As 2025 draws to a close, stablecoins like USDC are being used for more than just trading. These have become part of payments, business transfers, and everyday fund transfers, as well as activities related to market cycles. As more funds move more frequently, how those transfers are settled is starting to become much more important than before.

This change is putting pressure on existing blockchain networks. Activity increased over the second half of the year, manifesting itself in increased fees, confirmation delays, and unpredictable remittance costs during busy periods.

For example, on Ethereum, sending USDC in late 2025 will often cost anywhere from a few dollars to well over $10 during busy times, and even basic transfers can be more expensive than expected.

In the second half of this year, fee fluctuations became another familiar issue. Gas-based pricing means stablecoin transfer costs can change rapidly depending on network conditions, making it difficult for traders, businesses, and finance teams to plan day-to-day payments. In reality, once exchange and transfer fees are taken into account, the cost advantage of using stablecoins may be narrower than many users expect.

Bybit's decision to add USDC support to its XDC network fits here. As stablecoin transfers become part of daily operations, exchanges are under pressure to provide easy-to-manage and predictable routes. Now, how quickly and cheaply money can be moved is as important as access itself.

Angus O'Callaghan, head of trading and markets at XDC Network, said: “Most users don't care about the blockchain label anymore. They care whether the transfer is quick and what it will cost in the end.” “If stablecoins are to function as everyday financial tools, their underlying infrastructure must be stress-free and reliable.”

Bybit waives XDC’s USDC fees and launches $200,000 rewards program

For most stablecoin users, access is no longer an issue. USDC is already available on almost all major exchanges. What people are concerned about now is whether the movement of funds actually works the way it needs to, quickly, regularly, and without thinking too much about costs.

Bybit's recent changes make sense in this context. In addition to opening another route for USDC transfers, the exchange will waive withdrawal fees on XDC from December 1, 2025 to January 1, 2026, and will offer a reward pool of 200,000 USDC to new users who register and make qualifying deposits.

From a user's perspective, this is more about convenience than functionality. When people start to feel that sending money is expensive or unpredictable, they will naturally change the way they send money. Some people wait longer before sending money, some make lump sum payments, and some avoid small transactions altogether. Having different options available makes those decisions easier.

For Bybit users, USDC on XDC simply adds flexibility. This gives you another way to move your funds without changing what you're using or how you think about stablecoins if you don't think the normal route is the best choice.

What does this indicate to the exchange?

Bybit's recent moves regarding USDC remittances reflect changes that are starting to emerge across exchanges. Bybit has taken clear steps to expand the ways users can move funds, but it's also part of a broader pattern that's been playing out over the past few weeks.

BTSE, KuCoin, MEXC, Gate.io, Bitrue, and Pionex have also expanded their support for XDC, allowing you to deposit, withdraw, and trade. Taken together, these moves indicate a growing interest among exchanges for payment networks that can handle regular transfer activity without the fee fluctuations seen on more crowded chains.

In the case of exchange, the reasoning is almost realistic. As stablecoin flows increase, relying on a small number of networks can expose platforms to sudden cost fluctuations and settlement delays during peak periods. Adding alternative routes increases the flexibility of exchanges, relieving these pressures and providing users with a more consistent way to move funds without changing the assets they are already using.

All of this will happen as stablecoins begin to be treated like actual payment tools. In the United States, proposals such as the GENIUS Act focus on establishing clearer rules for how stablecoins are issued and used, particularly regarding payments and institutional activities. When that happens, the way stablecoins move between platforms and networks becomes more than a technical detail, it becomes part of what users and institutions expect by default.

“Once stablecoins start being used for things other than transactions, the story changes,” O’Callaghan added. “As discussed in the GENIUS Act, when clearer rules are established for how money transfers work, people stop treating them as experiments. They expect their money transfers to behave like regular payments: on time, at an understandable cost, and without the need to second-guess every move.”

XDC in action

The XDC network is primarily used for practical behind-the-scenes work rather than consumer-facing cryptocurrency activities. It is used in areas such as trade finance, tokenization of real-world assets, and payment processes where the system must work consistently without surprises.

The same setup works well for moving stablecoins as well. Transfers with XDC tend to be quick and usually cost little, but this is even more important now that stablecoin transfers have become more common. For individuals and businesses that frequently send USDC, the low and predictable costs make transfers easier to manage over time.

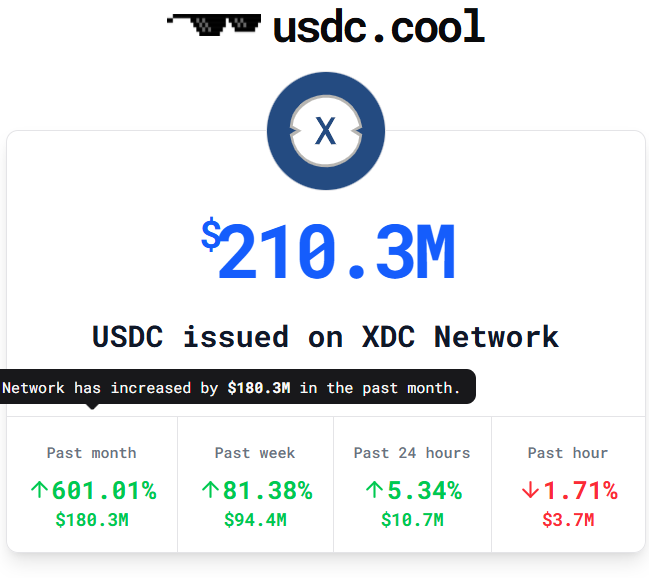

This is starting to show up in the data. The amount of USDC issued on XDC continues to grow and recently exceeded $200 million. This indicates that usage is moving beyond initial testing and into more regular activity. This number indicates steady usage by participants who frequently move funds, rather than a temporary spike.

Image source: USDC.COOL

From XDC's side, integrations like Bybit are primarily meant to be useful. This network is used not as something to draw attention to itself, but as another place where stablecoin transfers can be made reliably.

XDC is also designed with institutional payment flows in mind, where predictable payments and consistent costs are more important than short-term optimization. This makes it practical to move stablecoins at scale for businesses and financial institutions where delays or sudden fee changes can quickly turn into operational issues.

That focus is already showing up in how the network is used. Beyond basic money transfers, XDC supports more complex financial workflows such as global payments, tokenized payments, and stablecoin-based liquidity. Assets like USDC are increasingly being used within these flows, including as collateral, with over $500 million of assets already tokenized and settled on the network.

Image source: TradeFi Network

This type of activity is particularly relevant to trade finance and cross-border payments, where funds need to move reliably across jurisdictions, rather than fluctuating based on market conditions. As more payment and transaction processes move on-chain, infrastructure that can handle stable, high-volume transfers becomes more than a nice-to-have, but a must-have.

At the end

At the end of the day, decisions like Bybit's USDC support on XDC are not about a single network or promotion, but rather how the exchange adapts to a mature market. For exchanges, offering another way to move USDC is part of the adjustment, ensuring the experience lasts not just during quiet periods, but also when activity picks up and small frictions start to matter. XDC's role in that setup reflects how infrastructure choices are increasingly becoming part of exchanges' responsibilities, even if they remain largely invisible.

“Good infrastructure doesn't draw attention to itself,” O'Callaghan concludes. “When it works properly, users don't think much about it, and that's usually the goal.”

The post USDC is used for more than just trading, Bybit expands support for XDC appeared first on BeInCrypto.