Google has supported $3.2 billion to sign Terawulf's HPC hosting agreement with Fluidstack, which will ultimately own approximately 14% of the company. Will more hyperschools rely on Bitcoin miners for their energy and infrastructure needs?

Terawulf's new HPC deal

The next guest post comes from bitcoinminingstock.io, One-stop hub for everything Bitcoin mining stocks, educational tools, and industry insights. Originally published on August 22, 2025, it was written by the author of bitcoinminingstock.io Cindy Fen.

There is currently another major HPC transaction between Bitcoin Miners. Similar to the 2024 Core Scientific agreement with CoreWeave, Terawulf's recent announcement has attracted a lot of attention from investors who have increased their share price by 60%. Clearly, the expected billions of dollars of revenue is a big highlight, but Google's involvement is something like the Cherry above. In this case, Google has messed up $3.2 billion for the transaction and could hold up to 14% of Terawulf through a warrant. This is the first time a major hyperschool has signed such an agreement with Bitcoin Miner. It is not a direct customer or borrower, but it examines long-standing speculations. Hyperscalar focuses on Bitcoin Miners and recognizes power access and data center infrastructure.

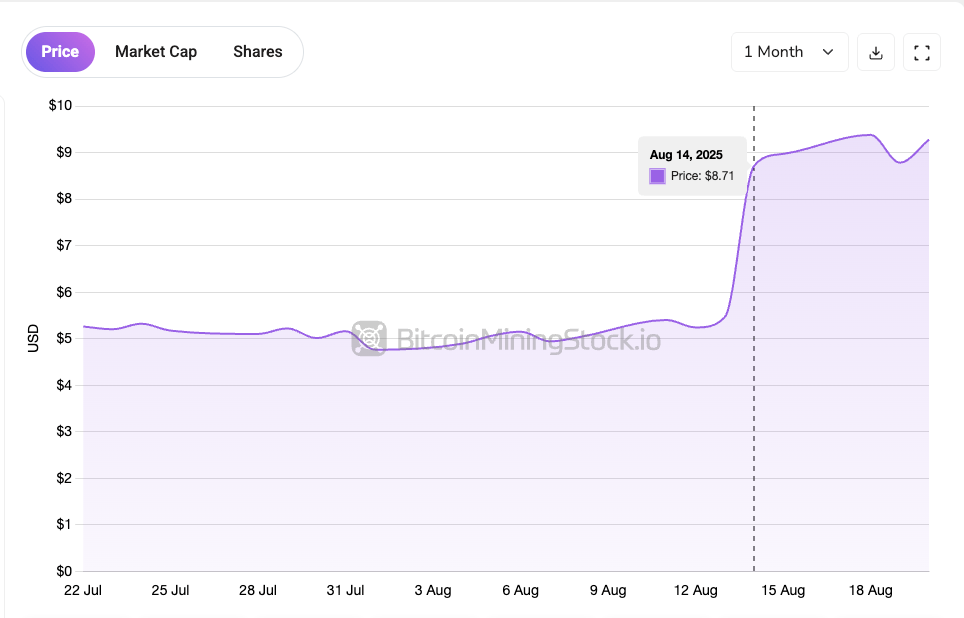

$Wolf It rose almost 60% after the announcement of the HPC hosting agreement.

What makes the Terawulf trade even more exciting is the outline of a repeatable blueprint for other public miners. In this post, we will break down important aspects of trading and share some thoughts to evaluate future hyperschool partnerships in Bitcoin mining.

Terawulf X Fluidstack: contract revenues are $6.7 billion, up to $1.6 billion

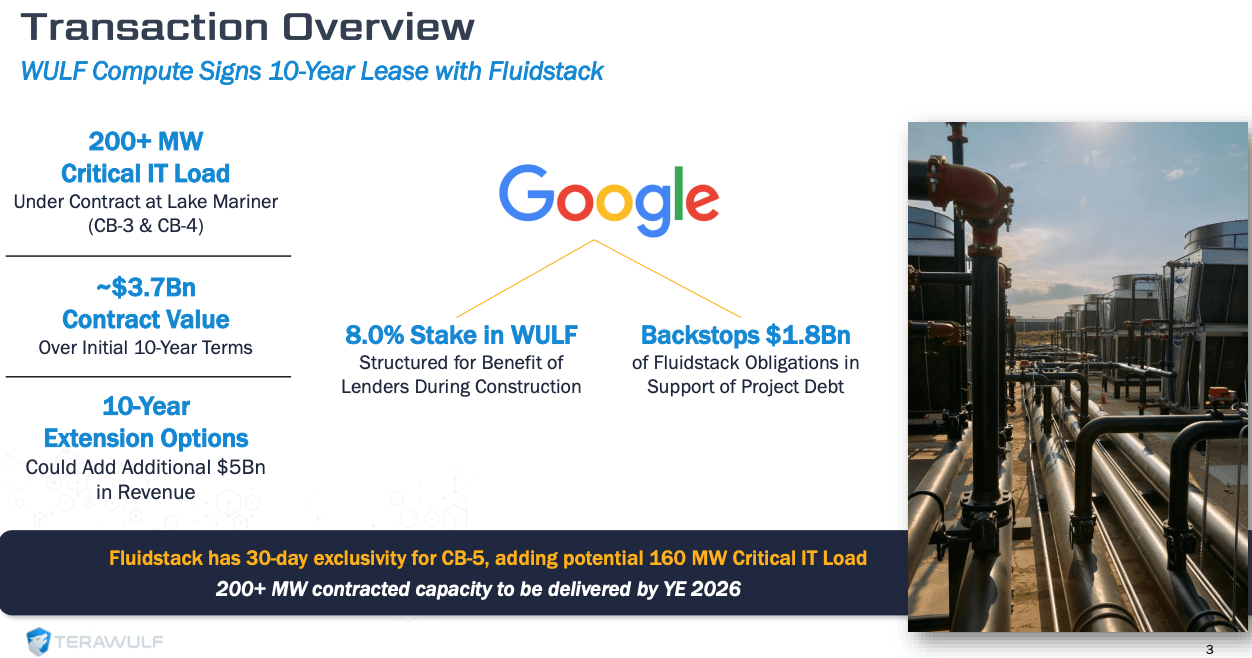

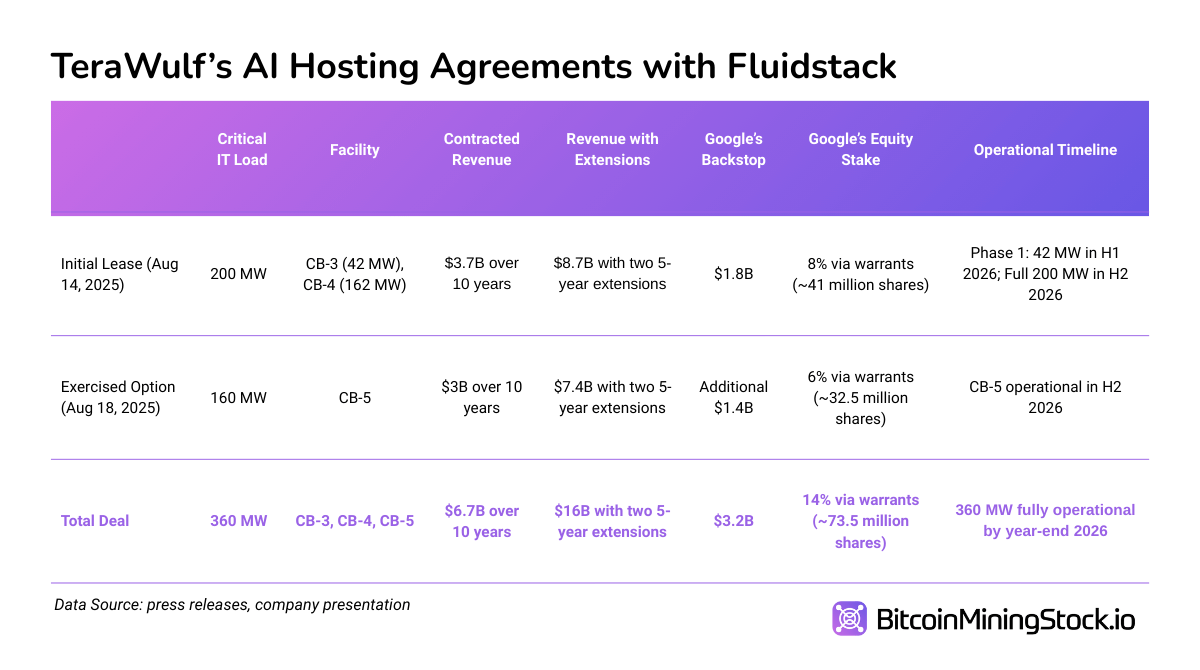

Terawulf first announced its 10-year HPC hosting agreement with Fluidstack on August 14, 2025. The deal covers more than 200 MW of infrastructure capacity at the company's Lake Mariner facility in New York. If the contract extension is exercised, it could reach $8.7 billion, which is expected to generate $3.7 billion in contract revenue over the early semester.

A summary of the first 10-year lease (screenshots from presentation of Terrolf).

The agreement is organized as a colocation model in which clients provide their own hardware and Terawulf provides scalable power and dedicated data center space (CB-3 and CB-4). Important loads for Fluidstack are expected to be online by mid-2026.

On August 18, 2025, Fluidstack exercised the option to expand further by leasing the third building (CB-5) and adding an additional 160 MW. this is total The contract capacity has now been approximate 360 MW at Lake Marinercontracted revenues are $6.7 billion, representing a potential benefit up to $16 billion (if the lease is extended).

For those who are unaware, this is not Terawulf's first HPC transaction. In 2024, the company announced a partnership with Core42, a subsidiary of G42, which has a 72.5 MW, on the same site. The agreement with these two partners is higher than Terawulf's current 250 MW mining operation, combining a committed HPC infrastructure of over 420 MW. This illustrates a slow shift from bitcoin-centric operations to infrastructure providers for both mining and HPC hosting.

Google's involvement: financial and strategic support

The reason Terawulf's new HPC deal brings even more excitement is Google's participation. The role of the giant is inherently strategic and financial. Through its partnership with FluidStack, Google has guaranteed its first 10-year lease obligation $1.8 billion to support project-related debt financing. With the exercise of an additional 160MW option, Google offers Backstops totaling $3.2 billion. Interestingly, Google also supports Fluidstack lease obligations, including early termination protection for the first six years. All this support from Google will reduce revenue streams risk and make it easier for Terawulf to secure funding.

In exchange, Google will acquire approximately 73.5 million shares of Terawulf via a warrant. If you exercise completely, this will give you Google 14% stockmakes it one of Wolf's biggest shareholders. Although these warrants are not immediate dilutions, they show long-term consistency with the benefits of Terawulf. If Terawulf is run, Google is standing to gain a significant amount of equity stakes.

Overall, Google's involvement offers more than capital security. that Send strong signals to a wider market About the reliability of the company and the value of infrastructure. It will help open the door to future direct relationships with developers who may reconstruct the Miner-HPC hosting landscape.

In Terawulf's second quarter revenue call, CEO Paul B. Prager highlighted The importance of this transaction Over the long term:

“This new customer and a $1.8 billion Google Backstop have significantly strengthened our credit profile, allowing us to pursue low-cost, scalable capital solutions to match our growth trajectory.”

HPC Buildout Financing Strategies: Lean and Leverage

Terawulf pursues to build the infrastructure needed for Fluidstack trading Asset Light Model. The client is responsible for providing its own GPU and Compute cluster. This significantly reduces Terawulf's upfront capital requirements for expensive and fast hardware.

Another source of funding will be born Prepaid hosting feesprovides instant cash flow support during build-out. This approach is consistent with typical data center funding strategies. Secure long-term contracts first, then use them to undertake capital expansion.

Terawulf also announced to accelerate construction and fund short-term needs Convertible Note Offering Immediately after a Fluidstack transaction. The first $400 million convertible note offer rose to $850 million on August 18th, according to the announcement.

I can't tell you the exact reason that management uses convertibles, but I think this approach offers Low-cost capital (1.00% interest rate) Funding a rapid HPC expansion to meet Fluidstack timeline (H2 2026) while retaining cash flow compared to traditional liabilities. CAPP's call transaction also reduces the dilution risk protecting shareholders as Terawulf's stock price has skyrocketed (as of August 19, 2025, 55% YTD, 101% over 12 months).

How does it compare to Core Scientific trading?

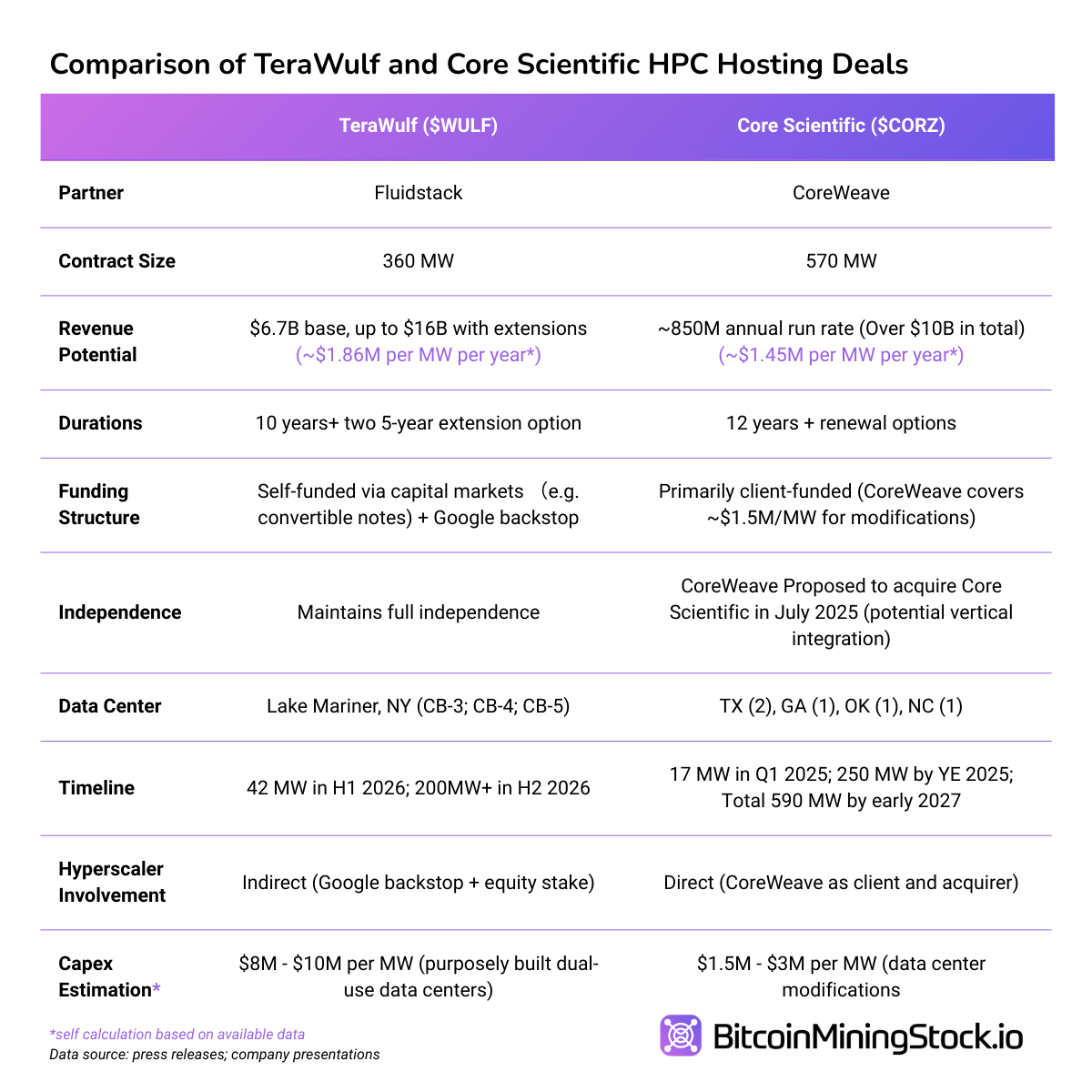

Both Terawulf and Core Scientific have landed major HPC hosting deals, but their models differ in one way or another.

meanwhile Core ScientificThere are benefits to contracts Scale and equipmentTerawulf's transactions have grown in terms of total revenue potential. Most importantly, it includes direct financial involvement from Google. This is the first in this space. This can increase reliability among investors and other potential clients.

Final Thoughts

Terawulf may have joined the HPC hosting game later than some peers, but it quickly proves that early is not everything. From its initial partnership with Core42 in 2024 to the Fluidstack deal in 2025, the company has moved from “just another miner” to becoming a reliable infrastructure partner for the AI and HPC economy.

Unlike some companies that actively sell AI pivots without showing much, Terawulf has a relatively low profile on X. Institutional investors are attracting attention. Over 55% of our shares are held by institutions, while retailers only have 15%. Perhaps one reason is communication. Terawulf has consistently spoken business in languages familiar to traditional investors. For example, they treat Bitcoin mining like a commodity business, focusing on marginal unit economies that investors can easily understand.

This clarity could have resonated with not only investors but also partners. Google's involvement is especially important when trading FluidStack. With a $3.2 billion backstop commitment and associated warrants, Google could become a 14% stakeholder of Terawulf (if fully exercised). It's not just capital support. In both potential clients and capital markets, it is a greater reliability.

More importantly, the deal presents replicable playbooks for other miners. Ensure the right partner and provide results. Tell us what the language institution players understand. Think carefully about your fundraising and then try again.

The demand for HPC is real. You could adapt your infrastructure and messaging to win the next big hyperscalar partnership without overly commitment. Transactions containing names such as AWS, Microsoft, Meta, Oracle, etc. may no longer be “Mission Impossible.”