Ethereum prices have been stronger than most prices on recent sales. The token tested $4,300, but quickly bounced over $4,500, earning 11% each week. In contrast, Bitcoin slipped 1.6% a week.

Traders are currently asking if Ethereum can push $5,000. This is one of the more popular price levels. On-chain data refers to strong purchasing pressure, and experts believe the upside down story is not over.

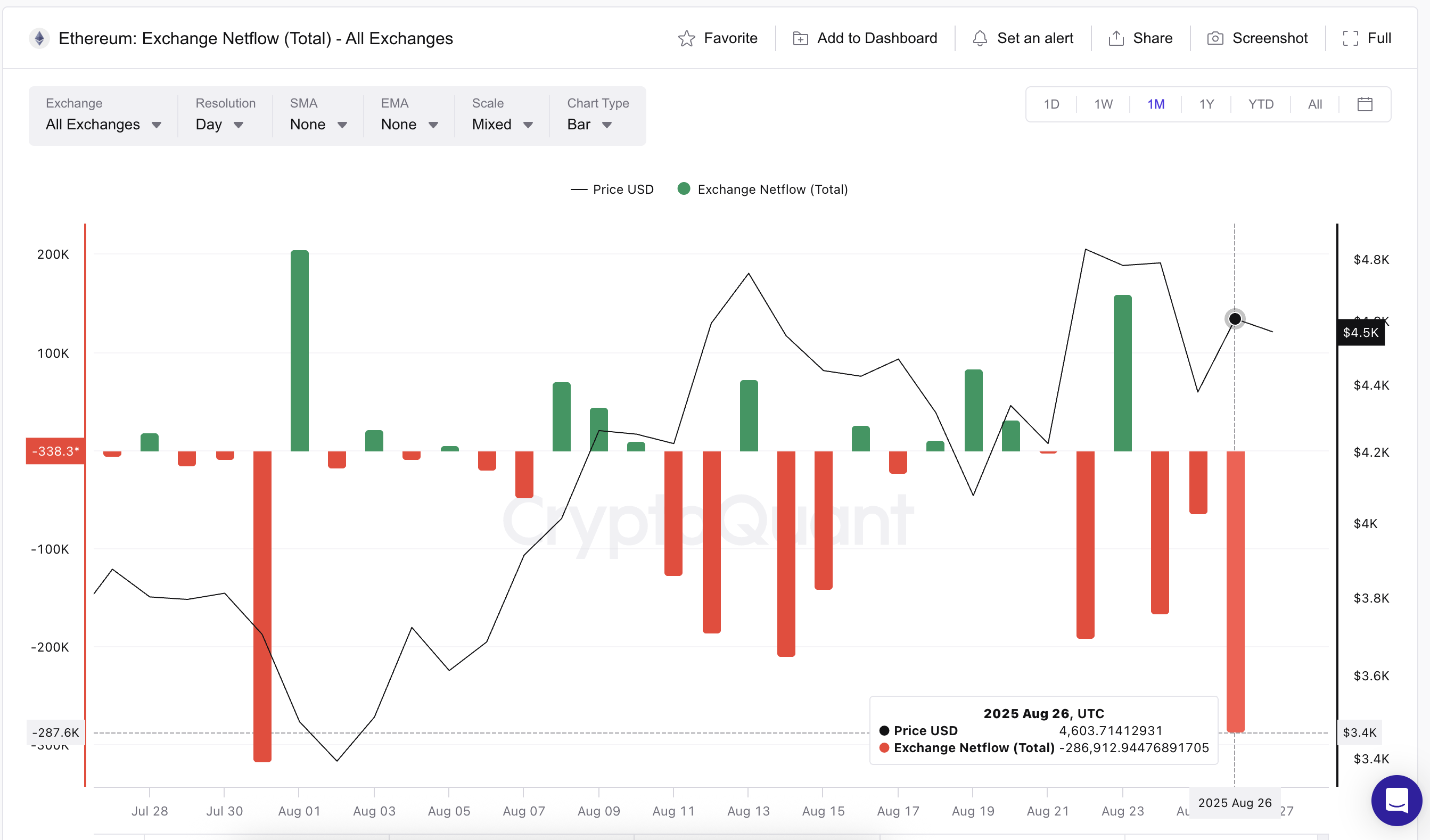

Exchange Outflows highlights the profits of your purchases

One of the clearest signals is the exchange net flow. If there are more exchanges than ETH enters, that means the trader is pulling a coin into his wallet – usually keeping it rather than selling.

On August 26th, Exchange Outflows reached nearly 287,000 ETH. This marked the second highest level since July 31st, when over 316,000 ETEs finished in one day. At the time, the move went from $3,930 to $4,750, ahead of the rise in Ethereum prices within days.

Ethereum Outflows continues to surge: encryption

Kevin Rusher, founder of Real World Asset Platform Raac, told Beincrypto that the latest flows are below ETH's resilience.

“ETH increased by 17% last month and Bitcoin fell by 7%. Despite the short-term decline, ETH appears to be in the realm of price discovery,” he said.

Additionally, BlackRock recently discovered revolving capital from Bitcoin, purchasing around $89 million worth of Ethereum, forming the majority of its latest spill.

BlackRock bought $89,200,000 worth of $ETH. pic.twitter.com/6nok247ufi

– Ash Crypto (@ashcryptoreal) August 26, 2025

This pattern suggests that even though the wider market shows weaknesses, large players are still buying dips.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya's daily crypto newsletter.

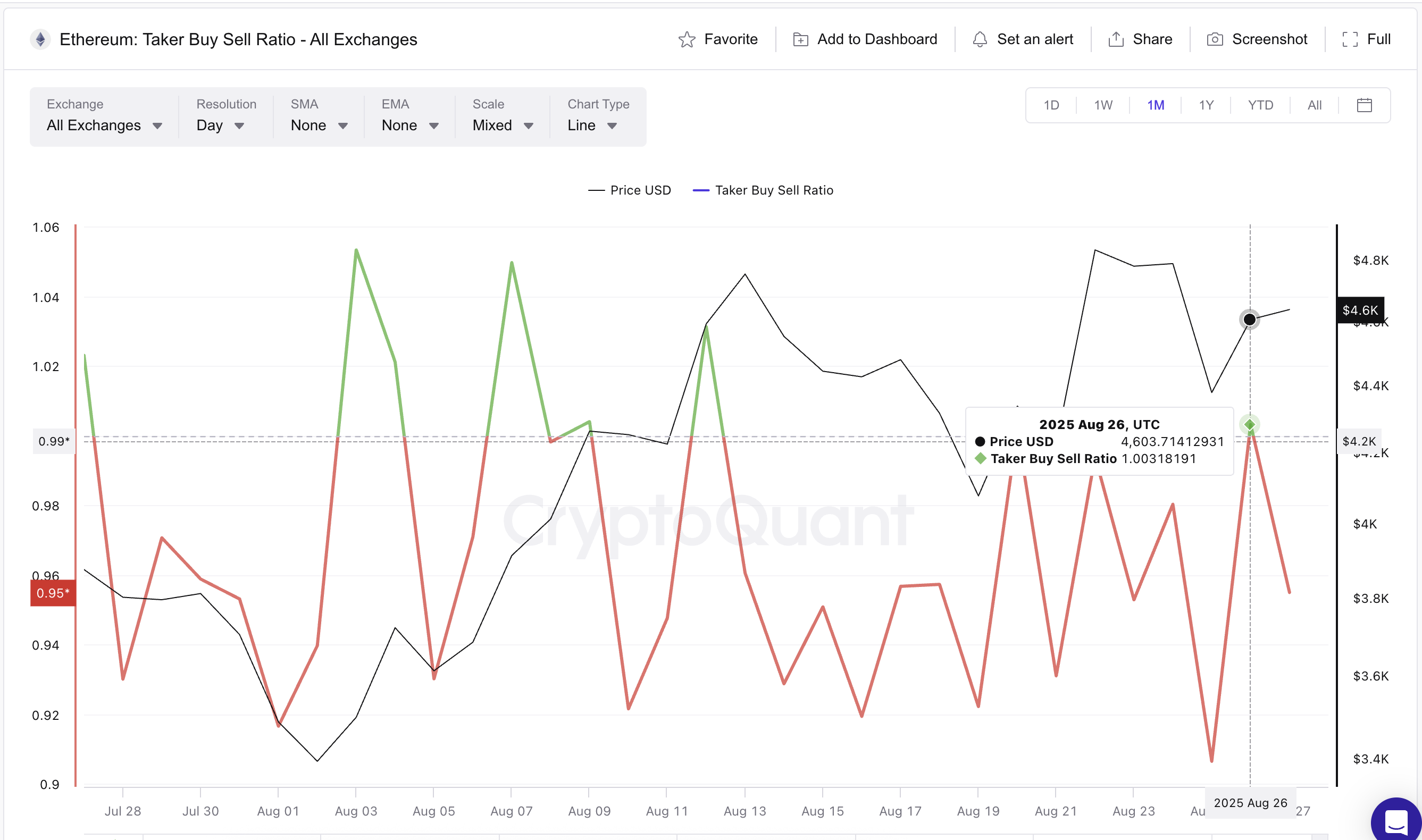

Taker Buy-Sell Ratio adds confirmation

Another metric supporting this trend is the buy-and-sell ratio of takers. This measures how aggressive the aggressive buyers on the exchange are. One reading above means that the buyer is a “lifting offer”.

In short, they want to buy anything available without waiting for the price to reach the desired level.

Ethereum buyers become aggressive: encryption

On August 26th, the ratio that surpassed 1 for the first time since August 20th was followed by a strong Ethereum price rallies, following previous local peaks above 1, such as August 9 and August 12th.

The latest surges are the best since mid-August, even if ETH prices fell. Dip saw the post on August 26th represents incomplete data at press time and is subject to change.

Rusher added that Ethereum's appeal now surpasses traders.

“So far, ETH's relative performance has been driven by the Treasury of Digital Assets, betting on Ethereum's role in Defi and Tokenization. In addition to this, unlike Bitcoin, ETH is more than just capital appreciation. Holders can earn returns by eating up tokens. They've been counting the past few days and counting,” Rusher said.

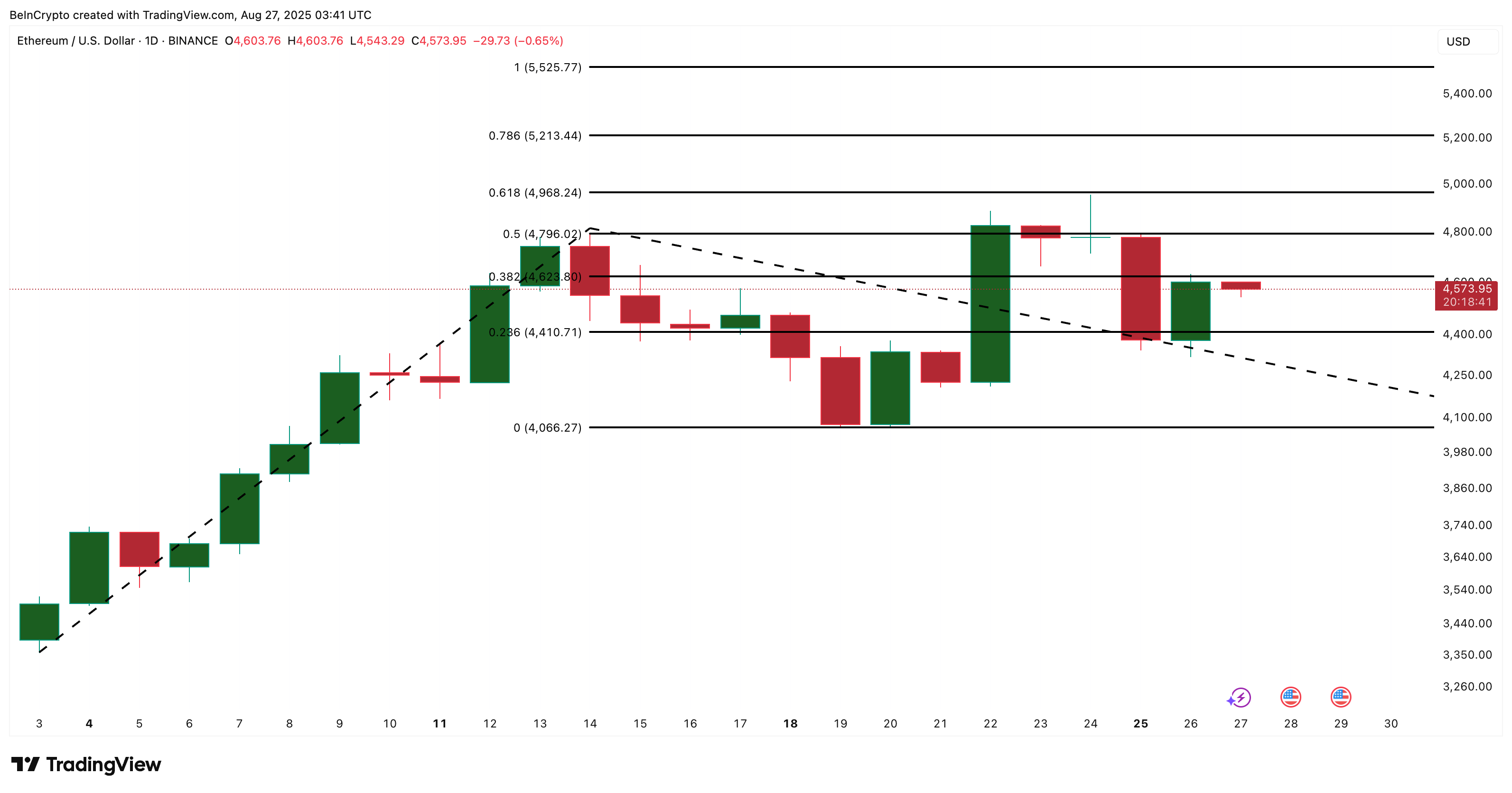

Major Ethereum price levels and the road to $5,000

Despite recent volatility, Ethereum still has a price of $4,623, trading close to major resistance. Clearing this zone will open the way to $4,749, followed by a psychological mark of $5,000. If momentum continues, analysts are monitoring $5,213 as their next technical target.

Ethereum Price Analysis: TradingView

Rusher believes that the larger paintings prefer Ethereum. He pointed to yield and institutional adoption as long-term drivers. He also said that whales have recently dumped billions of dollars from Bitcoin into ETH, adding them to their bids.

“Finally, adding the Fed's potential interest rate cuts opens retail capital, which only increases the intense demand for ETH, which could quickly send $5,000 in ETH into history,” Rusher added.

For now, Ethereum's trajectory depends on whether the buyer is able to protect the level of support while pushing towards resistance. As history repeats, the latest spills and taker ratio spikes can become higher sparks on another leg.

It is worth mentioning that bullish Ethereum price trends will only be void if they violate the $4,066 mark. A higher level could lead to bounces led primarily by capital-turning buyers.

When the big player first appeared on BEIncrypto spins out of BTC, the story resurfaces resurfaced at $5,000 Ethereum price.