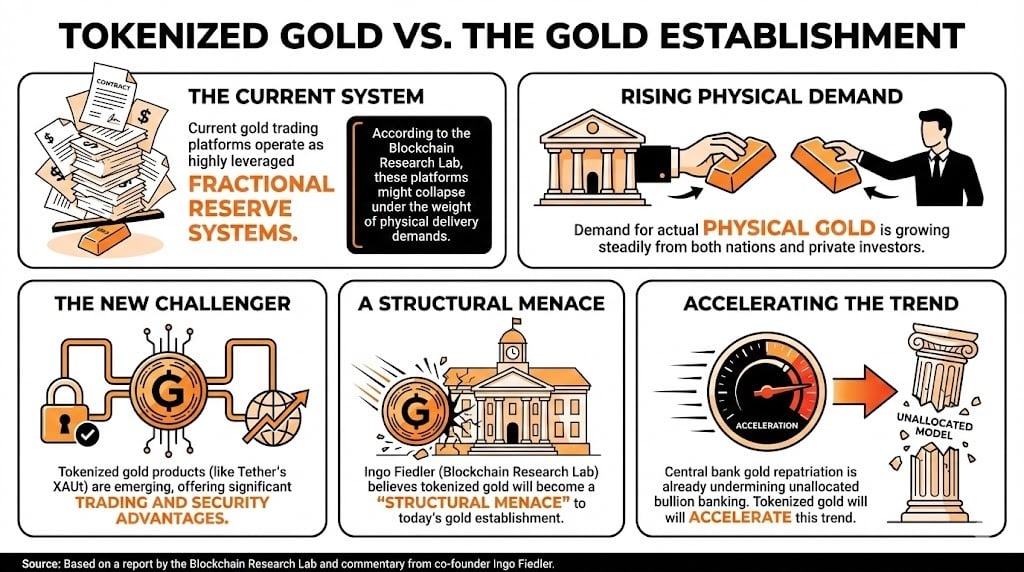

A recent report by Blockchain Research Lab examines the benefits of tokenized gold and the current paper gold platforms in use and predicts that tokenization will prompt gold investors to exit traditional systems and destabilize global gold institutions.

Tokenized gold triggers liquidity crisis as investors shift

fact

A recent report by Blockchain Research Lab, a German non-profit organization that studies the use of blockchain for social good, considers the impact that the rise of tokenized gold will have on the current system.

Ingo Fiedler, co-founder of the institute, said that as demand for physical gold increases from both sovereign and retail investors, current gold trading platforms that function as highly leveraged fractional reserve systems could collapse under the weight of physical deliveries.

While geopolitical factors may also mitigate this crisis, Fiedler believes that tokenized gold could pose a structural threat to today's gold establishment, as it would definitely displace more investors from its trading and safety benefits.

Fiedler said:

Over the past few years, central bank accumulation and repatriation have steadily eroded the foundations of the bullion banking unallocated model. This trend will accelerate with the advent of tokenized gold products like Tether’s XAUt.

read more: Schiff doubles down on Bitcoin criticism, pushes tokenized gold as real asset on blockchain

Why is it relevant?

Fiedler’s views on the future of the gold market are a prime example of how blockchain can be part of a better designed system to support real-world assets (RWA), and how substitution can lead to the collapse of legacy platforms.

While Fiedler's analysis may seem far-fetched to some, as the numbers moved in London, New York, and Shanghai are huge, and tokenized gold is still in its infancy, the benefits of tokenization are undeniable.

“History teaches us that leveraged and fragile systems rarely unravel gently. Bitcoiners intuitively understand that, as Hemingway describes bankruptcy: gradually and then suddenly,” he concluded.

I'm looking forward to it

Financial analysts predict that tokenization will sweep the financial world and gold will be no exception, but given the level of leverage in the gold market, the consequences of this change could be disastrous.

FAQ

What is discussed in the recent Blockchain Institute report?

This report is tokenized gold It may impact traditional gold trading systems based on fractional reserves.What are the likely effects of increased demand for physical gold?

Due to increased demand, current gold trading platforms may face difficulties in physically delivering gold, leading to the collapse of the existing system.How could tokenized gold impact the traditional gold market?

Ingo Fiedler believes in tokenized gold like Tether XAUtcould undermine traditional bullion banking by shifting investor preferences towards its transparency and safety benefits.What are the future predictions for tokenization in finance?

Analysts are tokenization The increase in assets will revolutionize finance, but the transition in the gold market could cause problems due to high levels of leverage.