Currently, several financial institutions and market analysts are projecting the country's central bank, the US Federal Reserve, and will cut interest rates from the current target rate of 4.25%-4.5% in 2025 at least twice in 2025.

The bank forecast followed a weak employment report in August that only 22,000 jobs were added a month, compared to an expectation of around 75,000.

Analysts at Bank of America, a bank and financial services company, have reversed their long-standing stance on no-rate reductions in 2025, forecasting a 25 basis point (BPS) cut in September, according to Bloomberg.

Economists at investment banking firm Goldman Sachs projected three 25 bps reductions in 2025, continuing through September to October and November.

Similarly, banking giant Citigroup forecast a total cut of 75 bps in 2025, with a 25 bps increment in September, October and December, Reuters reported.

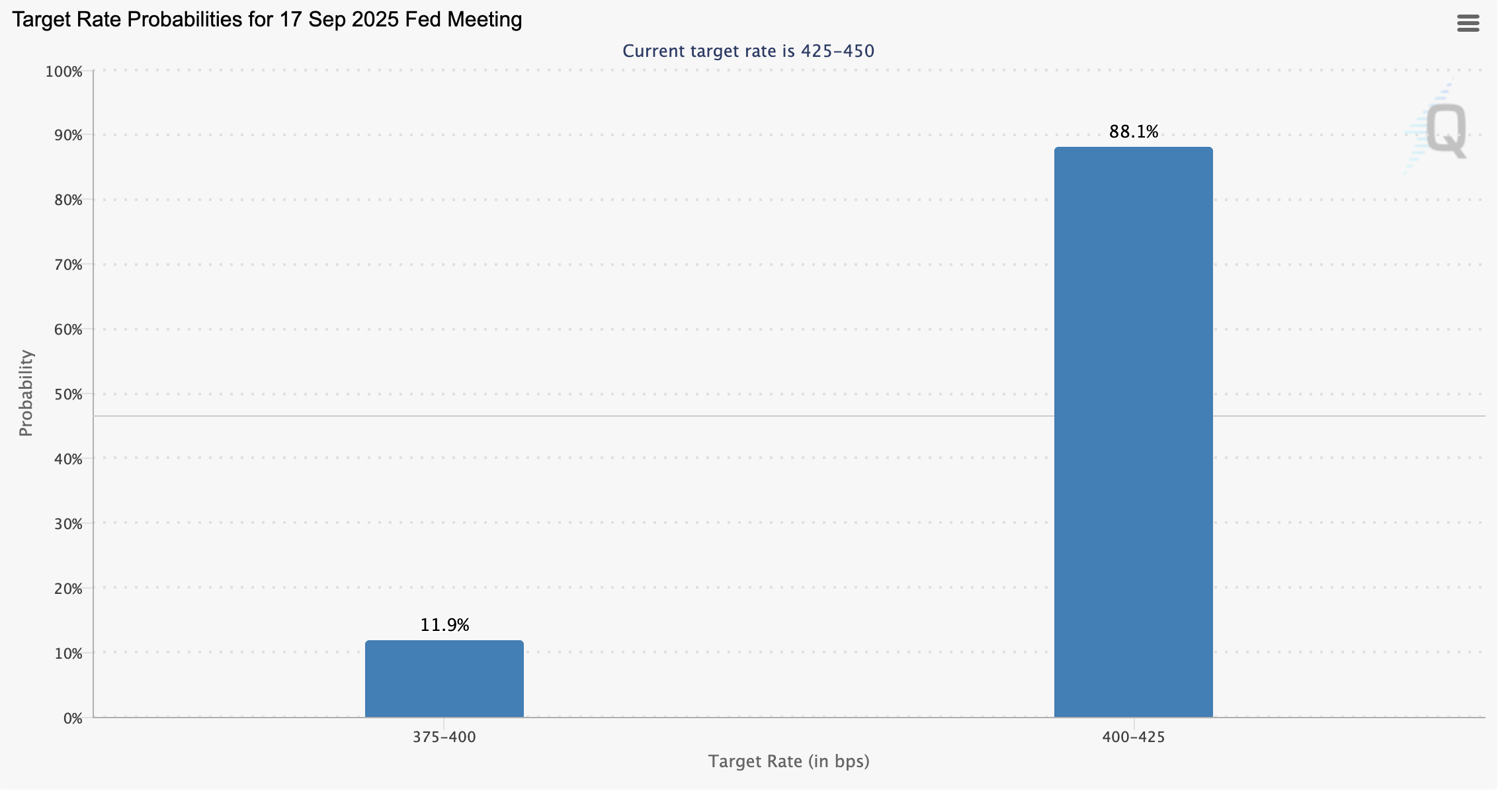

Interest rate target probability at the next Federal Reserve Conference in September. sauce: CME Group

According to data from the Chicago Commercial Exchange (CME) Group, over 88% of traders expect a rate cut of 25 bps, with approximately 12% of traders expecting a rate cut of 50 bps at the next Federal Open Market Committee (FOMC) meeting in September.

Lower interest rates drive liquidity into the crypto market and are considered the main catalyst for crypto prices and sustained bull run rise, while higher interest rates have opposite effects on asset prices.

Most traders expect interest rate cuts amid large job number revisions

Federal Reserve Chair Jerome Powell showed potential rate cuts in September in his keynote address at the Jackson Hole Economic Symposium held in Wyoming on August 22.

The speech came amidst signs of weakening the US job market. This is part of the Federal Reserve's dual mission to achieve maximum employment and stabilize prices.

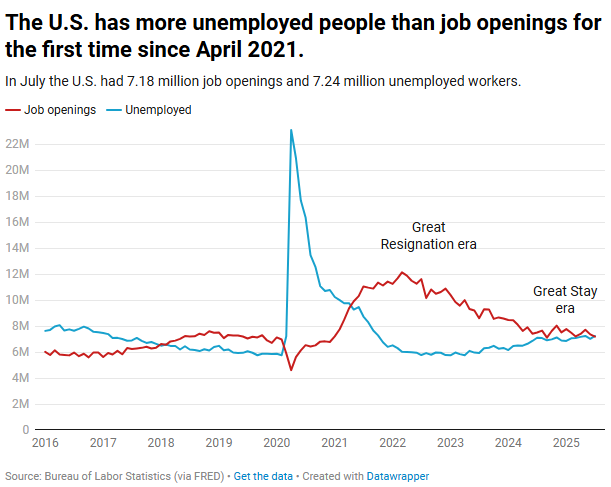

The US job market shows signs of weakening, with more unemployed people than job seekers. sauce: Cobessy's Letter

“The US just revised its June employment report with a second drop, with a total of -160,000 jobs, and the US officially lost 13,000 jobs in June,” Kobeissi's letter said in a post in X.

Kobeissi's letter also warned that the U.S. Bureau of Labor Statistics (BLS) could revise its job count downwards at around 818,000 in 2024, and could amend the 2025 figure with a maximum of 950,000 jobs.