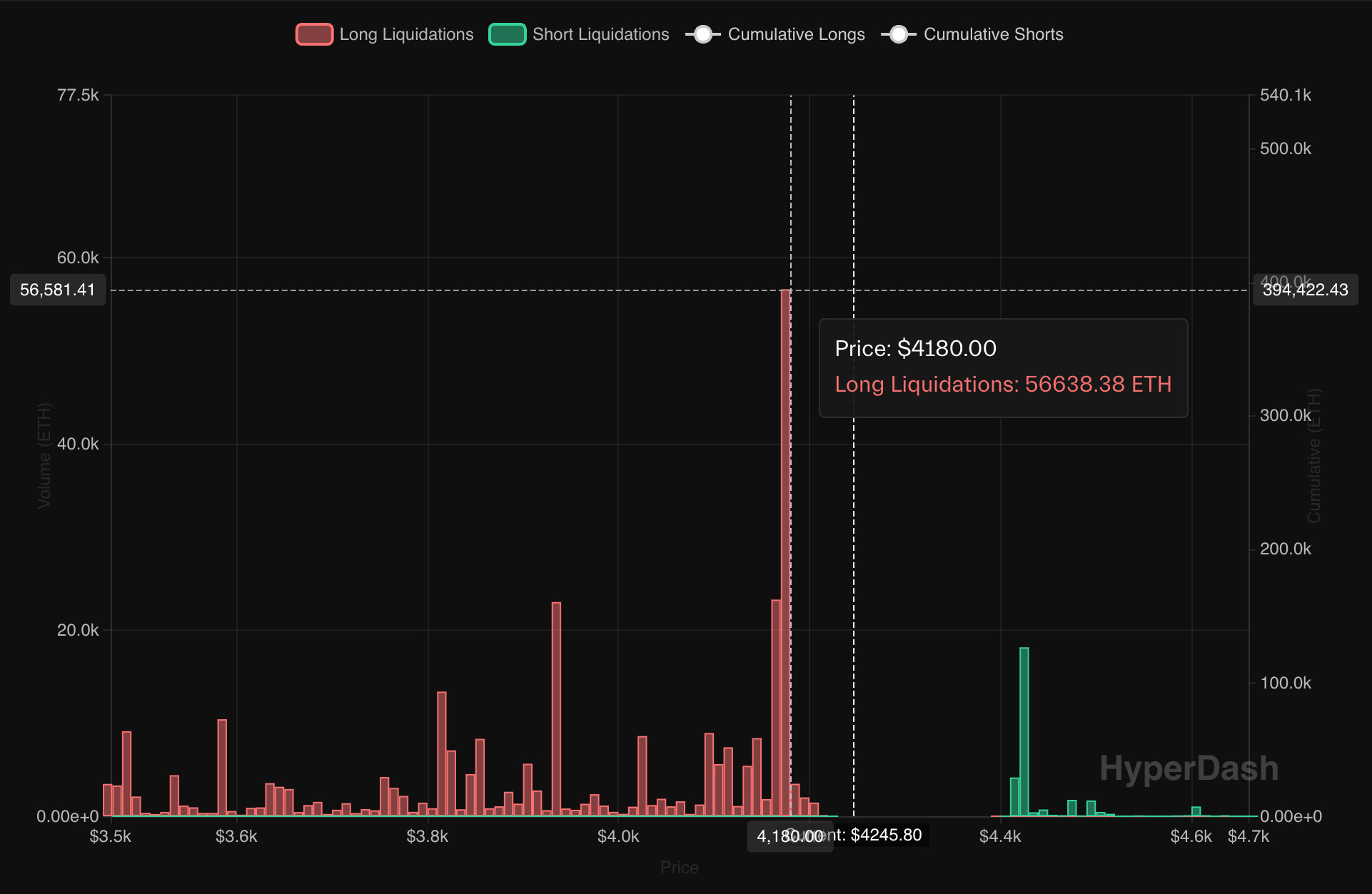

Crypto traders need to remain vigilant as the price of ether (ETH) falls below $4,200.

At the time of writing, HyperDash data shows that if the ether price drops to $4,170, it faces the liquidation risk of decentralized permanently exchanged lipid liquids facing a liquidation risk of over 56,638 bullish long positions (valued by $236 million);

The data also showed significant liquidation risks of $2,150-$2,160 and $3,940. At press time, Ether changed its hands to $4,260 at $4,260, down nearly 5% in a day, according to Coindesk data.

Andrew Kang, founder of Crypto Venture Capital Firm Mechanims Capital, said in X that a massive long liquidation could reduce Ether prices to $3,600.

“We estimated (i) we were trying to achieve $5 billion with a $500 million ETH liquidation across the exchange, reducing it from $3.2,000 to $3.6,000,” Kang said.

ETH clearing map. (hyperliquid/hyperdash)

A liquidation, or forced closure of leveraged bets, occurs when the trader's position has not reached the margin requirements set by the exchange.

Typically, a margin shortage occurs when the market moves against the trader's position, causing account capital to fall below the minimum maintenance margin. This will prompt the exchange to automatically close positions to prevent further losses and ensure that borrowed funds are collected.

Mainly long liquidation, sales pressures suddenly surge, resulting in cascade effects that can cause additional liquidation, resulting in even lower prices. This negative feedback loop tends to amplify market volatility.

Read more: Dogecoin Sellers are in control as Monero attackers vote for Doge. Bitcoin under $116K