Standard Chartered also raised an optimistic outlook for BTC. As It's attracting attention In a previous post, Global Bank targeted BTC for $135,000 in the third quarter. This projection is consistent with previous predictions from Berstein Research. detail In our last news piece.

- Bitcoin futures funding rates are reversed negatively, suggesting that potential prices will rebound first.

- Bitcoin's momentum is improving as BTC focuses on ATH.

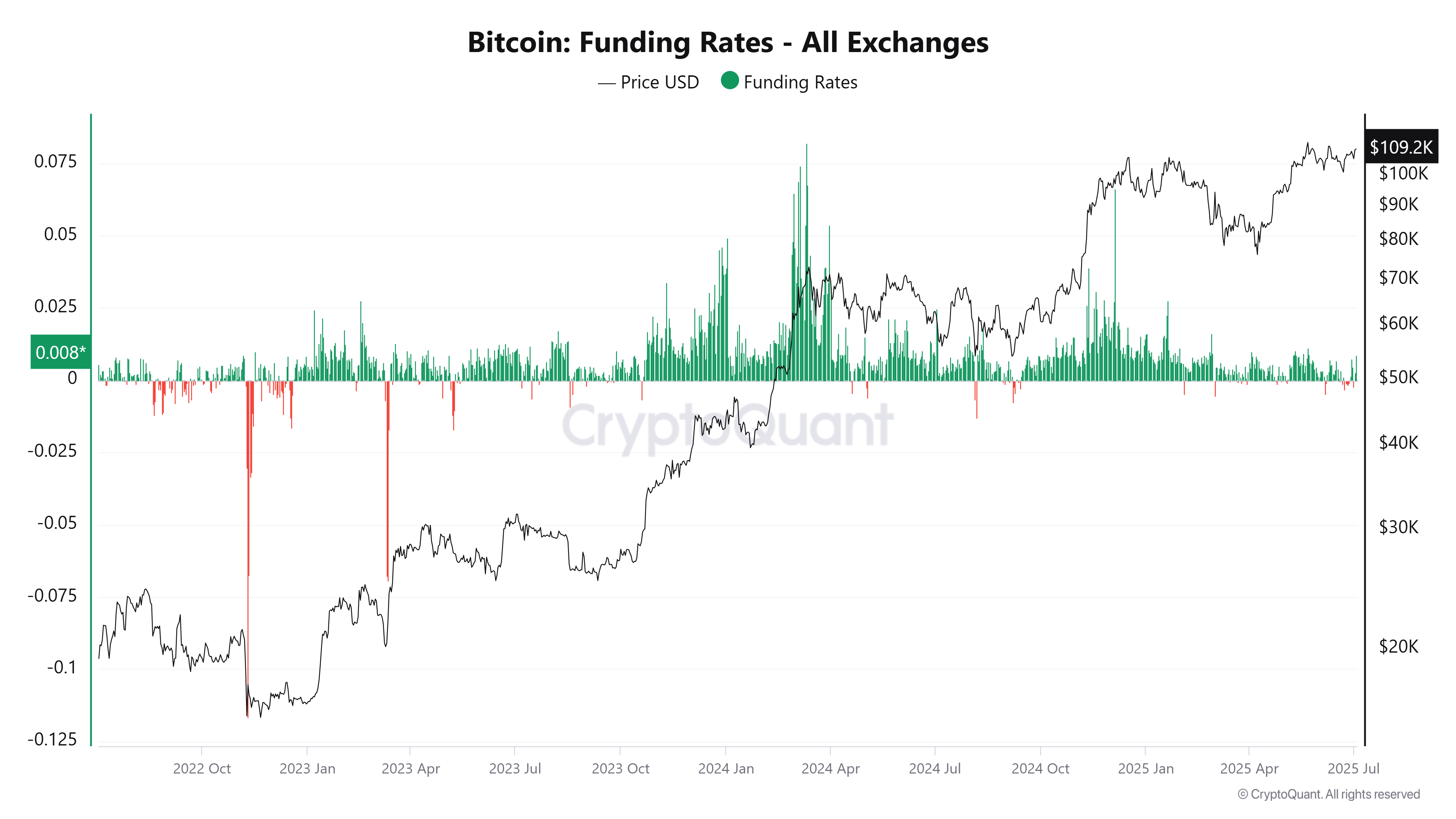

Bitcoin (BTC) futures funding rates have become optimistic for bulls. In particular, this metric was reversed negatively in late June. During this period, BTC spot prices fell below $100,000 to $108,000.

In the past, such differences have shown a major price boom for Bitcoin going forward. In one cycle, BTC prices skyrocketed by 80%.

Bitcoin prices follow historical trends

ONCHAIN Data Analysis Platform Encryption It has revealed that the permanent funding rate for Bitcoin futures has been negative. A negative financing rate means that the cons holder pays long traders to maintain the contract. This is usually a sign of bear market sentiment.

However, sustained negative rates may suggest that the market is oversaturated with bearish bets. This could precede a price rebound if the shorts are forced to buy back their positions.

When futures funding rates slipped in September 2024 and July 2023, BTC quickly experienced 80% and 150% profits, respectively. Given this performance, the main coins may be preparing for a fresh upcoming gathering. Analysts argued that a bearish reset may have already been rolled out.

Bitcoin Funding Rate | Source: Cryptoquant

According to Coinglass liquidation data$111,320 for the BTC/USDT pair represents the highest liquidation concentration projected over the past three months. Within this price level, data revealed an estimated $5231 million in leveraged positions at risk.

This fluidity can cause shorter throttles when tapped. In this case, forced buybacks from short traders could raise prices.

Two major factors that have influenced the latest BTC rally are the influx of ETFs and the confidence in the decline in Fiat's strength. With a recent update, we It's covered The US dollar fell nearly 11% in 2025, reaching an unprecedented low in decades.

Amidst the weakening of the dollar, US spot Bitcoin ETFs recorded net inflows of over $4.63 billion in just three weeks. Long-term holders continue to buy Bitcoin. On H1 2025, Bitcoin mints over 26,000 billionairesshowing that its rising price.

BTC approaches ATH

Bitcoin, the major cryptocurrency, is currently trading $110,306. Over the last 24 hours, BTC prices have increased 2.3%.

Daily trading volume also rose more than 24% to $58.4 billion. The rally shows momentum has resumed as investors show a renewed interest in the coin.

Based on the latest price performance, BTC is approaching the all-time high (ATH) of $111,924. Technical analysis also points to potential gatherings on the horizon.

Analyzing the daily chart revealed breakouts above the top trendline of the bull flag pattern. This pattern of movement shows a potential target of nearly $117,500 based on the previous flagpole. The price is closely in line with the $116,000 forecast by Markus Thielen, a 10x study at the end of July.