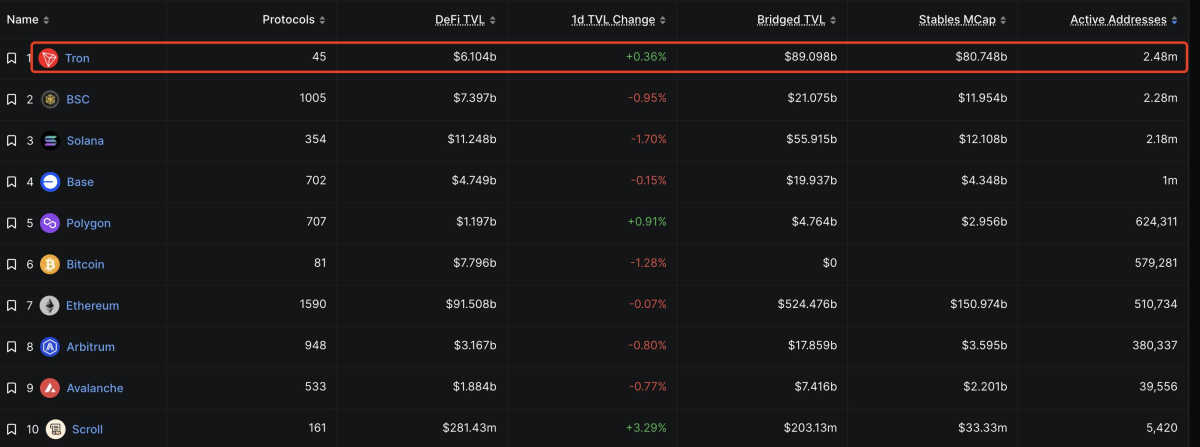

Tron has 2.48 million active addresses, far surpassing Ethereum (0.79m), Solana (0.35m), and the Vinance Smart Chain. The spikes came after it was announced by founder Justin San on August 29, 2025. He said trading fees will be reduced by 60% after community voting. So it's almost trivial what the spike is.

According to Defillama, its use of over 70 billion Stablecoins on the network, particularly in the relocation of USDT, compared to 30 billion Ethereum, is linked to Tron's growth. The network's market capitalization is 13.76 billion, and despite a significant price rise of over 300% in 2025, it sinks slightly every day (-0.70%).

Community Response: Growth or Artificial Inflation?

The community enjoys Tron's performance and it is doubtful that there could be a Cibil attack. In that case, the measurements may be distorted by false addresses. A journal article published in 2021 confirms that blockchain networks are permitted to do such operations. This also allows performance indicators to be irrelevant based on addresses.

In 2025, founder Justin Sun is estimated to have a net worth of 12.5 billion, most of which are associated with TRX Holdings. Tron received a regulatory boost in 2024 after moving to Grenada for the welcome cryptography. Tron also has established itself as a cheaper alternative to Ethereum, which has a lower fee and uses stablecoins widely. According to a report from Coindesk, this has prompted ecosystem growth and allowed Tron to maintain cost leads for users, particularly with large quantities of USDT exchanges.

Opportunities and risks

For analysis, we strongly recommend the introduction of more advanced on-chain analysis. This helps you identify bot-based activities. This also helps to provide investors with a guarantee of actual network use. However, to maintain trust, you need to address transpresy issues with user metrics. Analysts propose applying more sophisticated on-chain analytics to detect bot-based activity and ensure authentic network use for investors.