Bitcoin (BTC) continues to face resistance just below the $120,000 mark and is struggling to build enough momentum for a breakout. Over the past 24 hours, cryptocurrencies have maintained a tight trading range of over $118,000, a slight decline of nearly 4% from their recent high.

Despite the lack of upward movement, analysts suggest that Bitcoin could enter the energy integration phase rather than signaling an imminent slump.

According to data from Cryptoquant, two independent market analysts share perspectives on BTC's current cycle, focusing on long-term valuation metrics and investor activity patterns that could impact the next important price movement.

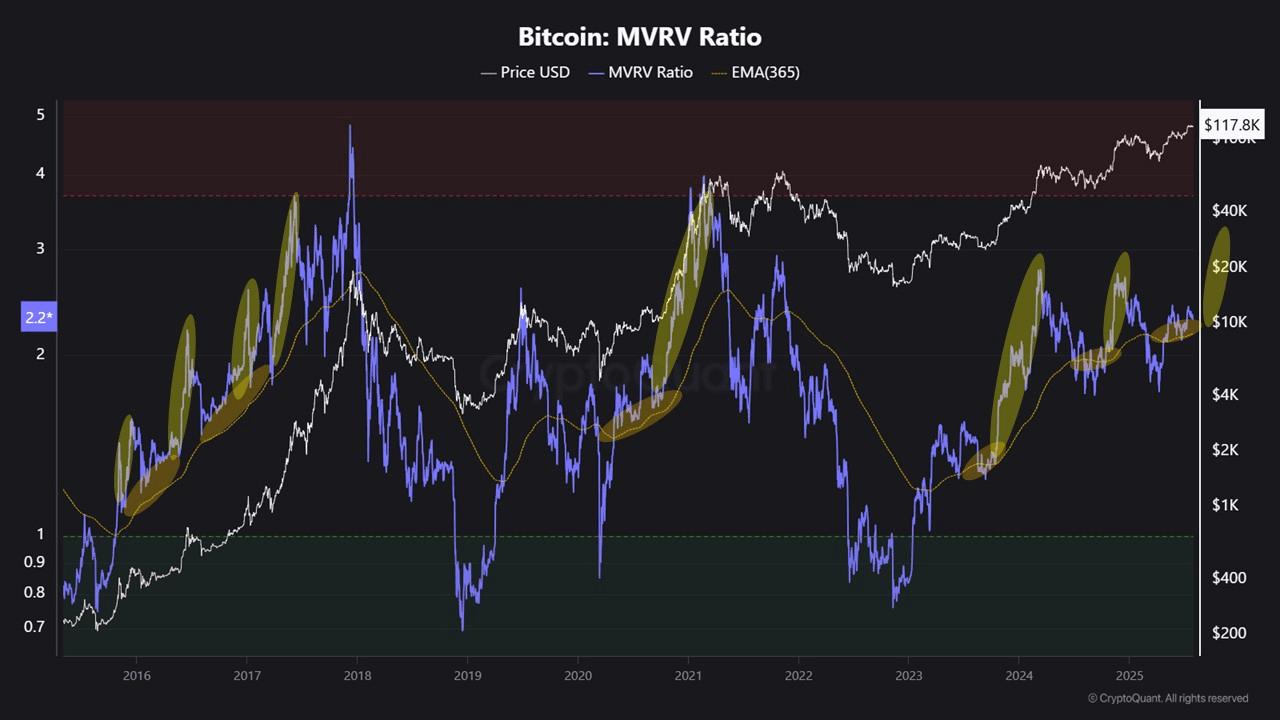

Bitcoin MVRV ratio shows potential upside down momentum

The coincidence of Cryptoquant's contributors highlighted its role in assessing the position of Bitcoin in the current market cycle on the market value realised value (MVRV) ratio.

The MVRV ratio measures whether BTC is trading above or below the recognized fair value. Readings often mark market bottom and readings above 3.7, which are usually associated with market peaks.

In a recent post entitled “The MVRV indicator is converging to the 365-day moving average,” he explained that Bitcoin's MVRV is currently 2.2, gradually approaching the 365-day moving average.

“Historically, when MVRV ratios converge to the long-term average, it tends to rebound and move towards overvalued territory, often accompanied by price growth,” analysts said.

Based on historical patterns, coincidence expects BTC to continue its integration before attempting another upward push.

New Investor Activities Shows a Healthy Late Bull Cycle

In another analysis with another crypto analyst Axeladlerjr, we investigated the market structure of Bitcoin based on investor control measures.

Data showed that the new investor control is currently at 30%, well below the level that previously showed overheated market conditions, reaching 64% and 72% during local price peaks in March and December 2024, respectively.

According to Axeladlerjr, a steady increase in activity from new market participants since July 2024 suggests fresh liquidity is entering the market, supporting ongoing bullish sentiment.

At the same time, long-term holders are selling moderately with a coefficient of 0.3. That is, supplies from coins held for more than three years are absorbed without causing sharp market corrections.

“This dynamic shows that new buyers are active, but there is still space before the market reaches euphoric levels. This usually happens when new investors control is above 60-70%,” analysts say.

Special images created with Dall-E, TradingView chart