In September 2025, Gold extended its profit for the fourth consecutive week, setting a new record of $3,659 per ounce. Bitcoin investors were waiting for the BTC to continue as the correlation between the two assets attracted more attention.

However, capital flows may present more complex images. Precious metal gatherings are also thought to divert investors' interest from Bitcoin.

Experts predict that gold will continue to rise

Black Swan capitalist Versant Aljara cited Crescat's capital data on X, noting that for the first time since 1996, foreign central banks held more money than the US Treasury Department. Based on this, he predicted that gold could rise to over $4,000.

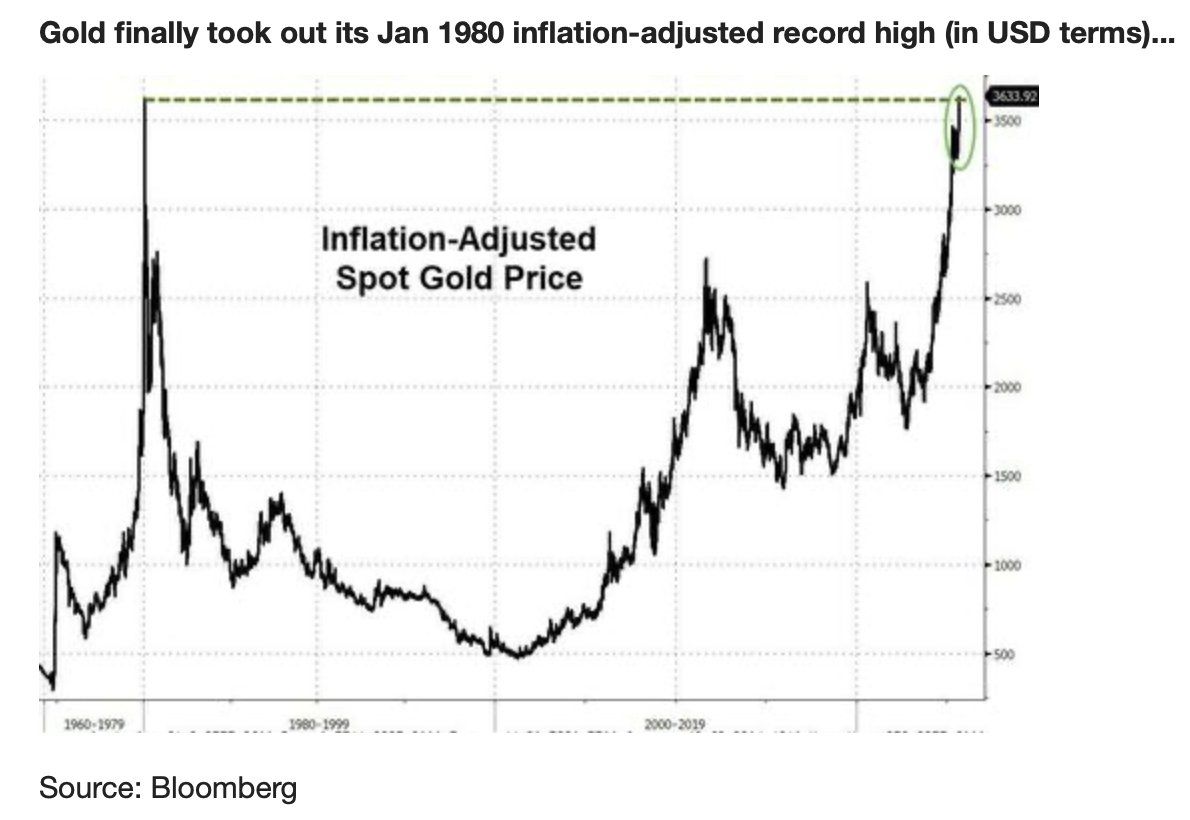

Other analysts added more reasons behind the continued surge in gold. Analyst Endgame Macro explained that in X, gold has broken beyond its inflation-adjusted peak since 1980, ending the 45-year stretch.

Inflation-adjusted spot gold price. Source: BarChart

This development is not random. This reflects a growing US debt, doubts about the Fed's reliability, growing geopolitical tensions, and wider decline in confidence in the current financial system, affected by record-breaking central bank purchases from emerging markets.

“Gold doesn't just gather because people suddenly like shiny metal. It comes together because confidence in the system is slipping into it,” Endgame Macro said.

Similarly, Bridgewater Associates founder Ray Dalio warned of the stag environment caused by global debt burdens. He emphasized that the financial system is heavily dependent on turning debt into money. However, due to the lack of cash today, it is attractive to devalue the US dollar against other currencies. As a result, gold is expected to outperform.

The rise of gold brings new hope for Bitcoin

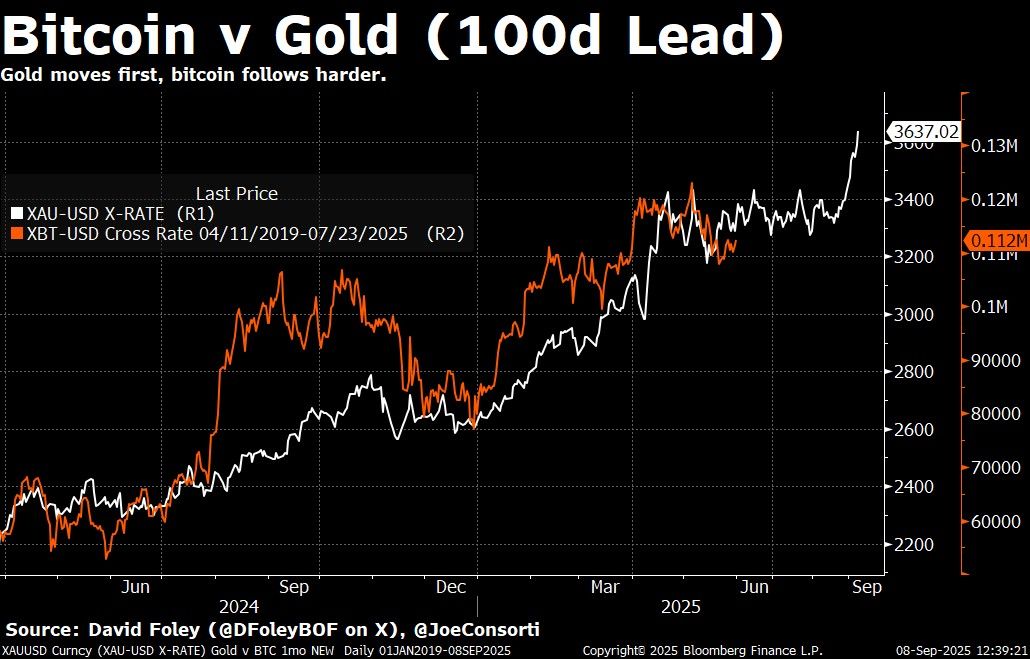

X's well-known Bitcoin analyst Joe Consorti pointed out that gold usually leads BTC for about 100 days, as it has 10 times the liquidity and wider distribution of gold.

Some analysts use 90 days delays instead of 100. But overall, there remains a consensus that Bitcoin usually tracks gold within about three months.

Bitcoin vs. Gold (100D lead). Source: Joe Consorti

This perspective frames BTC as a gold “echo”. With the initial maintenance rate cuts expected next week, the fourth quarter of 2025 appears to be set for strong growth.

“BTC is an echo boom. The first maintenance rate reduction for next week. The Q4 setup looks great,” predicted Consorti.

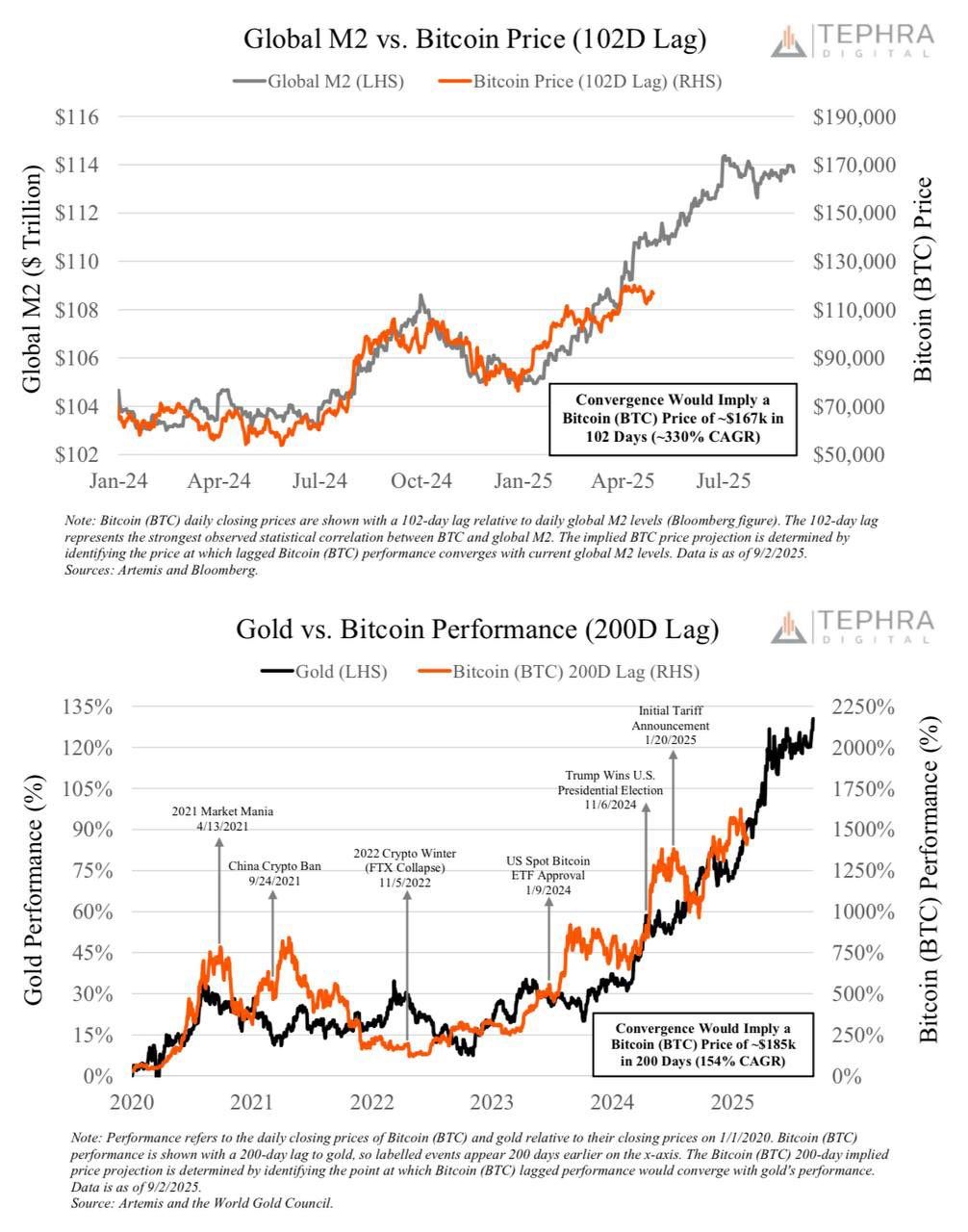

Tephra Digital reinforced this view by examining Bitcoin's correlation with the global M2 supply. Their chart showed that BTC tends to follow the M2 expansion with a 102-day delay.

Global M2, Gold, and Bitcoin. Source: Tephra Digital

“If Bitcoin's delayed M2 and gold correlation continues, the rest of the year could be very interesting. The chart below refers to $167K-185K,” predicted Tephra Digital LLC.

The technical perspective is slightly different, but both Joe Consorti and Tephra Digital line up with bullish prospects for gold and Bitcoin.

Despite optimism, some concerns persist. Silver has recently surpassed $41, the highest level since 2012. This sparked the argument that gold and silver could attract more capital than BTC and could potentially flow into precious metals.

“It appears that capital is beginning to spin from assets that have risen like Bitcoin and into traditional safe havens like traditional metals,” investor Lbroad said.

Furthermore, economist Peter Schiff emphasized that Bitcoin is currently about 16% lower than its November 2021 peak when valued in gold. This shows a broader trend in which investors favor precious metals over assets like Bitcoin.

Post Gold records in September could send Bitcoin to $185,000, analysts say it first appeared on Beincrypto.