Total crypto VC funding reached $8 billion in Q3 2025, driven by policy stability rather than hype. The Trump administration’s pro-crypto stance and the rise of tokenization have turned regulation from a headwind to an alpha.

For investors, this shift signals a structural reset that makes compliance a source of performance: a predictable framework, the withdrawal of institutions, and a market no longer dominated by speculation.

Why was policy a catalyst?

Why is it important?

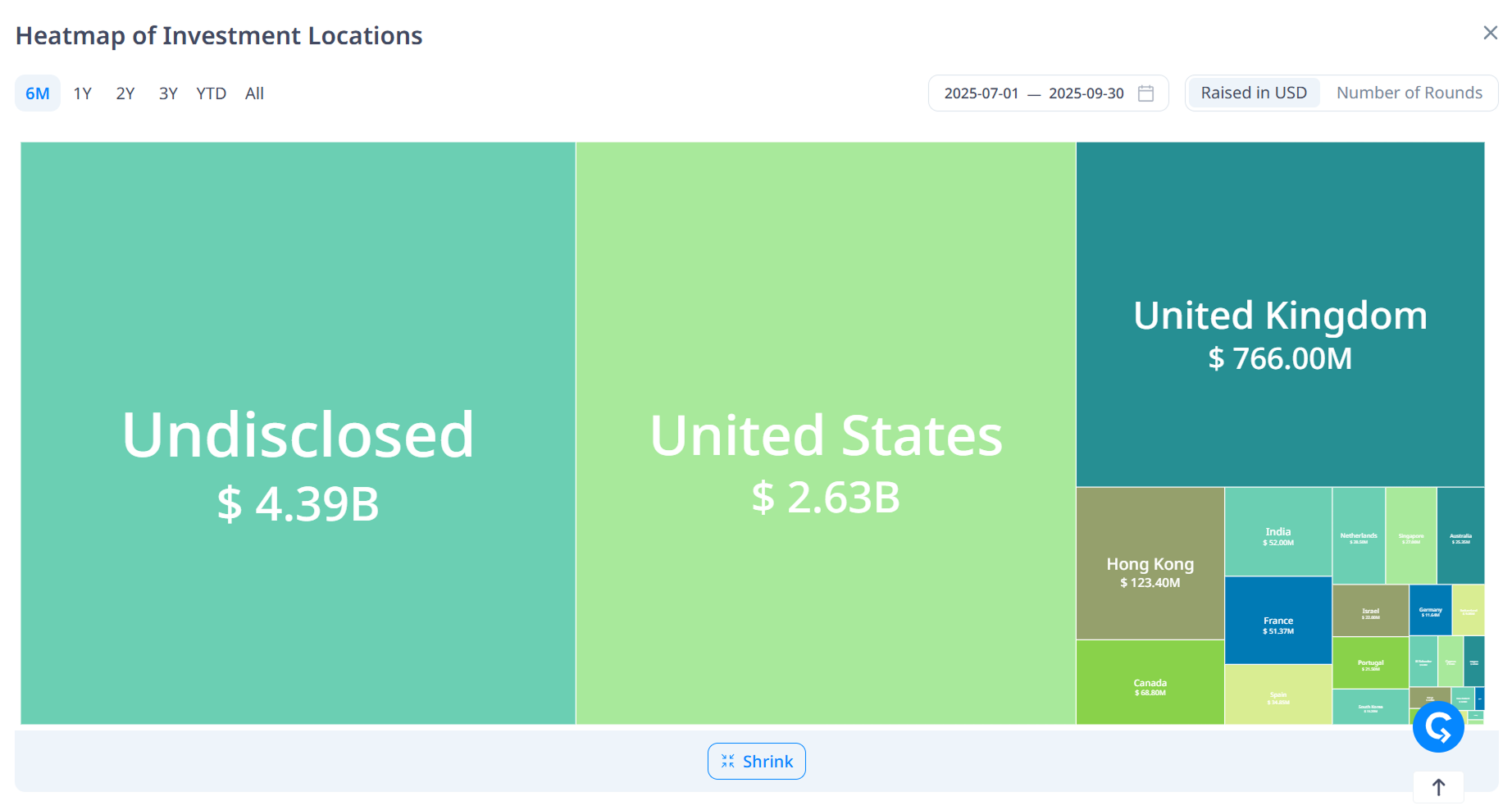

US-based funds drove one-third of crypto VC activity in the third quarter, according to CryptoRank data. The federal government's clear direction on stablecoins, taxation, and compliance helped institutions set back and post their strongest quarter since 2021. This number confirms that U.S. regulation, not liquidity, is currently shaping venture momentum.

Source: CryptoRank

Restoring trust in virtual currency VC

Latest updates

Silicon Valley's venture capitalist confidence index suffered its steepest decline in 20 years, before rebounding in the second quarter as tariff fears eased. Capital rotates into tokenization, compliance, the convergence of AI and cryptocurrencies, and is seen as resilient amidst uncertainty. This recovery suggests investors are trading the hype and recalibrating for fundamentals rather than retreating as policy replaces sentiment as the main compass for risk.

According to a State Street survey, 60% of financial institutions plan to double their digital asset exposure within three years, and more than half expect 10-24% of their portfolios to be tokenized by 2030. While tokenized private equity and bonds are becoming the “first stop” for allocators seeking liquidity, the LP token model remains legally gray. Tokenization institutionalizes the venture itself, turning private markets into programmable and tradable capital.

behind the scenes

Llobet noted that funds such as a16z, Paradigm and Pantera are currently using tokenized side vehicles, allowing LPs to trade fund shares on compliant platforms. DAO treasuries and decentralized pools have emerged as rivals to traditional VC funding, illustrating how cryptocurrencies are now raising money through their own rails.

background

Regulatory uncertainty used to deter allocators. A 2025 study by Llobet noted that “legal uncertainty and illiquidity were constraining blockchain finance.” That changed when Washington approved a national stablecoin framework and tax incentives for compliant entities, and legalized cryptocurrencies for pension and government funds.

global impact

wider impact

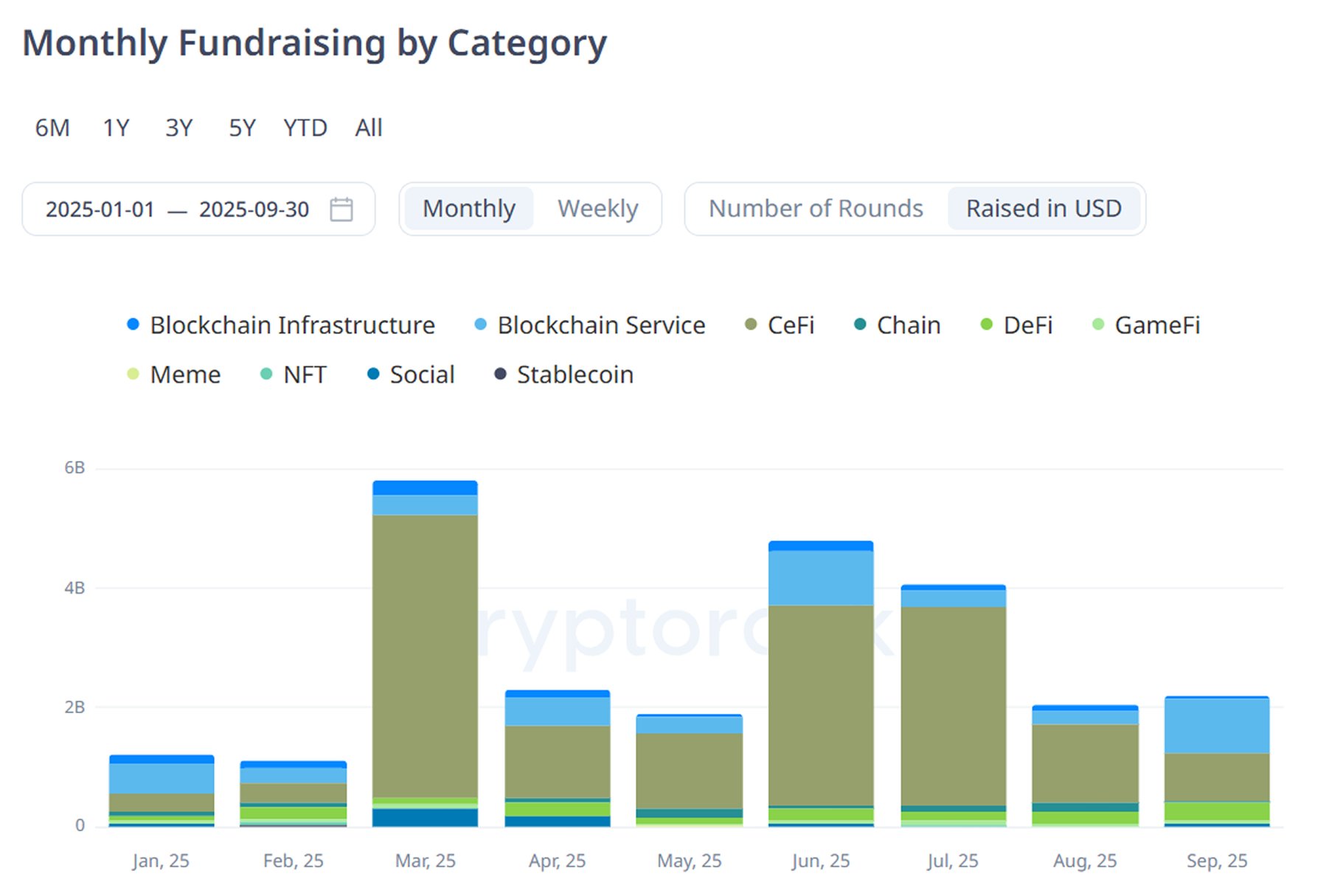

According to CryptoRank's Q3 data, there were 275 trades, two-thirds of which were for less than $10 million, clear evidence of discipline against speculation.

Source: CryptoRank

CeFi and infrastructure absorbed 60% of the capital, while GameFi and NFTs fell below 10%. Investors are reassessing risk through cash flow, not hype. This is a characteristic of market maturity.

State Street expects tokenized funds to become the norm by 2030, while Cryptotrunk is expected to see $18-25 billion in inflows in 2025, making this a sustainable compliance-driven cycle. Regulation now acts as a competitive force rather than a constraint.

Cryptocurrency VC faces first full-scale stress test

Risks and challenges

Ray Dalio warned that the US debt, currently at about 116% of GDP, reflects the situation before World War II and could undermine risk appetite if fiscal consolidation stalls.

I would like to briefly explain why the US debt situation is at a very dangerous tipping point.

Simply put, the United States is currently spending 40% more than we are taking in. This accumulation of debt repayments has been a vicious cycle for decades and is beginning to strain purchasing power. … pic.twitter.com/8IVZCUcoVb

— Ray Dalio (@RayDalio) October 6, 2025

Dalio's 'deficit bomb' and SVVCCI data suggest trade volatility could delay IPOs. DataTribe's Ackerman warned that AI excitement could create a “bubble” that resets valuations and diverts funds away from Web3. Policy may lock in sentiment, but macro debt and AI speculation will test whether the sector's newfound discipline can be maintained.

“Institutional investors are moving beyond experimentation, and digital assets are now a strategic vehicle for growth,” said Jorg Ambrosius of State Street.

“Trade fluctuations will limit exits in the short term, but AI and blockchain remain the two pillars of new value creation,” said Howard Lee of Founders Equity Partners.

“Cryptocurrency VC has become institutionalized. Tokenized funds are the new standard of liquidity,” said Marsal Llobet of the University of Barcelona.

Cryptocurrency VCs have entered a stage of disciplined organization. Regulatory clarity and tokenization are increasing access while reducing volatility. However, continued growth depends on macro stability and prudent risk-taking. Given predictability, 2025 may be remembered as the year compliance became alpha.