Bitcoin prices continue to exceed $110,000, but began to show sales pressure in the last week of September.

Currently, several on-chain metrics and macroeconomic signals warn that BTC rallies may have exhausted steam. What are these warning signs? Details can be found below.

Three warning signals for Bitcoin prices for the last week of September

Historical data show that September has a “curse” that lasts for over 10 years. It has been consistently the weakest month of the year. In just over a week, this pattern can be repeated when a negative signal is constructed.

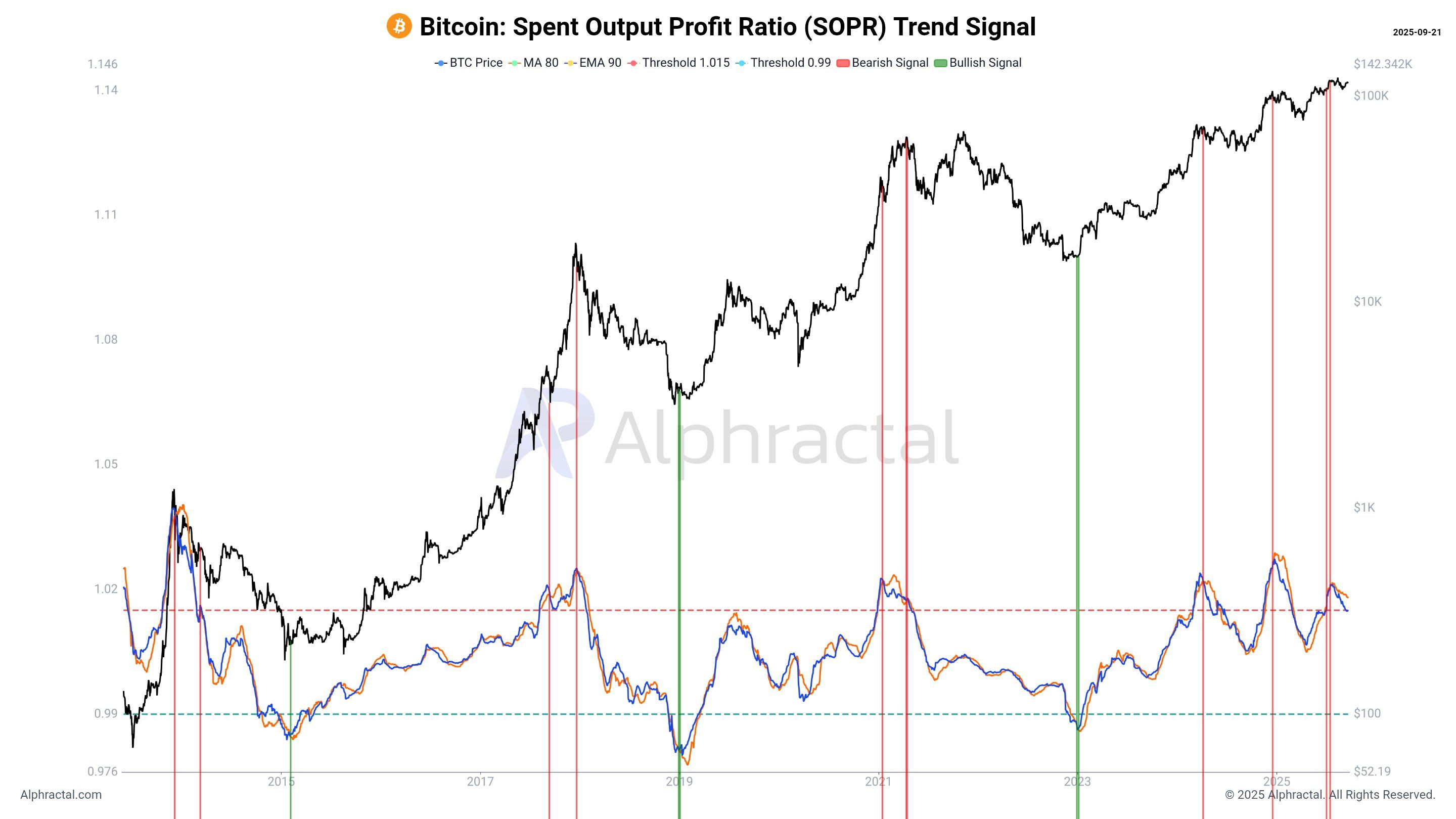

On-Chain Signal: SOPR indicates profitability is running out

Alphractal founder Joao Wedson stressed that used output profit margin (SOPR) trend signals are becoming bearish.

SOPR measures whether Bitcoin transactions on the chain are profitable or lose. Readings above 1 means that the seller is making a profit (selling BTC above the purchase price). Reading below 1 means that the seller is at a loss (selling below cost).

Bitcoin used the Output Profit Rate (SOPR). Source: Alphractal.

Currently, the SOPR remains above 1, but is heading downwards. This suggests that profitability from transactions on the chain is declining.

Historically, as shown in multiple past cycles, the chart mark Bitcoin peak red zone. Wedson explained that investors tend to have BTC too late at such times and prices tend to be excessively high.

“SOPR trend signals are excellent at signaling when blockchains are profitable. In Bitcoin history, investors have never accumulated BTC very slowly and at such a high price,” Joanne Wedson said.

Wedson also noted that the Short-Term Holder (STH) recognized the price at $111,400, close to current market levels. If this threshold is below this threshold, it could trigger a stop loss sales. Surprisingly, BTC has already fallen below this level in the last week of September.

Furthermore, despite the higher prices than Bitcoin's previous cycle, the Sharp ratio is weaker. This means low risk-adjusted returns and low profitability.

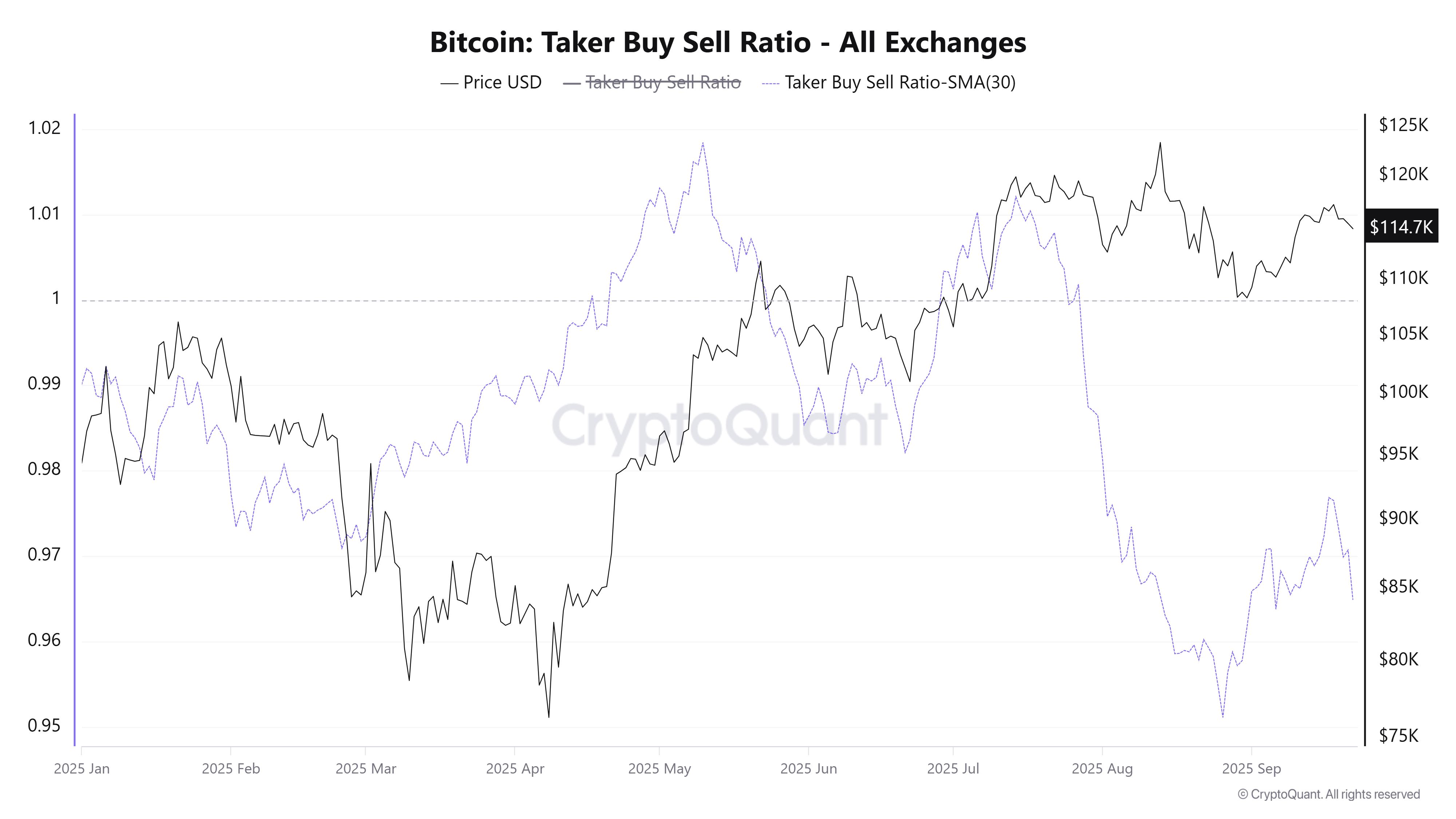

Exchange Signal: Taker Buy/Sales Ratios drop sharply, with sales pressure dominating

According to encrypted data, taker buy/sell ratios across all exchanges have fallen below 1 in recent weeks. The 30-day simple moving average (SMA30) also follows this downward trend.

Bitcoin Taker purchase and sales ratio. Source: Cryptoquant.

This shows that aggressive sales volume (taker sales) is currently outpacing buying, reflecting negative trader sentiment. Historically, if this ratio remains below 1, Bitcoin often faces downward pressure, especially when prices are already close to record highs.

This is a clear indication that bullish momentum is weakening. Without new capital inflows, there could be a reversal in the last week of September.

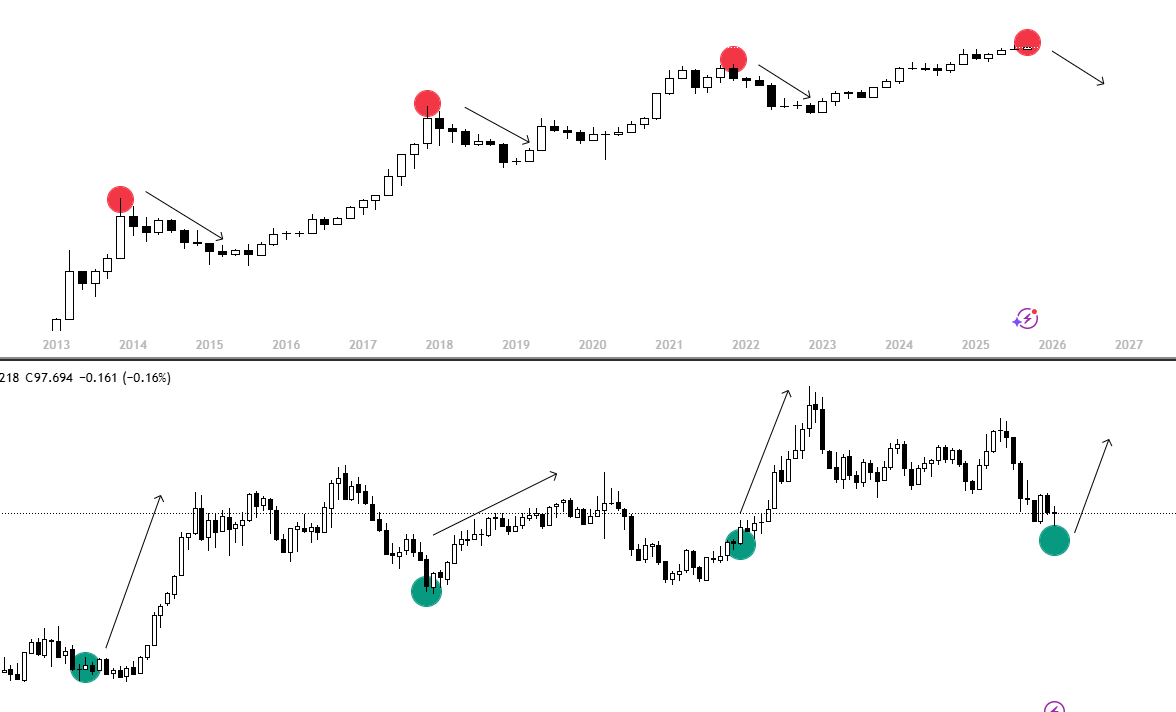

Macro signal from DXY

The US Dollar Index (DXY) has rebounded since the Federal Reserve's recent interest rate cuts. It rose from 96.2 points to 97.8 points.

Some analysts warn that an inverse correlation between DXY and BTC could return, pose a negative side risk to the price of Bitcoin.

Bitcoin vs dxy. Source: Killa.

Analyst Kira outlined a broader scenario. If DXY continues to recover, Bitcoin could turn around like in 2014, 2018, and 2021.

These three signals (chain, exchange base, macro) strengthen the September curse of Bitcoin. As history repeats itself, you can see it on the last day of the month.

Three warning signs of Bitcoin fatigue for the last week of September first appeared on Beincrypto.