Ethereum sell-off intensifies: The reason is $ETH Does it crash?

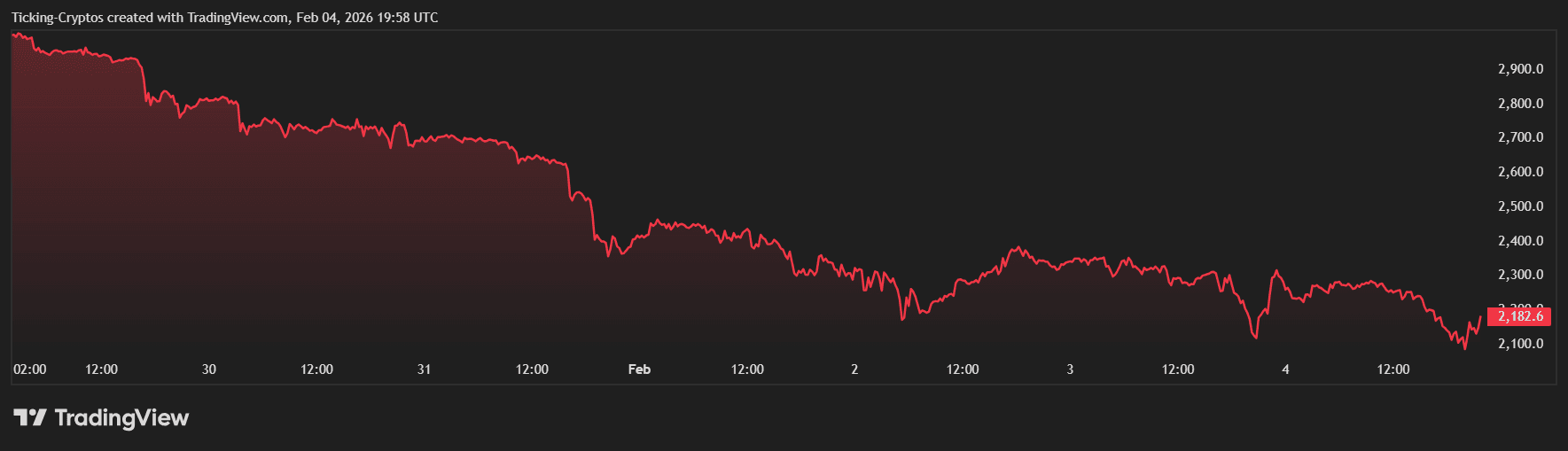

The cryptocurrency market is currently witnessing a major “catastrophe” towards February 2026. Ethereum ($ETH) It has seen a sharp drop in value, dropping nearly 25% in the past seven days. This downward momentum was accelerated by a massive liquidation event on February 1st, which wiped out more than $2.5 billion in positions across the market.

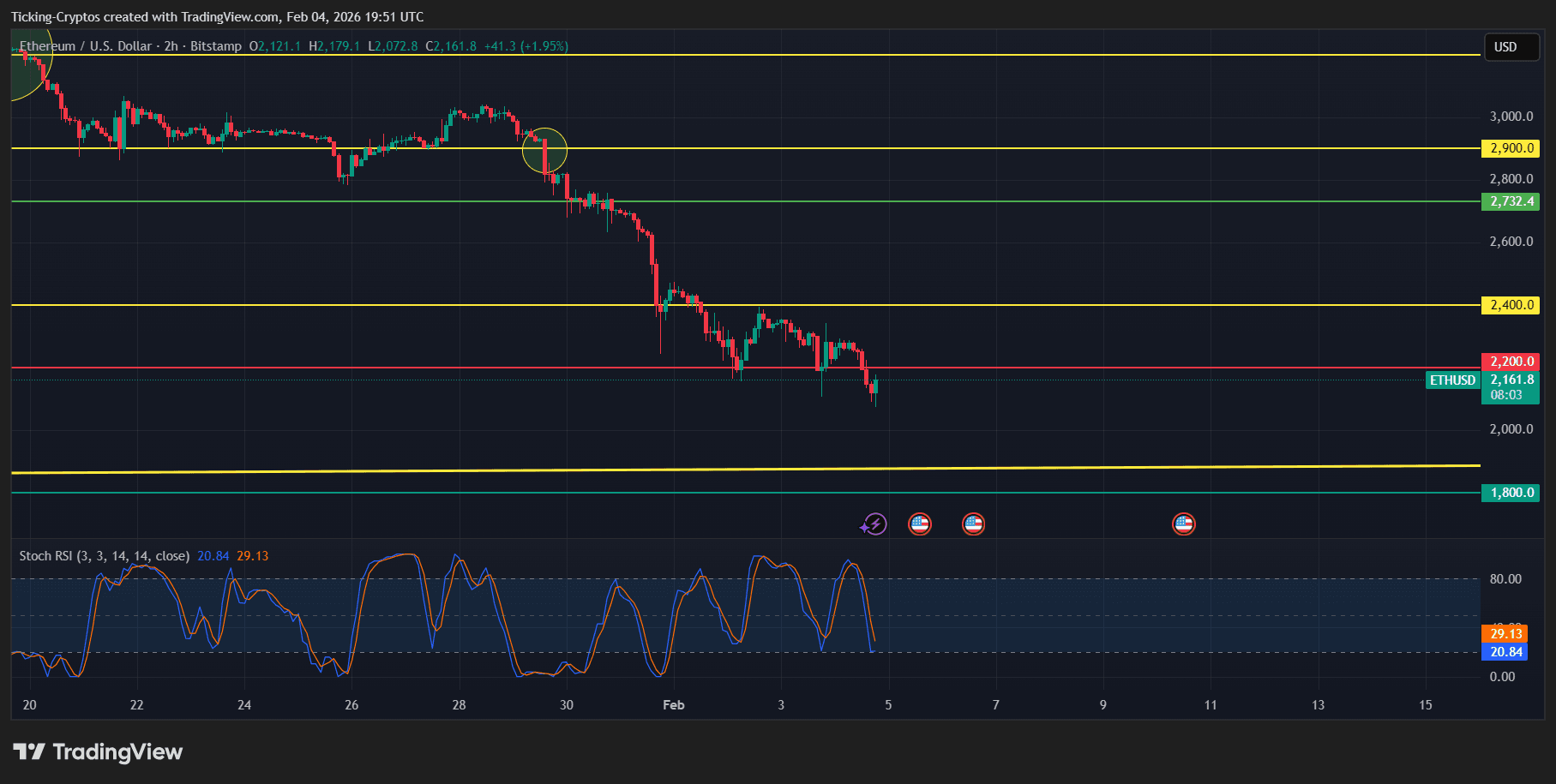

$ETH/USD for the past week – TradingView

Several factors are accelerating this cryptocurrency news cycle. engine leakage from Ethereum ETF The move continues relentlessly, with major companies like BlackRock reportedly moving large amounts of money. $ETH In exchange. Additionally, expectations for the US Federal Reserve have become more hawkish following the appointment of Kevin Warsh as Fed Chairman, weakening the risk-on sentiment that had previously fueled the 2025 bull market.

Technical analysis: Analyzing the ETHUSD chart

Looking at the present $ETH Price, structure is clearly bearish. The price has recently failed to maintain the key psychological level of $2,500 and has now turned into a heavy resistance zone.

As seen in the technical data, $ETH is trading well below its 50-day and 200-day simple moving averages (SMAs). of Relative Strength Index (RSI) is hovering around 30, indicating an oversold situation, but the lack of buying volume suggests that a bottom has not yet formed. The “Layer 2 story” also appears to be cooling, adding fundamental pressure to technological failure.

Ethereum price prediction?: Strong support at $1,800

The $2,200 support zone is currently under extreme pressure and traders are eyeing the next major “demand zone”. If Ethereum fails to recover $2,350 in the short term; $1,800 would be the most likely scenario.

of $1,800 support level Historically important. This will serve as a key pivot point during the mid-year correction in 2025 and coincides with the long-term Fibonacci retracement level. Many analysts believe this area acts as a “liquidity trap” that institutional buyers could eventually return to and accumulate.

- Immediate resistance: $2,420

- Key support 1: $2,100

- Ultimate support: $1,800 – $1,850

For those looking to protect their assets during this volatility, comparing the best hardware wallets is an important step to avoid currency-related risks. If you're considering trading this move, check out our exchange comparison pages to ensure you're using a reliable platform.

Market sentiment and macro outlook

The Fear and Greed Index has plummeted into the “extreme fear” zone (currently at 15), the lowest level since the 2022 bear market lows. Extreme fear is often a contrarian buying signal, but the macro environment, characterized by geopolitical tensions in the Middle East and tight US liquidity, suggests that the “digital gold” narrative is being tested. The correlation between stocks and cryptocurrencies remains high, according to Bloomberg data, so Ethereum may need a recovery in the Nasdaq for a sustained rally.