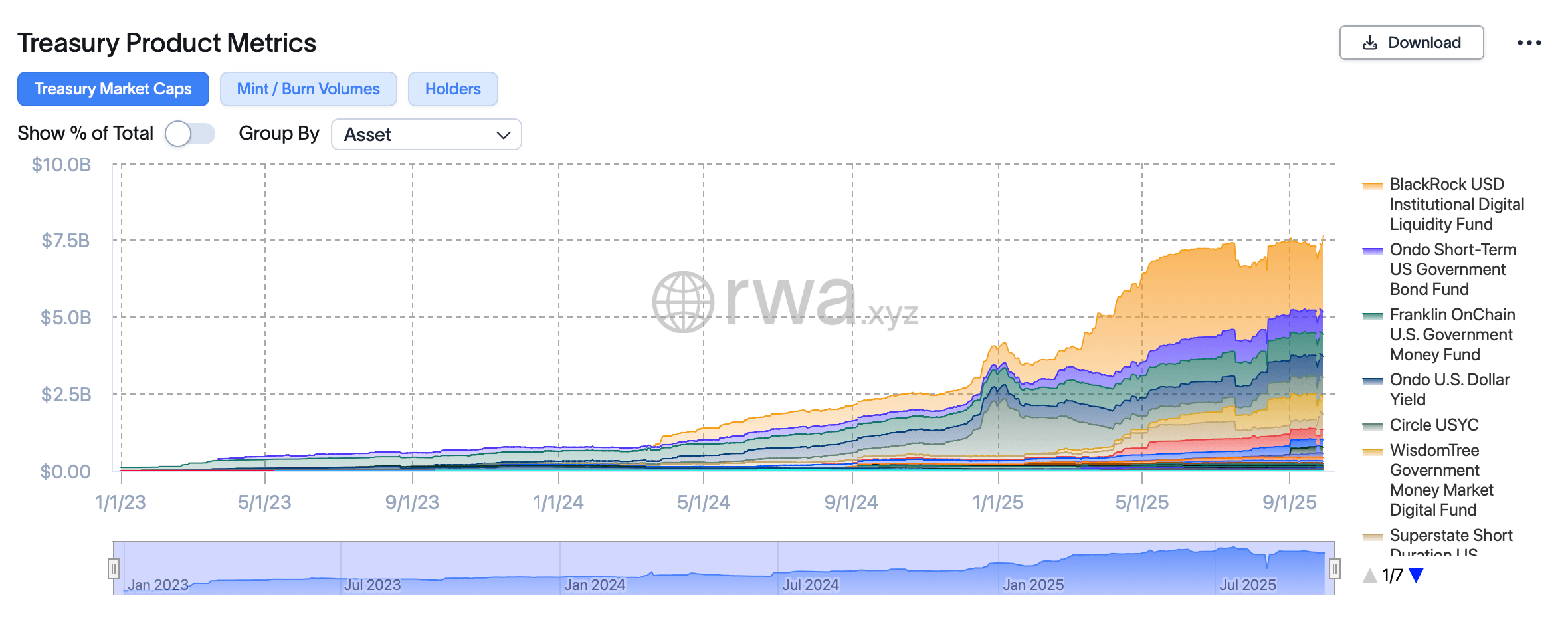

The tokenized US Treasury has added $372.55 million over the past seven days, increasing its total to $7.65 billion.

Tokenized bonds expand as institutions support on-chain money funds

Current data from RWA.xyz shows value at $7.65 billion, up 4.87% a week, with an average yield of 3.95%. With 52,484 owners and a 1.08% drop in one week, a big ticket suggests they drove it. This is a centralized market that continues to attract traditional finance (TRADFI) managers built on public rails.

Due to the blockchain network, Ethereum remains an anchor with a market capitalization of $5.3 billion. The BNB chain continues at $496.8 million, followed by $476.7 million, while Solana continues at $456.0 million. Arbitrum is $171 million, XRP ledger is $169.6 million, and avalanches is $137.8 million, with fewer stocks in other chains.

The seven-day net flow was found at $391 million by Ticker Buidl, the USD agency's digital liquidity fund in BlackRock. WTGXX, WisdionTree's government money market digital fund, reduced $275 million, while USTB, Superstate's short-term US government securities fund, reduced $156 million. Circle's USYC added $60 million, Kaio's Uma brought in $20 million, and Libeara's Thbill won $12 million.

Not all products printed a plus week. Openeden's Tbill has hit $12 million in XTBT, the flexible term USD Vault for Outflows and Opentrade. This mix fits into a market that still grows more liquidity that rotates between products as publishers adjust fees, durations and railroads.

The tokenized Treasury Funding Federation remains fairly top. BlackRock's Buidl is leading by market capitalization at around $24.9 billion and is beginning to recover from previous outflows. Ousg, Ondo's short-term US government bond fund, costs around $728.6 million, while Benji, Franklin Templeton's Onchain Money Fund, costs $717.4 million.

Ondo's US dollar yield, USDY holds approximately $689.4 million. Circle's USYC is approaching $636.2 million, while Wisdomtree's WTGXX lists $557.2 million, reflecting the demand for money market exposures from Onchain Settlement.

Superstate's USTB is around $491.6 million, and Janus Henderson's Anemoy Treasury Fund's JTRSY has recorded $345.6 million. Openeden's Tbill holds $239.9 million, while Fidelity's Digital Interest Token FDIT sits near $240 million on Ethereum. Libeara's super clock costs around $136.4 million.

Further down the ladder, Spiko's USTBL commands $116.4 million, while Vaneck's VBill lists $74.1 million. Fidelity's FIUSD shows $45.4 million, while Opentrade's XTBT is nearly $30 million. Guggenheim's DCP lists $30 million and Kaio's fund total of $22.1 million, while Plume's Net's NTBill valued a lock-in of about $17.5 million.

Abrdn's Aaulf tracks $15.5 million, Midas' Mtbill posts $12.6 million, Wisdomtree's USFR.D posts $12.1 million, and Theo's Thbill posts $11.6 million. Backed's Bib01 concludes the group with $9.54 million, showing the long tail of a niche Treasury that taps multiple issuing facilities and chains.

Big picture: The agency is testing token rails on conservative paper, and cash continues to appear. In addition to a stable yield of nearly 4%, a fast settlement is a clean pitch for finance companies who want operational efficiency without exotic risk. This looks just too early, but the scoreboard is getting bigger.