Over the past few months, daily active addresses have been declining sharply across smart contract platforms (SCPS), raising concerns among investors and developers.

Meanwhile, Ethereum's Pectra upgrades could be a turning point, with crypto analyst Jamie Coutts calling its current state an ecosystem cleansing.

SCPS see a sudden decline in active users

Jamie Coots, who built the Bloomberg Intelligence crypto research product, says this is the worst decline recorded in SCPS history.

He also states that it is much worse than the 2022-2023 Bear Market, with daily active addresses falling 40.5% in just five months.

“This is the biggest use in SCP history,” writes Coutts.

Coutts' analysis offers a deeper look into the broader crypto ecosystem. This simultaneously witnesses an increase in global liquidity and the highest Stablecoin market capitalization ever.

Smart contract platforms will collapse. Source: Jamie Coutts on x

While the sector appears to be experiencing a shakeout, Coutts says the decline does not indicate the death of smart contract platforms. Rather, it is the necessary cleansing of the ecosystem.

Analysts attribute the decline in daily active addresses to several key factors, including increased artificial activity.

“The majority of the growth in the past cycle has been artificial. Usages and incentive programs that have been inflated by bots and civil farms have created temporary traction that is not sticky.

The rise of bots and cibil attacks, in which bad actors create multiple fake identities to manipulate platform usage, artificially inflated the number of activities across a variety of smart contract platforms.

With these fake users currently being weeded, the actual growth potential of SCPS is becoming clear.

Furthermore, this trend suggests that SCPs with application ecosystems or limited use cases face significant evaluation compression. This is especially true without Stablecoin integration or real-world asset (RWA) applications.

Coutts points out that many SCP tokens risk valuation compression if the platform does not offer high throughput, low cost, and actual payment capabilities.

Markets could reward mature platforms that can support real economic activity. These include Stablecoin transactions, payments, and AI native applications.

“…Today, value will be focused on platforms that allow for high throughput, low cost, real payments and agent automation,” he added.

Ethereum Staking Surge Post Post

Interestingly, these predictions are consistent with the recent Ethereum Pectra upgrade, published on May 7, 2025.

The Pectra upgrade introduces important features that will help Ethereum, the largest smart contract platform, stay ahead of the game at this arena. Specifically, the upgrade will improve Ethereum's staking model and validator operations.

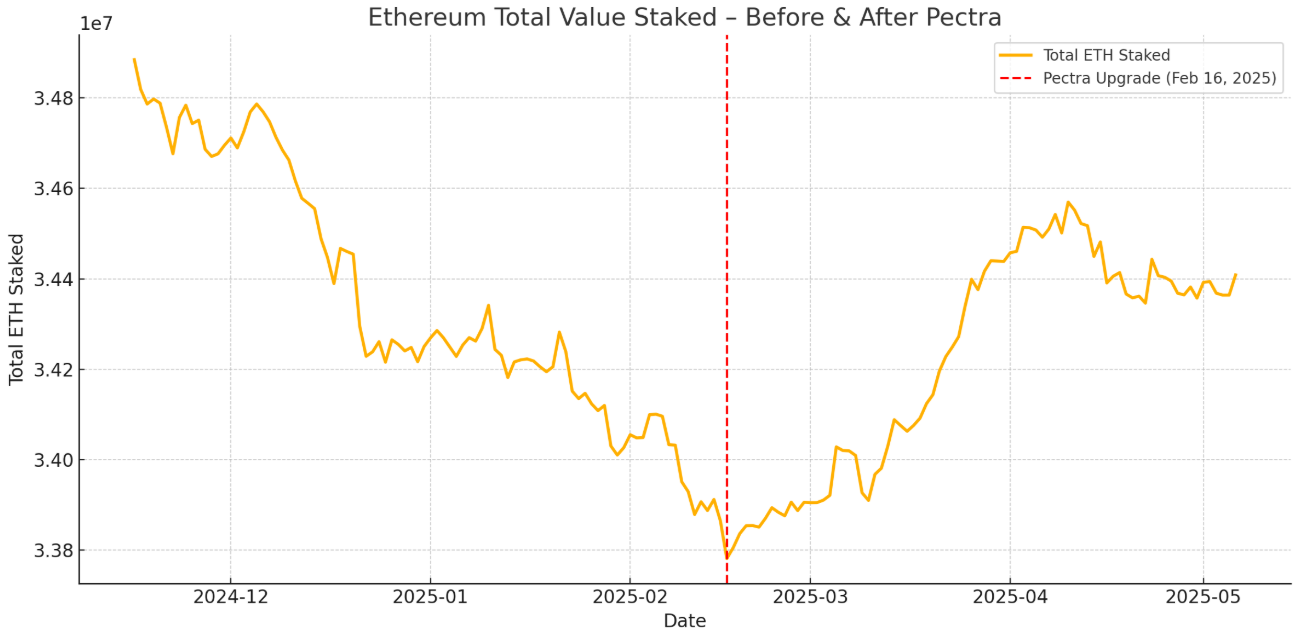

Cryptoquant recently showed notable spikes in ETH over the Pectra Upgrade News. Specifically, before the Pectra Upgrade News, ETH Staking saw an approximately 102 million ETH net leak, reflecting uncertainty.

However, after the news, staking rebounded with an influx of 627,000 ETH, releasing the market's trust in the Ethereum staking ecosystem.

“Pechtra News (November 16 – Feb 15): ETH staking has dropped from about 34.88m to 33.86m ETH, which is about 1.02m ETH. This period reflects market uncertainty and mild rewinding of staking positions prior to the upgrade. ETH.

ETH staking before and after Pectra Upgrade News. Source: Cryptoquant

In the same tone, Everstake co-founder and COO Bohdan Opryshko told Beincrypto that Pectra upgrades could be Ethereum's most institution-friendly update. He says the upgrade is the clearest signal that Ethereum is ready for conservative capital.

“For the first time, agencies can bet on a large scale with less operational clarity and complexity. This is a green light for conservative capitals to engage in native Ethereum staking,” Oprishko told Beincrypto.

Additionally, Pectra's introduction of smart accounts allows Ethereum Wallets to perform smart contractologies. This could help facilitate Stablecoin integration.

At the same time, it could improve scalability. This makes Ethereum suitable for handling actual economic activities such as payments and financial transactions.

Nevertheless, Coutts highlighted the differences between price action and network activity, a common phenomenon in crypto space. The market is stable, but activity at many SCPs is stagnant.

Coutts notes that this difference does not last. More sophisticated capital flows more and more into platforms that lock down actual economic behavior, particularly through the flow and payments of Stablecoin.

“The market may be stable, but the activity is not,” says Coutts, more sophisticated capital will turn more and more towards the chain that locks in real economic behavior, particularly through Stablecoin flows, payments and AI native applications.”

Finally, Coutts expects liquidity-driven gatherings to return, backed by the substantial liquidity that is expected to enter the system in the coming months.

However, he warns that this value is likely to occur in a subset of SCPS, which can provide concrete value through real applications and Stablecoin integration. This sentiment is consistent with the structural upgrade brought about by Ethereum's Pectra Fork.