Tether's Xaut surpassed Paxg by market capitalization, becoming the largest tokenized gold asset.

summary

- Tether mints Xaut tokens worth $436.94 million

- Xaut overtakes Paxg by market capitalization and becomes the largest tokenized gold asset.

- This mint has increased the market capitalization of tokenized gold by 20%.

Tokenization has influenced the way investors buy gold. On Monday, August 11th, CEX.IO released a report detailing the biggest trends in the tokenized gold industry. The biggest event in recent months is that Tether's Xaut surpasses the market capitalization of Paxos Gold.

On August 8th, Tether planted 129,047.917 XAUT tokens, worth around $436.94 million. This not only made it the largest gold tokenized asset by market capitalization, but also pushed the total market capitalization of tokenized gold by 20%.

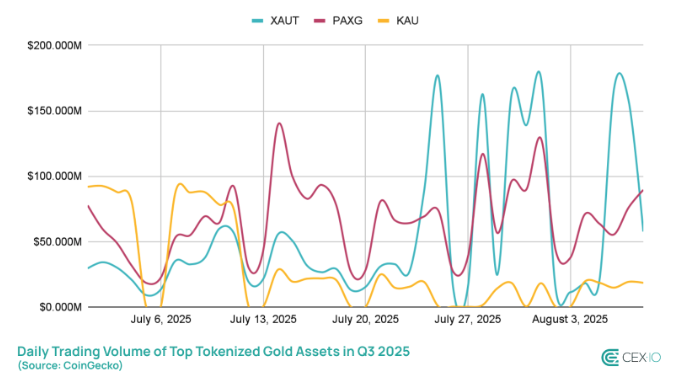

This mint came when Xaut overtook Paxg in terms of trader engagement and active holders. Since July 25th, Xaut's trading volume has surpassed both PAXG and KAU in daily trading volumes.

Top 3 trading volumes of Gold Assets tokenized in the third quarter of 2025 | Source: CEX.IO

Xaut also ruled in terms of a new tokenized gold holder. In 2025, the number of XAUT holders rose 173%, but 29% of PAXG. PAXG still has a larger user base and has a 7x advantage, but the gap is quickly closed.

Macroeconomic conditions prefer tokenized gold

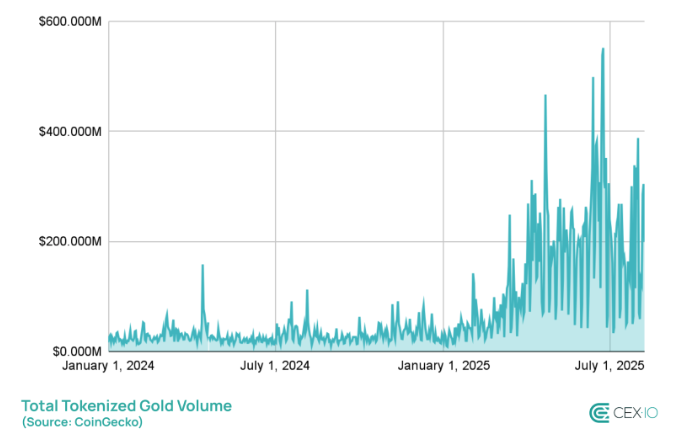

As an original safe haven asset, Gold has benefited from recent macroeconomic uncertainties. Specifically, since President Donald Trump announced tariffs on major US trading partners, the amount of tokenized gold has seen a multi-week rally. Paxg, Xaut and Kau volumes all benefited, with quadrilateral growth in some cases.

Gold volumes from January 2024 onwards have been converted to tokens | Source: CEX.IO

Tensions in the Middle East, labor market growth and other negative economic indicators also contributed to the interest. In particular, in the second quarter of 2025, tokenized gold volume exceeded $19 billion, overtaking major gold ETFs.

read more: Xauusd Weekly Gold Forecast: Gold looking for a setback to this week's purchase level