the company is building a team that combines engineering expertise with business development and partnerships.

Investment Story: Resilient in the face of headwinds?

Capital inflows have slowed in the broader Layer 2 market. Existing tokens have also struggled to remain attractive to investors. Therefore, how Soneium is perceived is important. Watanabe said scale and composability are now fundamental features. As a result, Startale aims to stand out through distribution channels and new user groups.

“The industry is maturing. The competition has moved beyond existing crypto users to a whole new group of users who have never engaged with crypto before. The number of companies going on-chain in 2025 clearly shows that. StarTale and Aster have been working on this since 2023. We are good at securing distribution channels, and that becomes our moat.”

He cited activity data that as of September 2025, Soneium had processed over 295 million transactions (OKLink showed 297.16 million). The number of active addresses per day averaged approximately 90,000, for a total of over 4.8 million addresses. We also recorded over 350,000 account abstraction operations. So these numbers show scale.

However, L2BEAT's Total Value Secured rankings show that Arbitrum and Base have tens of billions of dollars in assets, highlighting the difference. Additionally, academic studies such as Optimistic MEV on Ethereum Layer 2 reveal how MEV extraction and spam loads differ between Arbitrum, Base, and Optimism. This represents Soneium's growth not only in actual numbers but also in quality of use.

At the same time, Flashbot analyzed the spam load across OP-Stack rollups, reminding observers to consider quality alongside throughput. When asked which metric is most important: TVL, user base, or application growth, he cited distribution channels instead. In his view, securing a new pipeline for hiring is a more durable moat than chasing raw numbers.

Token design: sustainability or pain points?

Soneium currently uses ETH as gas. However, questions remain about native tokens and sustainable revenue. Watanabe acknowledged that a native token could arrive later, an issue related to US SEC scrutiny of Layer 2's “independence.”

For now, he stressed that sustainable revenue must come from sequencer fees, joint ventures and compliance-driven services. In contrast, token incentives are short-lived. The U.S. Securities and Exchange Commission has issued KPI disclosure guidance that calls for clarity on growth and value creation. Therefore, Watanabe emphasized reinvesting sequencer revenue, joint venture revenue, and account abstraction activity back into the ecosystem rather than relying on quick token incentives.

“The Layer 2 ecosystem has matured rapidly. Differentiating factors such as scale, composability, and protocol-level innovation are now fundamental requirements. Simply launching with a bridge or DEX is not enough. Our approach is to secure distribution, expand to new user bases, and reinvest sequencer and JV revenues back into the ecosystem to support long-term growth.”

Sony Edge: A catalyst for native demand?

Soneium's TVL still relies on bridged assets. In contrast to the more diversified liquidity profiles of Arbitrum and Optimism, DeFiLlama clearly demonstrates this dependence.

Nevertheless, Sony's IP offers a consumer channel that few chains can match. Watanabe outlined plans to tokenize music, movie, and gaming content. He also highlighted wallets, compliance tools, and account abstraction to make the experience seamless.

“Startale is working on entertainment and media use cases on Soneium. We offer ecosystem builders and the opportunity to tokenize music, movies, and games. We also offer wallets, account abstraction, and compliance tools that enable these fan experiences and monetization models. This drives native demand as users engage with the content they love instead of speculating.”

Between centralization and decentralization

Soneium still operates a central sequencer and a central anti-fraud agency. L2BEAT has already flagged these as governance risks. For example, Arbitrum's DAO enforces timelocks on upgrades. Base, on the other hand, remains connected to Coinbase through the sequencer. In this context, Soneium's phased approach appears to strike a deliberate balance between usability and compliance.

“Pure decentralization without ease of use will not achieve mass adoption. Complete centralization defeats the purpose of Web3. We started with a centralized sequencer to ensure stability and scale, and from there we are gradually upgrading the network towards a more open and eventually decentralized model.”

He cited the example of the Dawn Concert app, where fans were voting on-chain without their knowledge. This example shows how invisible UX can integrate compliance and Web3 functionality.

Corporate strategy in Asia: Is trust the pillar?

In Japan, Singapore, and Hong Kong, companies prioritize auditability and predictable costs. At L2 in partnership with Sony, trust is at the heart. Watanabe outlined three pillars: regulation-first infrastructure, cross-border scalability, and developer-friendly integration. Startale calls this framework Entertainment Tokenized Assets (ETA). Package programmable rights and royalties around cultural IP. Therefore, businesses can adopt blockchain without sacrificing compliance or user trust.

“Our strategy is focused on enabling enterprise adoption, and Soneium is a key part of that. Enterprises value three pillars most: regulation with robust security, scalability across Asia and the rest of the world, and seamless infrastructure including wallet and account abstraction.”

Connecting Japan's strengths to capital markets

Startale and SBI have formed a joint venture to launch a tokenized stock market and RWA market. SBI Holdings has announced a detailed release regarding this initiative. Watanabe argued that Japan's combination of regulatory clarity, trusted institutions, and cultural intellectual property favors the formation of large-scale tokenization.

“Japan has a unique combination of strengths that can shape the future of tokenization. Regulatory clarity, trusted financial institutions, and globally influential cultural IP put us in a position that few other markets can match. Our broader vision is to make Japan a model for how tokenization markets work at scale.”

Managing payment lag and price gaps

Tokenized assets in other contexts have exposed basis risks due to the gap between on-chain execution and off-chain settlement. Watanabe said Startail will apply safeguards modeled on traditional markets, including circuit-breaker suspensions and clear user disclosures coordinated with regulators.

“Settlement delays and price gaps are a real challenge in tokenized markets, and our principles are simple. Startail is building an infrastructure that enforces standards for regulated markets. Automated safeguards can suspend trading if discrepancies exceed thresholds, coordinated by regulators, and modeled after existing standards for circuit breakers.”

Japan's Financial Services Agency has finalized rules based on the Payment Services Act and the Financial Instruments and Exchange Act (FIEA). Additionally, Reuters reported that further amendments could expand the range of financial products.

Stablecoin interoperability and UX

By 2025, multiple regulated stablecoins are expected to coexist, ranging from bank-backed products to USDC and GHO, creating UX challenges. Watanabe said infrastructure should absorb complexity, not users. Account abstraction allows users to rely on familiar logins, recovery flows, and gasless transactions. Chambers & Partners outlined how Japan's stablecoin regime aligns with this compliance-first design.

“We expect multiple bank-backed and regulated stablecoins to coexist, and we designed for interoperability between them. Our philosophy is simple: Web3 should feel as intuitive as Web2. Behind the scenes, our account abstraction framework eliminates friction. Users can log in with familiar credentials, easily recover their accounts, and transact without worrying about gas.”

Tokenization and the role of ETFs

Japan's blockchain market has the potential to expand significantly over the next 10 years. This raises the question of whether tokenization will reduce reliance on ETFs and proxy stocks. Watanabe argued that direct, partial, and programmable exposure through real-time payments can streamline corporate activities and change the way liquidity is packaged.

“Tokenization fundamentally redefines the role of ETFs and proxy stocks by eliminating the need for layered financial wrappers. Tokens can directly represent underlying assets with real-time settlement, transparent ownership, and global reach. Smart contracts enable automated market making and peer-to-peer trading across time zones, while Treasury automates dividends and governance rights, reducing costs and operational risk.”

Regulatory and policy strategy

The global framework is evolving. The European Commission has published the Text on Markets in Cryptoassets (MiCA). Japan's Financial Services Agency has completed the domestic guardrails. The U.S. Securities and Exchange Commission has also issued KPI disclosure guidance. Watanabe described Startale's infrastructure as compliant by design. As a result, he argued, Japan could become a model for balancing innovation and trust.

“We have been an early supporter of Japan's Payment Services Act and Financial Instruments and Exchange Act because they provide a clear framework that balances innovation and trust. Our job is to ensure that our infrastructure complies not only with Japanese standards, but also with MiCA, SEC guidance and other global rules. Ultimately, our goal is for Japan to demonstrate that Web3 can be innovative yet compliant, setting the standard for global adoption.”

Watanabe's remarks depict Soneium as Layer 2, designed for enterprises under Japanese regulatory clarity and supported by institutional partnerships. The strategy emphasizes distribution channels, entertainment-driven demand, gradual decentralization, and market protection measures. The test for investors and companies will be whether headline growth translates into permanent adoption and whether the Japanese framework can reliably serve as a template for global tokenization.