Ethereum is facing resistance near key levels, but a surge in active addresses indicates increased engagement in the network and a likely recovery.

Ethereum ($ETH) is experiencing further volatility, as seen in recent price movements. The largest altcoin by market capitalization is trading at $2,113, down 6.99% in the past 24 hours and facing a steep decline.

$ETHprice of It has fluctuated between $2,110 and $2,230 in the past 24 hours. It is worth noting that the token is down 29.67% in the past 7 days and 36.17% in the past 90 days. year to date, $ETH has fallen by 28.74%, indicating a sustained downward trend.

Looking at the long/short ratio, Ethereum shows slightly bullish sentiment, with Binance having a ratio of 2.76. $ETH/USDT account. Recent performance has been characterized by continued pressure from resistance levels as Ethereum remains below key price points. Can Ethereum hold support and break out of a major resistance zone?

Can Ethereum sustain major support levels?

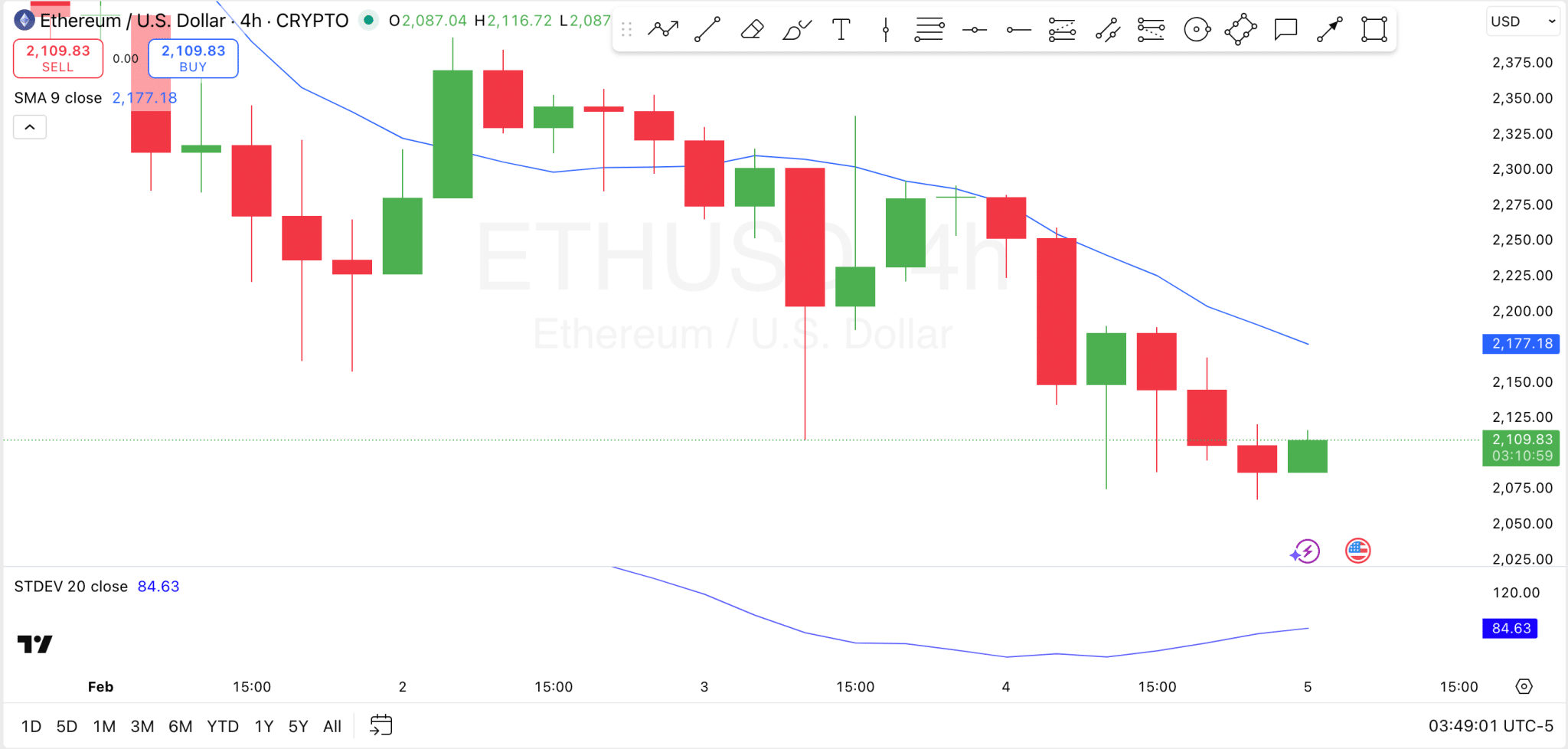

On the technical chart, the price is currently testing important support around $2,060-$2,080, which has seen some recent buying interest. A decline below this range could signal further downside, and the next support level could be around $2,025-$2,050, the last in March 2025.

Ethereum price analysis

On the resistance front, Ethereum faces an immediate barrier at the $2,170-$2,180 zone, which coincides with the 9-period simple moving average. A breakout above this level is likely to target higher resistance near $2,250-$2,300, where the bears recently sold.

Elsewhere, the standard deviation indicator is 84.63, indicating increased volatility and widening price movements. However, a recovery may require Ethereum to break above the 9-SMA and show reduced volatility to confirm a change in market sentiment.

Ethereum active address for ATH?

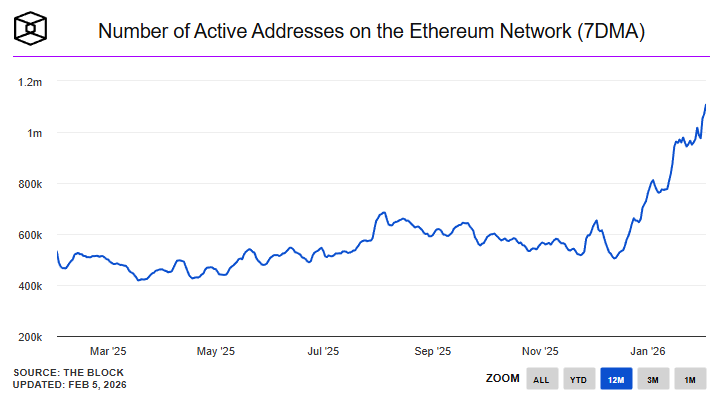

meanwhile $ETH Although prices are facing pressure, fundamentals continue to improve. According to To Joseph Young, the self-proclaimed “Narrator of Ethereum,” $ETHactive addresses have reached an all-time high, indicating increased usage and network activity.

Ethereum active address

This increase in active addresses highlights the growing engagement within the Ethereum ecosystem and provides a strong foundation for the network's long-term potential. Typically, a sudden increase in the number of active addresses often results in increased transaction volume, increased demand, and increased use cases. Such an environment typically supports higher prices.