According to Mert Mumtaz, CEO of Remote Procedure Call (RPC) Node Provider Helius, the exchange abstracts the stable tokens at different facets on the backend and presents users with only the “USD” option, which ultimately means losing the price ticker.

The bid war on high lipid USD stability (USDH) and suggestions from several companies that promise to return 100% of the yield to high lipids revealed that the Stablecoin sector has been “commoditized,” Mumtaz said.

Mumtaz added that many companies are hoping to issue their own Stablecoins and many existing Stablecoin publishers to launch their own payment chains in the future.

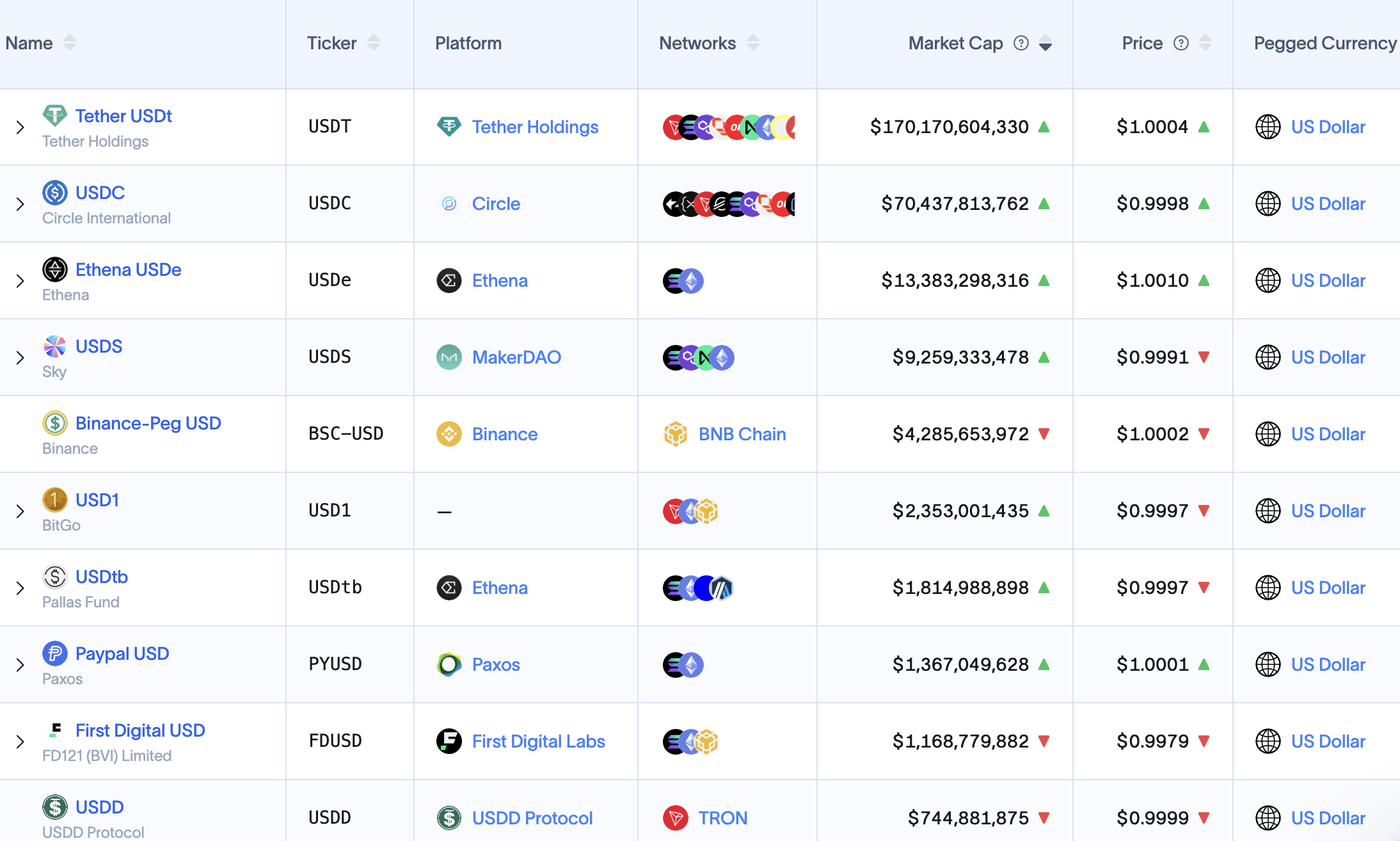

The number of Stablecoin publishers in the US dollar continues to grow. sauce: rwa.xyz

He said the most optimal solution to preempt this liquidity issue is to simply accept all stubcoins and convert them into the desired sect of the backend without the user seeing what is going on. Mumtazu wrote:

“The final endgame is that you don't see any tickers at all. The app simply displays 'USD' instead of USDC, USDT, or USDX, and exchanges everything in the backend via a standardized interface. ”

It is likely that the de facto standard for Fiat currency in the digital age will arise as the global financial system will drive the on-chain, adopt internet native systems and further erode the need to remove stubcoins from various issuers for end-users.

Artificial intelligence to increase stable abstraction

Reeve Collins, co-founder of Stablecoin Firm Tether and Blockchain Neo-Bank Wefi, told Cointelegraph he hopes the number of Stablecoins will grow in the coming years, and will be abstracted through AI agents that manage the portfolio on behalf of users.

Collins said that next-generation Stablecoin products containing tokens containing yield will be automatically managed via Agent AI, removing “all complexity” of dealing with a large number of different tokens, lowering the technical hurdles for end users.

“The only thing that drives you to use is which makes you the most money.