While Ethereum activity across the broader ecosystem has risen sharply, other charts indicate a potential long-term reversal structure and a short-term hiatus around major averages. These visuals show the increased usage of the network during price trading in the decision area.

Ethereum ecosystem activity spikes on growth graph

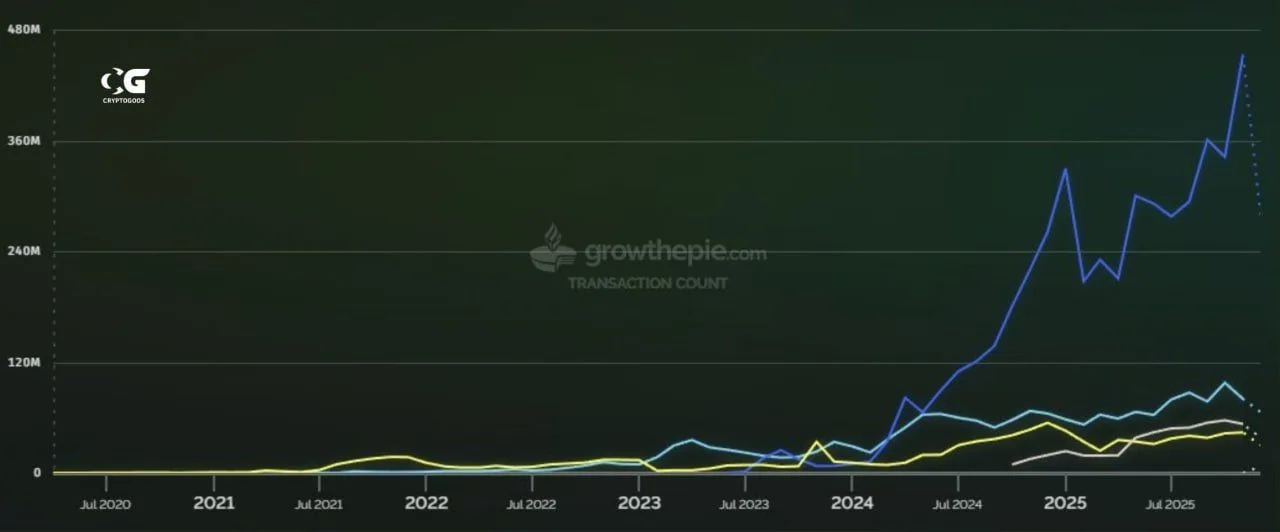

“Activity in the Ethereum ecosystem is currently exploding,” CryptoGoos’ post on X says, along with a chart from growthepie.com that tracks the number of transactions from mid-2020 to mid-2025. The figure shows that activity remains low for many years, then begins to increase until 2023, accelerating in 2024 and 2025.

Number of transactions in the Ethereum ecosystem. sauce: Growth pie. com/X

One line on the chart rises sharply from early 2024 onwards, passing the 240 million mark and approaching a peak near 480 million by 2025. Meanwhile, several other lines are also trending up, but more slowly and still well below the top line.

Although this chart does not explain what causes the spike, its shape fits a widespread shift to increased on-chain usage, especially among multiple users. Ethereum related network Transactions can be processed outside of the mainnet and then returned to Ethereum. Still, transaction counts alone don't tell you how many unique users participated or the value transferred. So more context is needed before this surge suggests broader adoption.

Ethereum weekly chart shows inverted head-and-shoulders setup near neckline

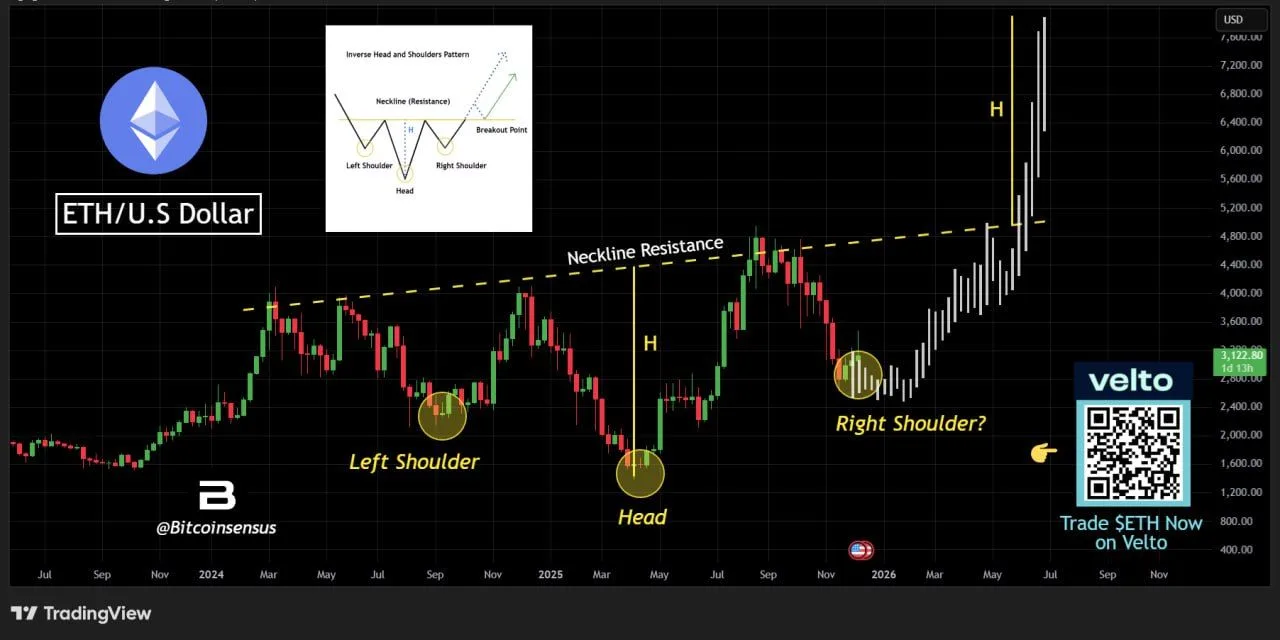

Meanwhile, Bitcoin Census stated: Ethereum On the weekly chart, the macro inverted head and shoulders pattern is nearing completion. This image shows a left shoulder in late 2024, a deeper “head” low in early 2025, and a right shoulder that may have formed after the peak and pullback in mid-2025.

Ethereum's inverted head and shoulders pattern. sauce: TradingView/X

The chart also depicts an upward neckline labeled resistance, where price movements repeatedly stall around that zone before moving higher. If ETH maintains the higher low structure on the right and then breaks through the neckline, the textbook signal for the pattern would be a breakout confirming a reversal from the previous downtrend.

Still, the right shoulder label includes a question mark, so the setup relies on follow-through. If ETH does not stay above the shoulder area and falls towards the head area, the pattern loses structure and traders typically treat the neckline as unbroken resistance rather than a trigger.

Ethereum trades near major moving averages as RSI stabilizes

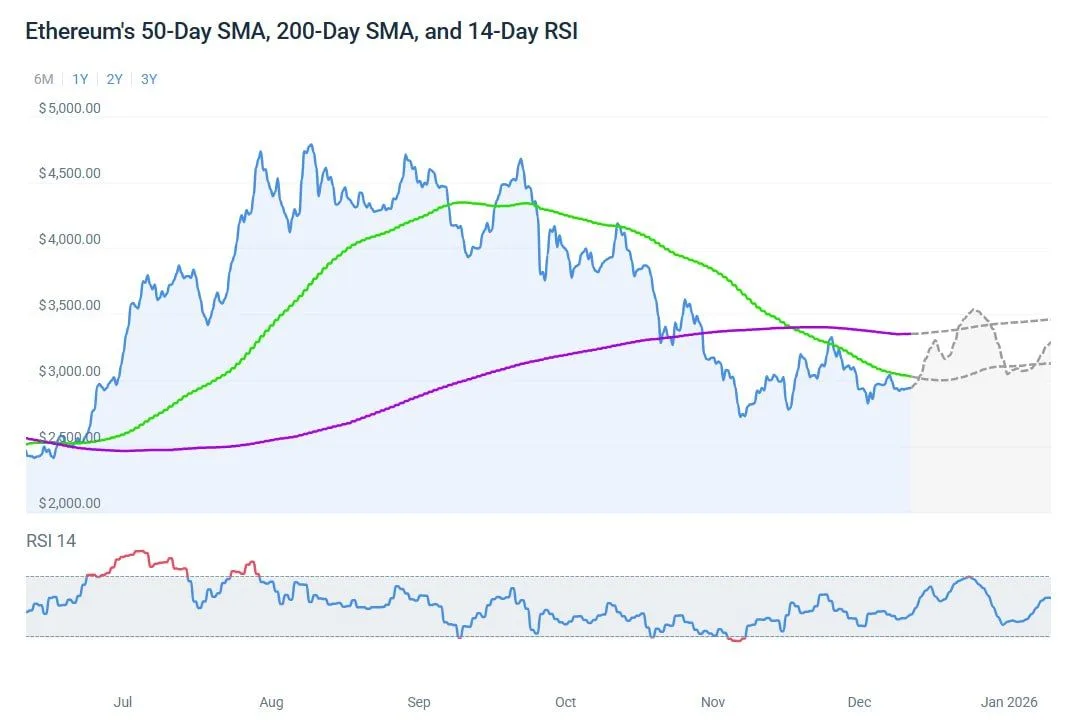

Ethereum price fluctuations indicates a mixed technology setup, with the asset approaching the 50-day and 200-day simple moving averages. While the chart shows ETH below its short-term average, it is hovering around the long-term trendline, indicating a pause in the recent decline from previous highs.

Ethereum 50-day SMA, 200-day SMA, and 14-day RSI. sauce: coin codex

Reflecting weak momentum in recent weeks, the 50-day SMA has turned downward and is now sloping towards the 200-day SMA. At the same time, prices have stabilized around the midrange, suggesting that selling pressure is slowing rather than accelerating.

On the other hand, the 14-day RSI remains near the neutral level. The indicator has recovered from its previous lows but has not reached overbought territory, indicating a balanced situation. Taken together, these signals indicate that Ethereum is holding firm as traders wait for a clearer directional move.