Bitcoin is trying to recover from last week's sharp correction, but the market is still in a critical judgment phase. Although prices have rebounded, overall sentiment remains cautious. The key question is whether this pullback is a true reversal or just a temporary easing before the next leg lower.

technical analysis

Written by Shayan

daily chart

On the daily chart, BTC found support and rebounded from the 200-day moving average near $108,000. This area had strong demand in previous corrections and served as the base for the recent bullish moves in September and early October.

However, the asset has not yet broken above the dotted midline of the channel or the 100-day moving average. Both are around $115,000. Buyers cannot regain full control until they see a daily close above these two resistance factors.

4 hour chart

On the 4H time frame, BTC is testing the downtrend line from recent highs and is currently hovering around the $111,000 level. This structure indicates a potential breakout, but the price would need to close above the $112,000 area to confirm a short-term momentum change.

The RSI is also rising towards 60, suggesting that bullish pressure is building but not too far yet. If the downtrend line breaks to the upside, the price could target the $116,000 resistance zone in the coming days. On the other hand, a failure to breakout would likely lead to a deeper decline towards the all-important $100,000 demand zone.

sentiment analysis

Open interest

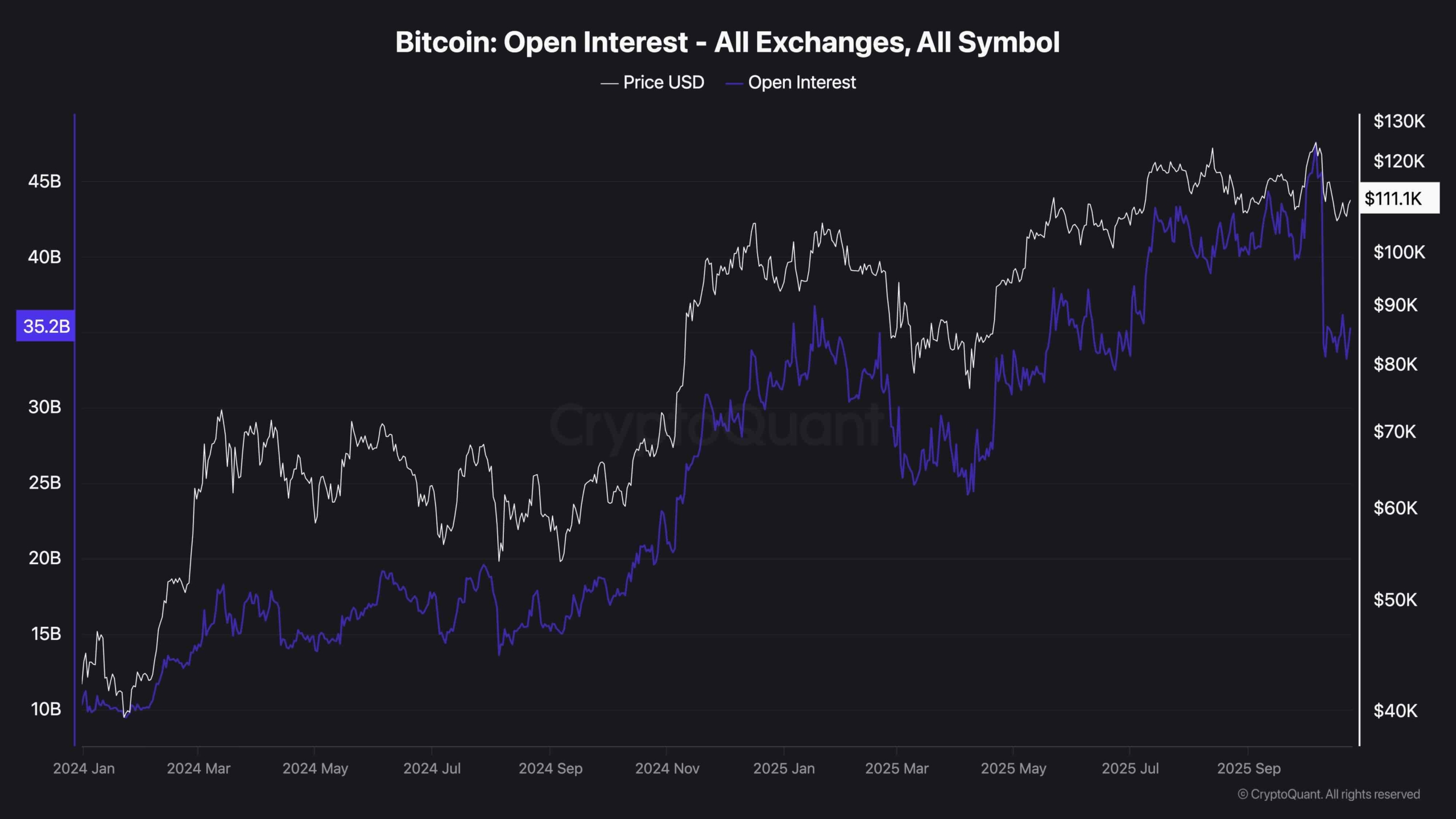

An analysis of futures market sentiment shows that after the sharp flush, open interest has formed a base of approximately $35 billion, indicating that while some traders are returning to leveraged positions, overall market sentiment remains uncertain.

As open interest remains relatively high compared to recent historical levels, the risk of further chain liquidations remains, especially if the market breaks below the aforementioned resistance levels. If BTC fails to recover $115,000 cleanly, we could see another prolonged wave of liquidations, especially heading into the weekend.