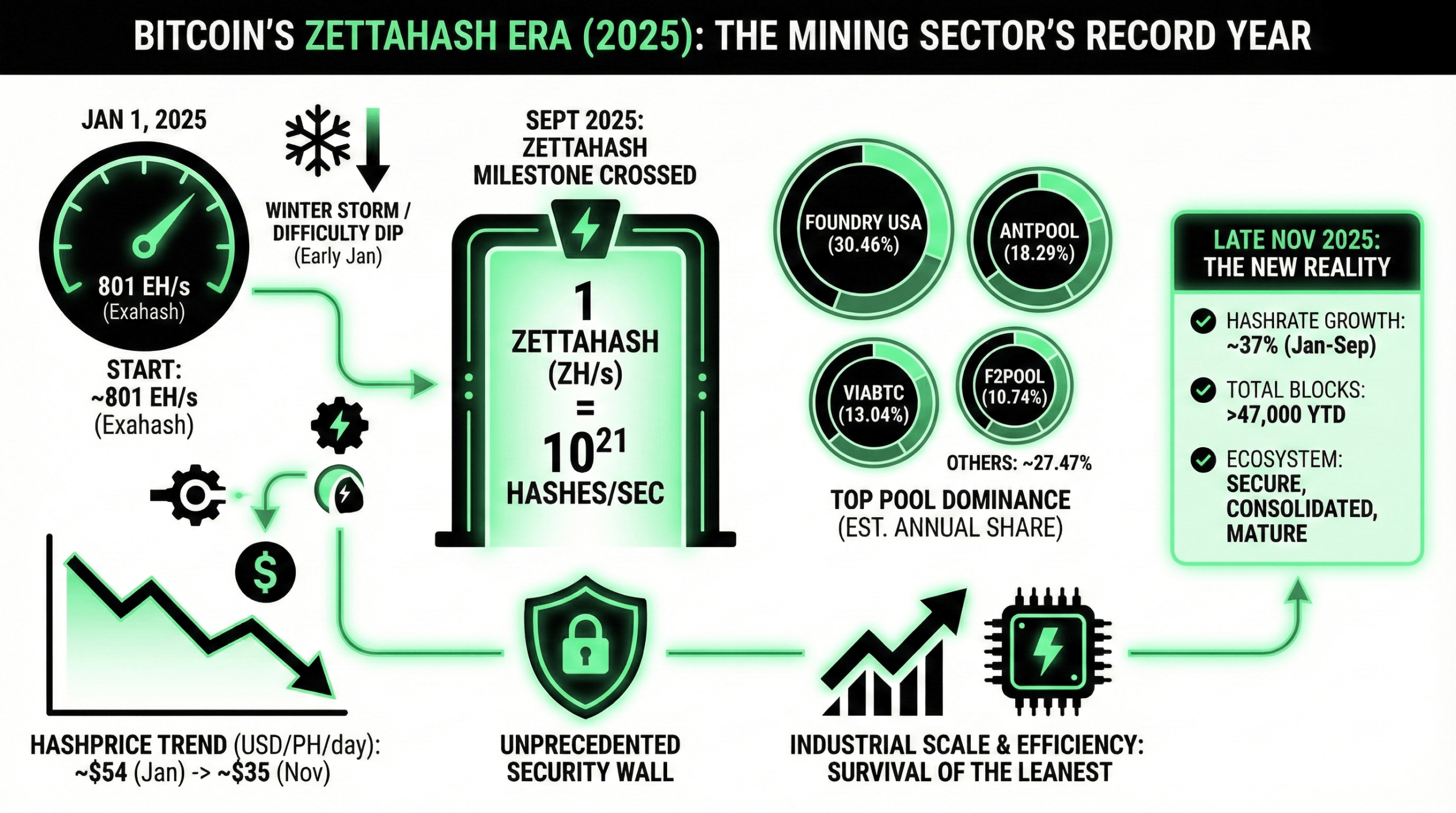

Bitcoin's mining sector spent 2025 rewriting records, strengthening a network that was already at a massive 801 exahashes per second at the beginning of the year into a historic Zettahash era by September.

Bitcoin miners raised money with small fees this year, but still entered the ZettaHash era

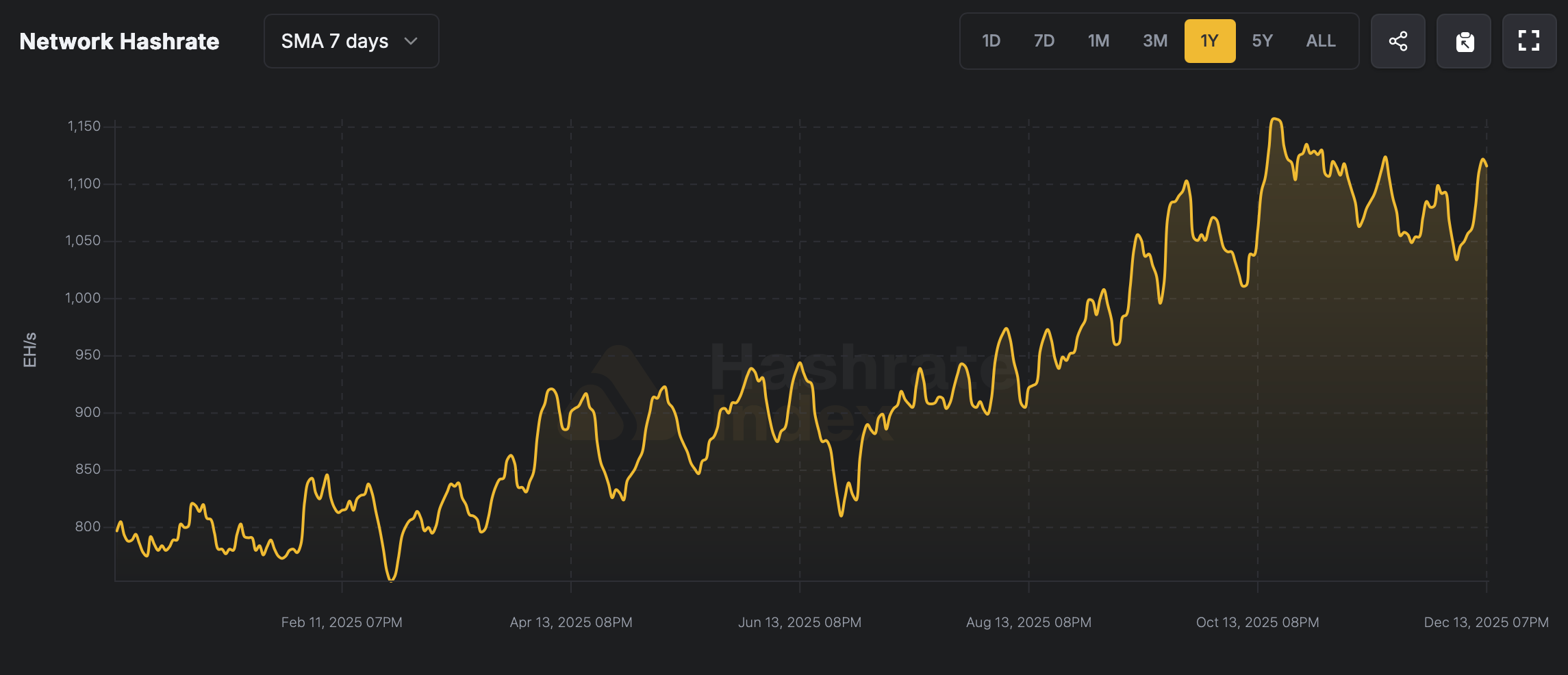

Bitcoin’s 2025 mining story begins with a number big enough to fit in your head. Approximately 801 exahash per second (EH/s) on January 1st. This number alone reflects a network humming along at a scale unparalleled in the digital world, performing 801 quintillion SHA256 calculations every second. This was an early indicator of what would become one of the most transformative years in the history of Proof-of-Work (PoW) security.

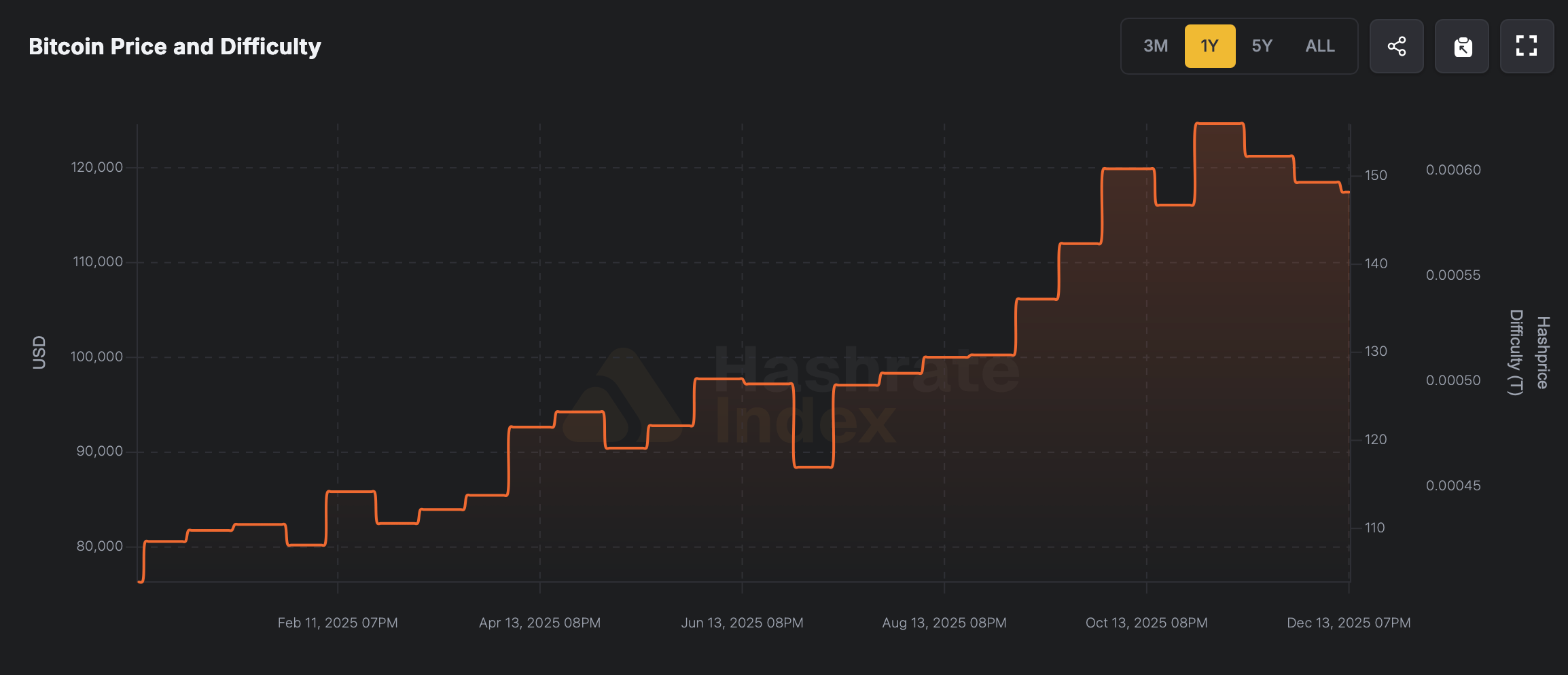

January didn't exactly roll out the red carpet for Miners. Severe winter storms knocked out power to many operations, reducing difficulty for the first time since fall 2024. The network difficulty level was approximately 109.78 trillion at the beginning of this year, but it gradually decreased after adjustment in late January. Meanwhile, transaction fees have fallen to their lowest levels since 2012, which is not the revenue environment miners want. But despite the weather-related downtime and low prices, the network's computing capacity remained strong and continued to inch upwards through the first few weeks of the year.

The difficulty level of Bitcoin has continued to rise this year.

But the real fireworks didn't arrive until September. At that time, the 7-day simple moving average (SMA) breached one full zettahash per second (ZH/s), one of Bitcoin's most iconic milestones. Exceeding the zettahash mark means the network is performing 10²¹ SHA-256 calculations per second. To put it simply, miners added three orders of magnitude more computational power compared to the one exahash threshold that was crossed in 2016. This achievement served as a stark reminder of how quickly industrial-scale mining has matured in less than a decade.

Total hashrate of Bitcoin in 2025.

Zettahash's milestone had significance beyond bragging rights. Nothing strengthens Bitcoin's security more directly than the raw hashrate, and controlling more than half of a zettahash would require investments in hardware and energy running into the tens of billions of dollars. Despite a year of low profit margins and high competition, miners still managed to anchor the network with an unprecedented level of protection. As a result, the ecosystem has become more resistant to attack than ever before, even though mining economics have tightened considerably over the years.

The mining economy in 2025 told its own story. As of January 1st, the BTC-denominated hash price was trending at around 0.00058 Bitcoin per petahash per day, which, when broken down into the smallest units, is equivalent to approximately 58 satoshis per terahash per day. In USD terms, hash price hovered around $54.45 per petahash per day, rising slightly during January but settling in the $50-60 range throughout the quarter. This was the baseline revenue that miners were working on before considering fees, overhead, or incremental difficulty adjustments that continue to squeeze profitability as the network grows.

Also read: Google Trends data shows Bitcoin quietly holding its ground as the year ends

As 2025 approaches, the pressure will only intensify. Hashprice has been on a downward trend throughout the year, falling to around the mid-$30s per PH per day in November and just under $40 per day in December. The combination of minimal transaction fees, increased global competition, and constant investment in next-generation ASIC hardware weighed heavily on inefficient miners. While some carriers were completely sidelined, others consolidated or changed their strategies as the market valued only the leanest, most energy-efficient configurations. In contrast, large-scale operations with access to cheap electricity and cutting-edge hardware strengthen their foothold and reflect the extensive industrial consolidation that shapes the sector.

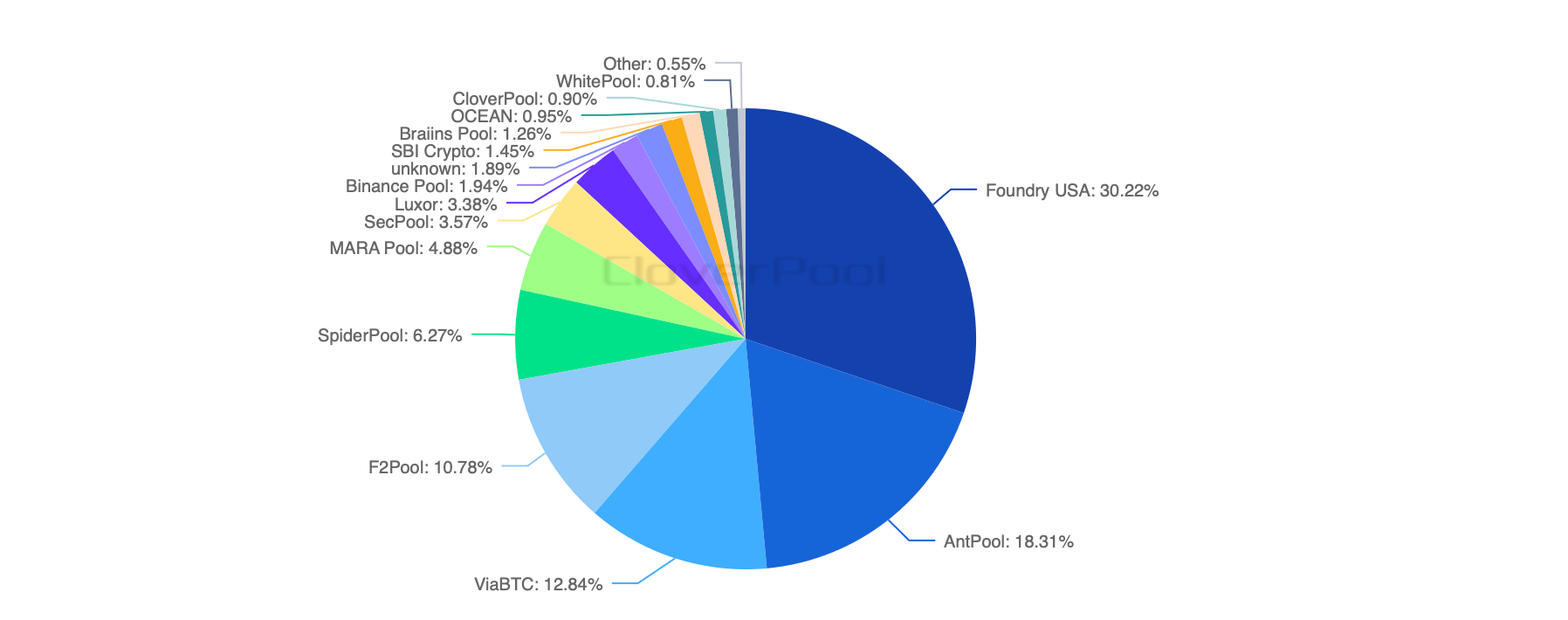

While hashrate and hashprice indicate economic reality, mining pool breakdown reveals how block production has actually fluctuated since the beginning of the year. Using a 335-day measurement window from January 1st to December 1st, the network generated an estimated 47,664 blocks. Each pool's annual share provides a reliable proxy for determining who mined what in a given year. According to this metric, Foundry USA dominated in 2025, winning 30.46% of all blocks (approximately 14,518 blocks year-to-date). This lead represents not only hashing power, but also the scale of operations required to maintain such a track record in a year of intense competition.

Distributing 12-month hashrate via cloverpool.com.

Next, Antpool was the second largest contributor with an estimated 8,718 blocks and held a share of 18.29% over the same period. ViaBTC ranks third with 13.04% of block generation, which equates to approximately 6,215 blocks. F2pool came a close second with a 10.74% share, or about 5,119 blocks. These four pools alone control approximately two-thirds of all blocks mined in 2025, reflecting the increasingly industrialized nature of the sector. In a high-difficulty, low-margin environment, scale is more important than ever.

Below the big four, Spiderpool carved out a meaningful slice containing an estimated 2,850 blocks, or 5.98% of total production. The MARA pool contributed around 2,340 blocks with a 4.91% share, while Secpool added around 1,702 blocks with a 3.57% share. Another notable contributor was Luxor, with a year-to-date share of 3.30%, or approximately 1,573 blocks. These mid-tier pools collectively account for a significant portion of the remaining hashrate and provide a glimpse into the competition occurring just outside the top tier.

The long tail of the mining landscape included an “unknown” category representing the Binance pool with an estimated 910 blocks (1.91%) and independent miners who collectively mined approximately 882 blocks (1.85%). Smaller pools such as SBI Crypto, Brains Pool, Ocean, Cloverpool itself, Whitepool, Ultimus Pool, Poolin, Bitfufupool, Solo CK, 1Thash, and Kanopool captured the remaining blocks in varying proportions. Although these operators together represent only a small portion of overall block production, their participation highlights the decentralization of the network and the tenacity of small, niche-focused miners who continue to contribute despite increasing competitive pressures.

By December, the situation was clear. 2025 was the year that Bitcoin leveled up. Hashrate increased by approximately 37% from early January to early September, and the 7-day average continued to exceed one complete zettahash per second. Even as hash prices fell and operating costs remained high, miners continued to push the limits of what their hardware and human appetite for risk could support. The network has secured more than 47,000 blocks year-to-date, and competition has never slowed down despite tough economic conditions.

The year ended with a storied and undeniably strong mining sector. Highly efficient operations proved able to weather tough revenue environments, while less efficient setups were forced to upgrade, consolidate, or shut down altogether. But the numbers tell a simple story. Backed by an unprecedented wall of computing power, Bitcoin security reached an all-time high in 2025. The era of zettahash didn't just arrive, it was here to stay, put down your shoes, and make yourself at home.

Frequently asked questions ⛏️

- How much has Bitcoin's hashrate increased in 2025?

It rose from around 801 EH/s at the beginning of the year to more than 1 ZH/s in early September. That is approximately 200 EH/s per year. - What was the hash price for miners on January 1, 2025?

Miners earned approximately 0.00058 Bitcoin per PH/day, or approximately $54.45 per PH/day in dollar terms. - What is the number of blocks mined since the beginning of the year up to December 1st?

The network produced an estimated 47,664 blocks in the first 331 days of this year. - Which mining pool will lead block production in 2025?

Foundry USA, Antpool, ViaBTC, and F2pool dominated with around two-thirds of all blocks mined.