ETHZilla CEO McAndrew Rudysil has announced that he has made the decision to take full action on Ethereum after seeing Ethereum potential in the global remittance market near trillions of dollars.

Two months later, his biotechnology company, previously in poor business, is now the eighth largest Ethereum Corporation in the world.

“Ethereum is effectively a gateway for money supply worldwide for remittances in US dollars,” ETHZilla CEO McAndrew Rudicil told Cointelegraph.

The company started out as Life Science Corporation, a Nasdaq-listed biotechnology company, but changed its brand name to ETHZilla Corporation in July shortly after US President Donald Trump signed the GENIUS Act, which aimed to establish stablecoins rules.

“There are many real-world asset applications that can use Ethereum, and they are currently in preparation,” he said, also referring to the ability of Ethereum as a storage of value.

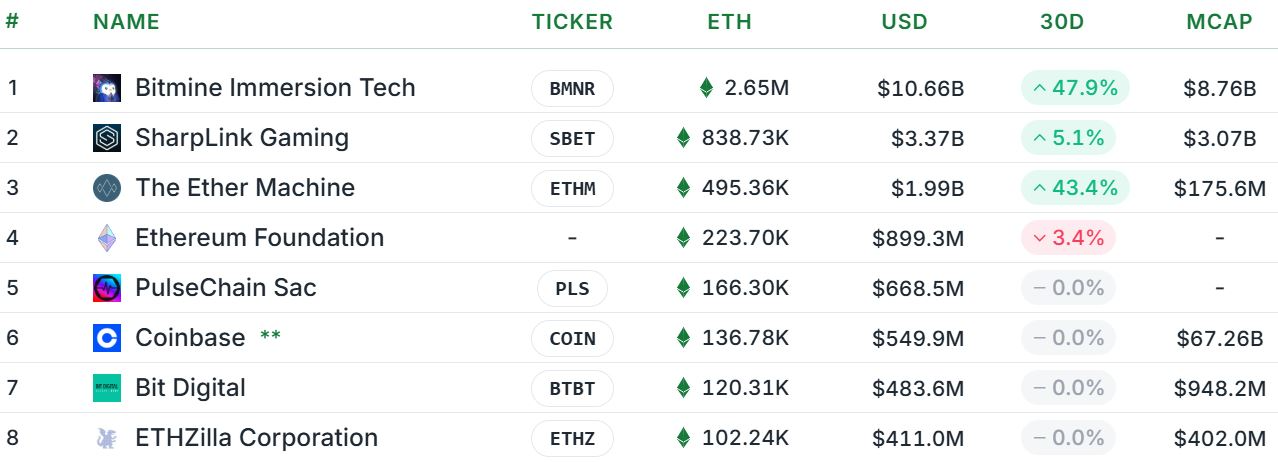

ETHZilla is the eighth largest Ether (ETH) financing company of 69 listed companies, with over 102,000 tokens.

Rudysil said the company decided to move forward with Ether, especially because “the race is now underway” to decide which blockchain is best, and “the horse has come out of the barn” at Ethereum.

Since shifting its focus to Ether, ETHZilla Corporation has acquired more than 102,000 tokens from the Ministry of Finance. sauce: Strategic Ether Reserve

“Many of the new networks created on Layer 2 will actually be networks that work with what is known as traditional financial activities in the world today, such as structured credits and all sorts of Wall Street applications.”

ETHZilla wants “as many Ethers as possible.”

BitMine Immersion Technologies is the largest ether treasury company with 2.65 million tokens worth more than $11 billion, and has set a target of holding 5% of the token supply.

Rudysil said that while ETHZilla doesn't have a fixed number in mind, it hopes to get “as many ether as possible,” and make it “operate with a variety of different L2 protocols,” resulting in a “significantly higher yield” than regular staking.

sauce: ETHZilla

“We are deploying to buy more cash from Ethereum and effectively help build more L2 networks because that will ultimately enable Ethereum to expand,” Rudysil said.

“The reason ETHZilla exists is because we want to be a bridge between what's happening in traditional finance and what's happening in the digital finance world, so having a ton of Ethereum helps us achieve that.”

Ether prices will rise as stablecoins grow

According to CoinGecko, Ether is trading at $4,148, and has been surged between $3,846 and $4,226 over the past seven days.

Rudysil predicts that the price of Ether would reach $20,000 over the next few years is not entirely unreasonable. This is because prices have been in a price-hardened pattern for many years, and are ready to break against the backdrop of stablecoins' growth.

“If we break past $5,000, I think we'll actually be going up one level at a time because the base load underlying our infrastructure is so tight, and we're actually going to get there right now.”

The GENIUS Act is still awaiting final regulations before it comes into effect, but analysts predict that the act will be a major driving force in the market.

Meanwhile, data analytics platform DefiLlama has already seen stablecoin transactions of $158 billion on the Ethereum network, with $77 billion on its second largest network, Tron.

More Ether companies could emerge

In total, the Ether Safe Company owns 5.5 million ethers, which is about 4.54% of the token supply. Rudysil speculates that more companies may take the plunge and take action, but he is also skeptical of whether all companies will survive in the long run.

“There will be a huge gap between quality and management, and I think there are many companies that have not actually built a business model to keep their business going,” he said.

At the same time, Rudysil believes more governments will also begin to engage in cryptocurrency to ensure they don't miss the boat.

“There's a general perception in many places that our financial infrastructure is outdated, and they are aware of that, and if they don't get involved in any way with what's going on with their digital assets, they'll be left behind,” Rudysil said.

“And I think you've seen big banks, financial institutions and people start talking about other digital assets and accepting Bitcoin as collateral just because we're in a period of transition globally.”

Founded in 2016 as a clinical-stage biotech company, LifeScience went public in 2020, but after its initial public offering, its share price has plummeted more than 99% over the past five years.

The main reasons for the plunge are lack of revenue and increased losses, but since ETHZilla pivoted to Ether, the stock has risen 44% annually, with the best-performing month skyrocketing to $10.70 in August.

ETHZilla shares have risen 44% since the start of the year since shifting their focus to cryptocurrencies. sauce: Google Finance

Rudysil said that it is true that many small listed companies with no clear pathways will be restructured or delisted, but ETHZilla is different.

“We're not just a cryptocurrency business, we're building a Layer 2 protocol business with assets of over $1 billion and generating cash flow,” he said.

“We're focusing on long-term technological development and practical practicality, not short-term financial strategies. Rebranding and redirection reflects a clear strategy towards growth and innovation, rather than a reactionary move to stock price performance.”