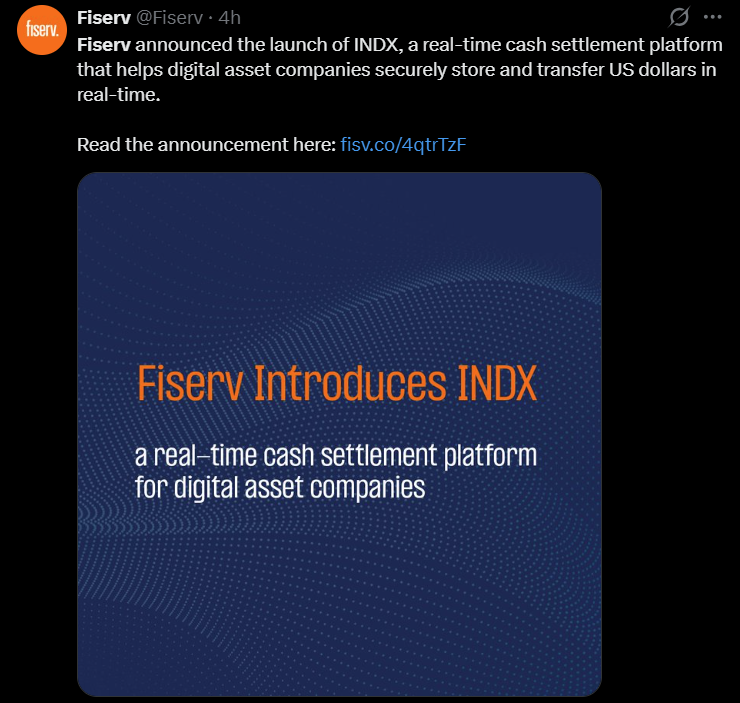

Fiserv, a leading US payments and financial technology provider, has launched a new cash payments platform for digital asset companies. This could strengthen crypto players' fiat infrastructure and improve access to liquidity.

On Thursday, Fiserv announced the debut of INDX, a real-time cash payments system that operates 24/7. The platform allows digital asset firms to instantly move US dollars using a single custodial account, potentially improving the way exchanges, trading desks and other crypto businesses manage fiat balances.

sauce: fiserv

INDX will be available to the more than 1,100 insured financial institutions participating in the Fiserv Deposit Network. The account structure provides up to $25 million in coverage from the Federal Deposit Insurance Corporation (FDIC), the company said.

The launch is notable as many digital asset companies still rely on traditional banking rails that only operate during business hours or on-chain token transfers to move dollar value. INDX provides functionality similar to blockchain-based payments while remaining off-chain by enabling 24-hour USD payments within the banking system.

Fiserv is one of the world's largest payments and financial services technology providers, offering core banking, merchant acquisition and transaction processing services. The company generated more than $21 billion in revenue in fiscal year 2025.

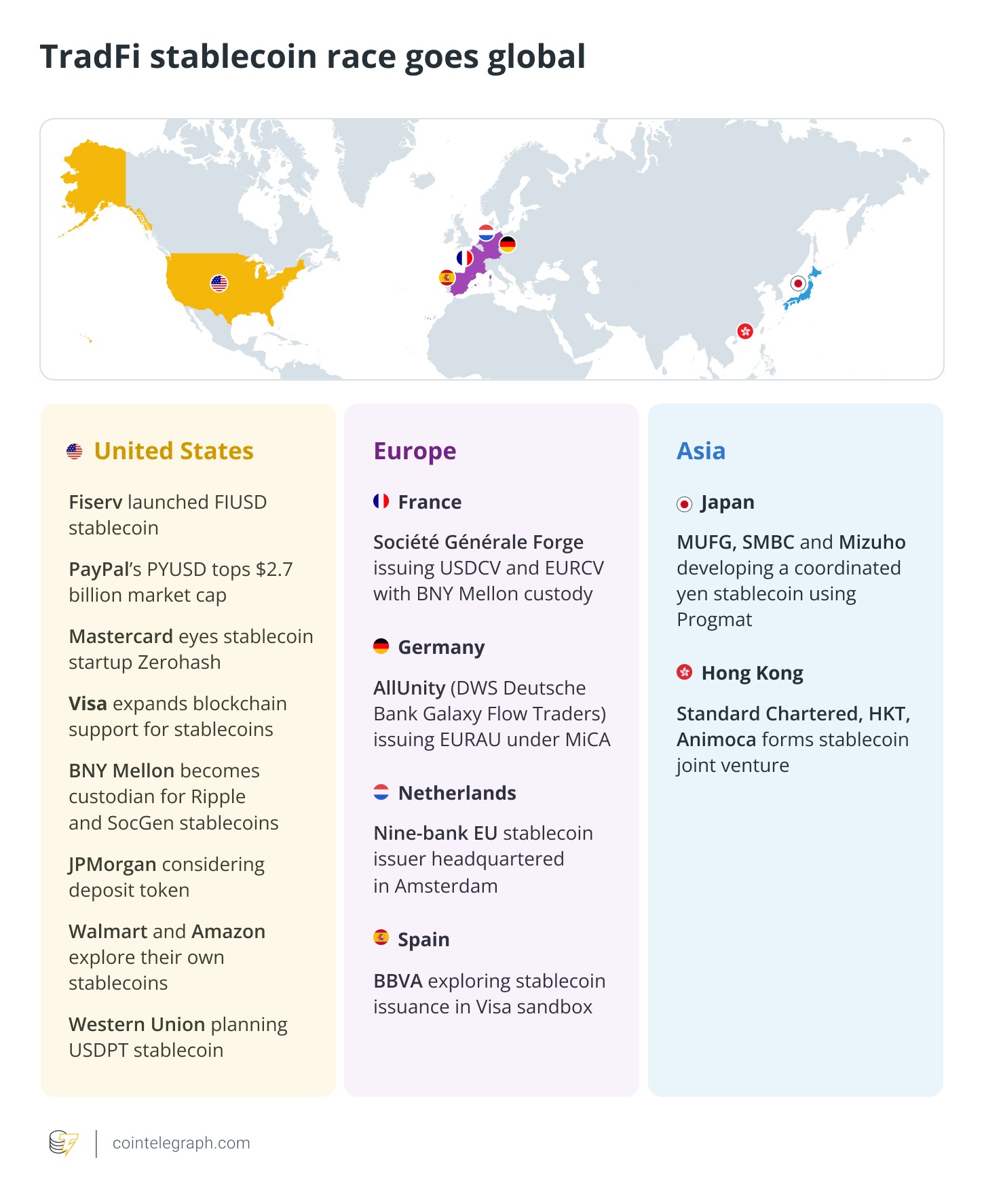

Fiserv is also expanding its efforts in digital assets. As Cointelegraph reported in October, the company is participating in a state-backed stablecoin initiative in North Dakota, providing payment infrastructure to support the project's rollout.

Related: 2026 Investment Strategy for Cryptocurrency: Bitcoin, Stablecoin Infrastructure, and Tokenized Assets

TradFi and digital assets continue to merge

INDX is the latest example of an established financial institution building the infrastructure for the digital asset sector. The platform provides institutional customers with a more familiar banking framework while introducing faster, always-on cash management capabilities.

The system could also give Fiserv an advantage over traditional banking partners that still rely on batch-based processing of USD transfers. For crypto infrastructure providers such as exchanges, trading desks, stablecoin issuers, and custodians, reliable real-time dollar liquidity can provide meaningful operational benefits.

In December, the Milwaukee, Wisconsin-based company completed its acquisition of Stone Castle Cash Management, which provides liquidity to banks, in a move widely seen as an enhancement to its FIUSD stablecoin, which was launched in June 2025.

Beyond payment speed, stablecoins are increasingly being looked at by traditional financial institutions as liquidity infrastructure. An always-on digital dollar reduces intermediaries, reduces settlement friction, and facilitates the movement of collateral, treasury operations, and cross-border payments.

Stablecoin competition is expanding globally. Source: Cointelegraph

While INDX stands out for its combination of traditional bank payments and continued use of the dollar in alignment with digital asset companies, other companies are also prioritizing real-time payments.

For example, Sygnum operates a 24-hour multi-asset network that enables instant settlement of fiat currencies, stablecoins, and other digital assets for institutional investors.

Similarly, Fireblocks supports real-time payments infrastructure for stablecoins and digital asset transfers, helping financial institutions streamline liquidity management.

Related: How TradFi Bank is driving a new stablecoin model