Gary Vaynerchuk, popularly known as Gary Vee, says he is once again saving up Bitcoin as the cryptocurrency trades below $70,000.

Speaking at a FOX Sports event, VaynerMedia's CEO said the current price point is an unexpected opportunity in the ongoing market decline.

Important points

- Gary Vaynerchuk said he sees this price level as an opportunity and is actively buying Bitcoin under $70,000.

- Bitcoin is trading at $66,755, down about 47% from its all-time high of $126,080.

- Vaynerchuk warns that BTC could fall towards $40,000 before returning to an upward trend.

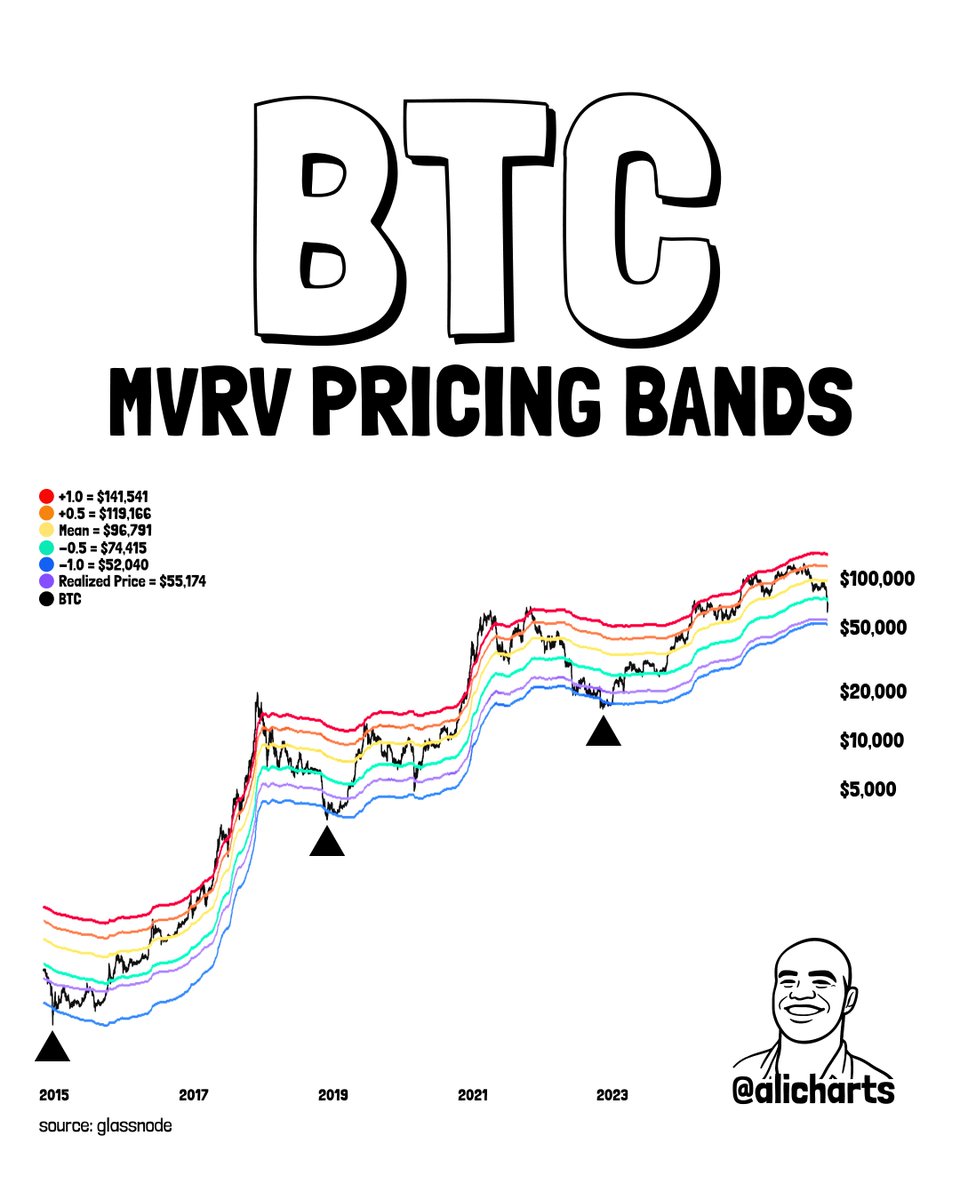

- Analyst Ali Martinez identifies $52,040 as a potential bottom based on the -1.0 MVRV pricing band.

- Bernstein maintains his Bitcoin price target of $150,000 by the end of 2026 despite the recent correction.

Gary Vee calls Bitcoin below $70,000 an 'opportunity'

During the discussion, Vaynerchuk revealed that he was actively buying Bitcoin at current levels and expressed surprise that investors were once again given a chance to accumulate below $70,000.

At the same time, he stressed that his comments should not be taken as financial advice. He explained that his decades of business experience have taught him to take prudent risks. In his assessment, Bitcoin is no longer as dangerous as it was in its early days.

Looking to the future, Vaynerchuk tied his optimism to broader macro and technology trends. He argued that while the global economy becomes increasingly technology-driven, skepticism towards governments and traditional fiat currencies is likely to continue to grow. Together, these forces could strengthen Bitcoin's long-term relevance, he suggested.

However, he acknowledged the possibility of further declines in the short term. He warned that Bitcoin could fall towards the $40,000 level before regaining upward momentum.

Bitcoin current price and market situation

Vaynerchuk's comments come as Bitcoin is trading well below its previous highs. The cryptocurrency reached an all-time high of $126,080 on October 6, 2025. Since then, prices have fallen significantly.

As of this writing, Bitcoin is worth $66,755. This is about 47% below the all-time high. The asset has fallen 3% in the past 24 hours and is down 27.2% month-on-month, according to CoinGecko data.

Taken together, these numbers highlight the scale of the recent correction. Still, market analysts are closely monitoring key technical indicators for signs of stabilization.

Analysts weigh short-term risks against long-term prospects

Adding to the discussion, cryptocurrency analyst Ali Martinez highlighted past price trends in a post about X. He pointed out that Bitcoin often finds a bottom around the -1.0 MVRV pricing band. Based on current calculations, that level would be $52,040.

Although technical indicators point to the possibility of a downside, some institutional analysts remain constructive. As previously reported by The Crypto Basic, research and brokerage firm Bernstein has reiterated its positive long-term stance. The company continues to predict that Bitcoin price will reach $150,000 by the end of 2026.

Bernstein said the recent economic downturn reflects a decline in market confidence rather than structural damage. Analysts maintain that the fundamentals of Bitcoin's network and core investment theory remain intact.

Taken together, these perspectives highlight that the market is at a crossroads. While short-term volatility persists and downside risks remain, several prominent voices continue to express confidence in Bitcoin's long-term trajectory.