A chart shared by GordonGekko shows Bitcoin trading below an “equilibrium” line based on global money supply, while another post links the new Russell 2000 breakout to the past rally in BTC. Together, the charts revived a familiar cycle narrative, even though neither post provided clear goals or timelines.

Bitcoin falls below global money supply line as traders warn of gap 'undershoot'

Here is the chart shared by GordonGekko on X Bitcoin It is trading below an estimated “equilibrium” price tied to the global money supply, framing current levels as an undershoot to the model.

The mutual integration of Bitcoin and the world's money supply implies equilibrium. sauce: Bloomberg, Bitwise Europe

The figure, labeled “Bitcoin vs. Global Money Supply: Co-integration Implicit Equilibrium,” plots the market price of BTC against a dotted equilibrium line on a logarithmic scale from the early 2010s to 2025. In the latest segment, the green BTC line is below the dotted series, indicating a negative gap to the model's implicit level.

Additionally, the bottom panel labeled “Mispricing (%)” displays the spread between Bitcoin and the equilibrium estimate. The latest reading is below zero, which indicates that Bitcoin is trading below its implied benchmark, rather than above it, based on the chart.

In a post, Gordon Gekko called the system “Bitcoin and the global money supply” and wrote, “It's clear what happens next,” adding, “Sellers will live in deep regret for the next 12 months.” The post does not mention any specific price targets or timing beyond that statement. This chart cites Bloomberg and Bitwise Europe as sources.

Russell 2000 breakout post brings back “Bitcoin bull market” link on X

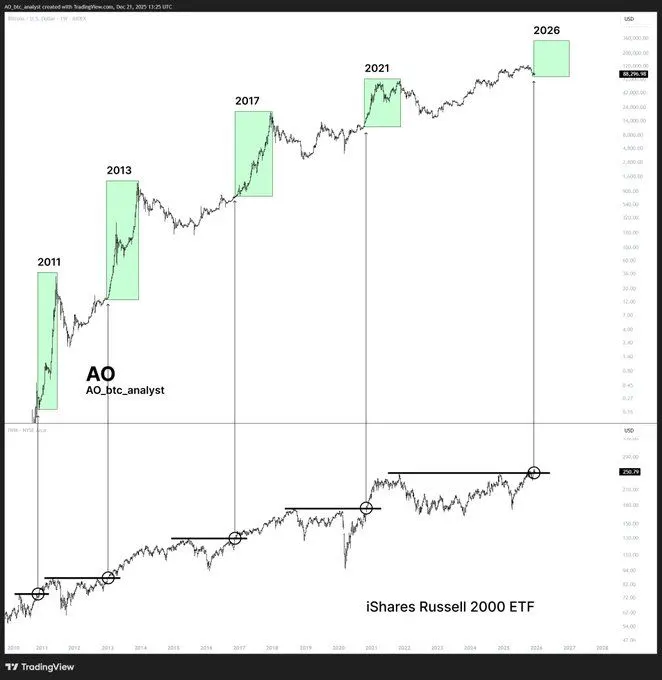

Meanwhile, a post on X by AO, who uses the handle AO_btc_analyst, claimed that Bitcoin's bull run is following a previous breakout in the iShares Russell 2000. ETF He also said that small-cap benchmarks have once again broken out.

iShares Russell 2000 ETF. sauce: AO_btc_analyst for TradingView, X

The chart marks previous Russell 2000 breakout points with horizontal resistance lines and circles, visually juxtaposing them with previous Bitcoin uptrends highlighted by green boxes labeled 2011, 2013, 2017, and 2021. A new green box labeled 2026 appears near the top right, suggesting a predicted continuation if the pattern repeats.

AO writes: “Every time the Russell 2000 breaks out, Bitcoin Brulfollowed by n,” and added, “Russell just broke out.” This post did not include any specific Bitcoin price targets or time periods beyond the historical comparisons shown on the chart.