Ethereum continues to consolidate between institutional zones, with clear boundaries defined by support at $3.4,000 and resistance at $4.6,000. The current symmetrical triangle formation indicates a period of compression, and a breakout is possible in either direction.

technical analysis

Written by Shayan

daily chart

On the daily time frame, ETH remains trapped in a midrange structure between the $3.4,000 institutional demand zone and the $4.6,000 supply zone. The rejection from $4.2,000 coincides with a retest of the broken uptrend line and the 100-day moving average, both of which are now acting as resistance levels.

Momentum has slowed, and ETH is currently hovering near the midline of its broad range and below its 100-day moving average. The 200-day moving average near $3.1,000 continues to act as the last dynamic support, while the demand zone at $3.4,000, the level that absorbed liquidity during the Trump tariff crash, is attracting repeated buying interest.

For ETH to regain bullish momentum, the price will need to decisively close above $4.2,000, reclaim the midrange, and set up a move towards $4.6,000. Until that happens, the broader structure remains neutral to slightly bullish, supported by the secular uptrend and the institutional accumulation zone below.

4 hour chart

The 4-hour timeframe shows ETH forming a symmetrical triangle, reflecting market indecision after the recent selloff. The upper bound of the pattern coincides with the resistance at $4,000, and the lower bound is supported by the lower end of the short-term range at $3.8,000.

This structure represents a liquidity compression phase, where volatility continues to contract before a directional breakout. If the bulls are able to break above the trend line, we can expect an increase towards $4.4 million to $4.6 million, which would coincide with the upper end of the range and the institutional supply zone. Conversely, a breakdown below $3.7k could re-expose the $3.4k demand zone.

Until confirmation, prices are expected to fluctuate within this narrow range, a typical setup for traders waiting for more volatility to develop.

sentiment analysis

Written by Shayan

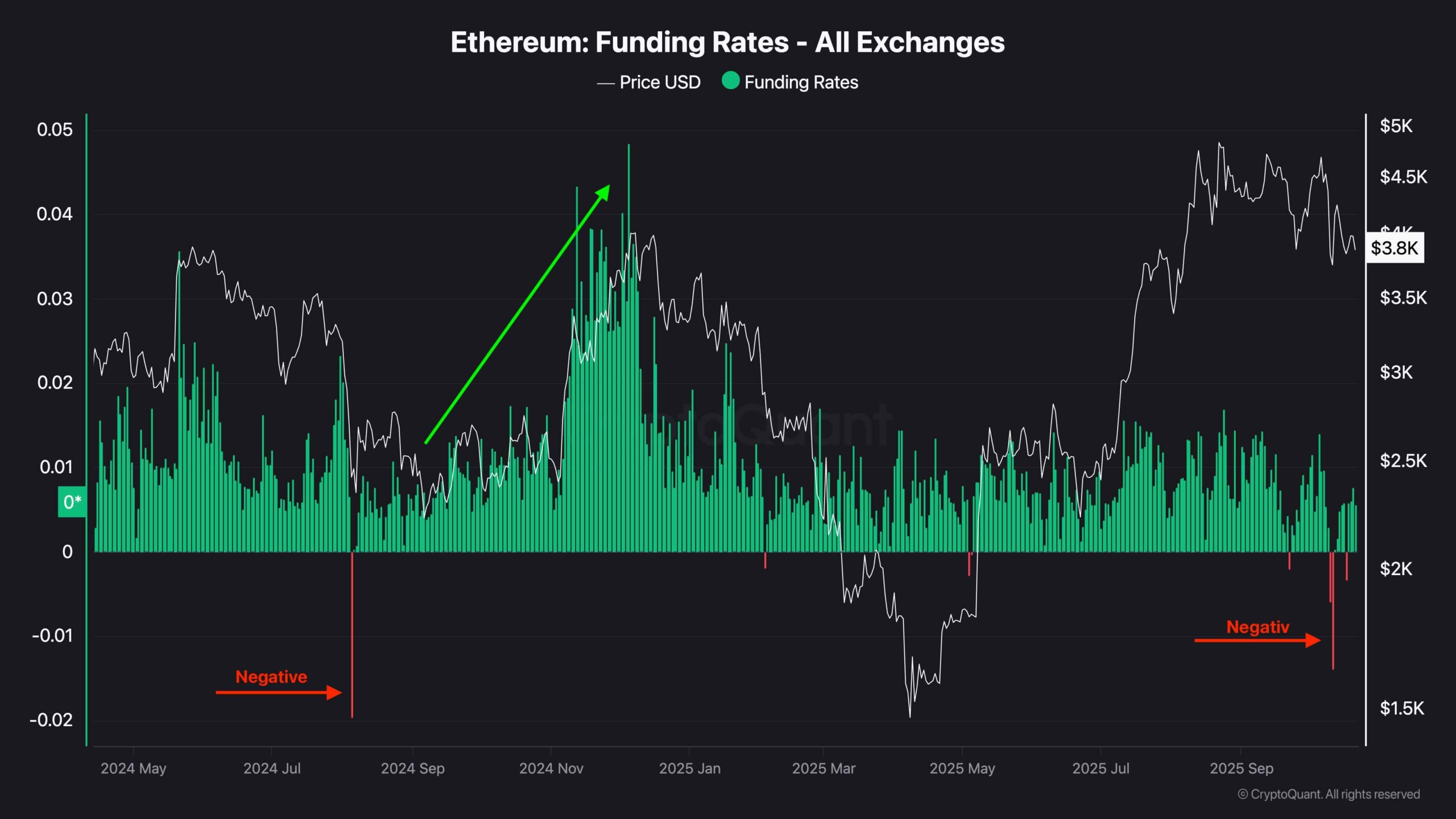

Ethereum funding rates across all exchanges have recently turned negative, reflecting the sentiment observed during major market bottoms in past cycles. Historically, a sharp bullish reversal has been preceded by a period of negative funding rates where short positions prevail and permanent traders pay a premium to hold the position, as seen in late 2024 before the rally towards $4.8K.

The current negative numbers suggest there is fear-driven short selling pressure, which paradoxically often acts as fuel for a bull market once the sell-off begins. If this situation continues while ETH maintains the structural support level around $3,800 to $3,400, it could set the stage for another short squeeze to return to the upper range.