Last week, the broader crypto market was steadily profiting, but the Stablecoin sector expanded significantly, donating another $458.1 billion to the FIAT-linked Crypto ecosystem.

Fiat-linked tokens expand amidst market volatility

As of Sunday's coverage time, Stablecoin Economy had a valuation of $2391.08 billion, requiring an additional $892 million to surpass the $240 billion threshold. According to data from Defillama.com, the Stablecoin sector expanded by 1.96% this week, measured from April 20, 2025.

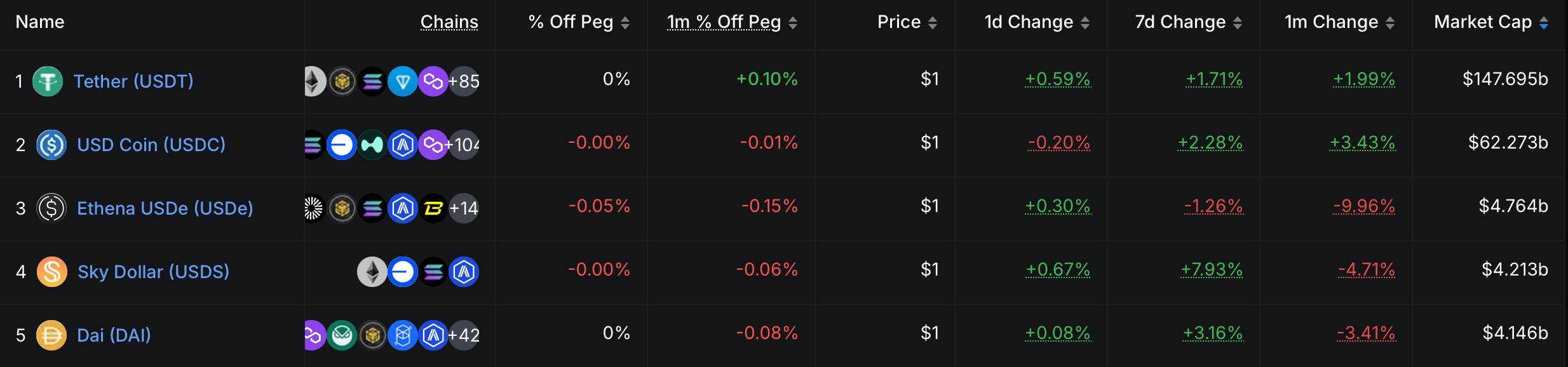

According to metrics on Defillama.com, the top five Stablecoins by market capitalization as of April 27, 2025.

The jump reflects a $4.5 billion increase in value over that period. Tether, the dominant force amongst stubcoins, saw a profit of 1.71%, with USDT supply growing to $14.7695 billion. Circle's USDC advanced 2.28% in seven days to bring its market capitalization to $6227.3 billion.

However, Ecena's USDE signed this week, slipping 1.26%, but over the past month, USDE supply has shrunk by 9.96%. As of April 27th, USDE's total market valuation was approximately $4.766 billion. Among the top ten market capitalizations, Sky's USDS achieved the biggest growth this week, reaching 7.93%.

Currently, USDS's market capitalization is $421.3 billion. DAI improved by 3.16%, while BlackRock's Buidl rose by 3.49%. Dai's valuation is currently at $4.146 billion, with Buidl reaching $2.536 billion on April 27th. Other notable risers this week include Tron's USDD and RIPPLE's RLUSD, which increased by 12.62%.

The Stablecoin, issued by Ripple, currently has a market capitalization of approximately $317.04 million. The stable climbing of the Stablecoin sector shows its important position within the Crypto market.

Certain assets have experienced a decline, but suggests the market dynamics that competitors such as USDS and RLUSD are evolving. The expansion, which is now close to the $240 billion mark, demonstrates the enduring importance of stubcoin in the face of wider market fluctuations.