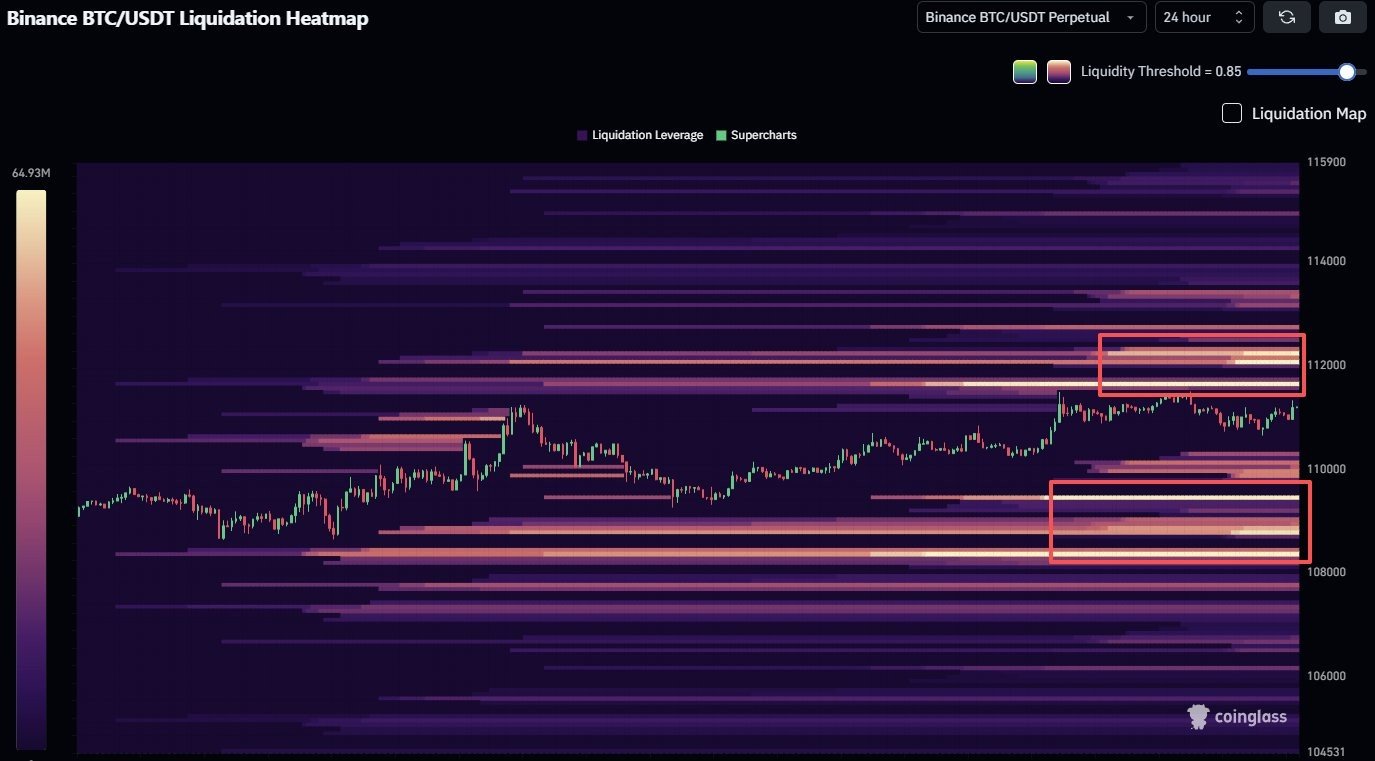

Bitcoin prices are stable at the $111,000 level, but volatility is likely to increase significantly as the weekend approaches and liquidity is expected to decrease. According to data from CoinGlass, Bitcoin can easily fluctuate between these key liquidation levels during periods of low trading volume, so traders need to monitor it closely.

Key zones to track

Five major price zones that can act as volatility magnets are highlighted in the liquidation heatmap.

The value of the primary downside liquidity pool is between $108,000 and $108,500. This is the most prominent cluster of long-term liquidations. A series of prolonged liquidations could quickly push Bitcoin toward $108,000 if it falls below that level. This is a key area of support that has protected Bitcoin several times recently. Anything below that can cause temporary anxiety.

$110,000 (weekend pivot/neutral zone): This level is used as a liquidity balance zone and midpoint. If Bitcoin remains above $110,000, it would indicate stability. However, below that level, liquidity could plummet to the $108,000 range.

The short-term liquidation zone is between $111,500 and $112,000. Short positions are moderately concentrated just above this level. If a surge in short-term liquidations causes Bitcoin price to break above $112,000 again, it could push the price towards the next key resistance level.

$113,000 to $113,500 (resistance area to target): The next pocket of liquidity above the current price is indicated by this range. Here you should expect the possibility of profit taking and significant short pressure, especially if weekend volatility picks up quickly.

$114,500-$115,000 (High Risk Short Cluster): Longest short liquidation zone shown. If Bitcoin can break out of this range, forced liquidations could send the price soaring towards $118,000 to $120,000.

Given that Bitcoin is trading closely between its moving averages and the market is generally cautious, traders should expect a liquidity-driven rally over the weekend. Since Saturday and Sunday sessions are typically thin on orders, these areas can be flashpoints for both short squeezes and liquidation cascades, meaning the next move could be harder and faster than expected.