According to Eva Oberholzer, chief investment officer at VC firm Ajna Capital, venture capital (VC) companies are making crypto projects more selective and representing a shift from previous cycles due to market maturation.

“It's difficult because we've reached another stage of cryptography, just like every cycle we've seen with other technologies in the past,” Oberholzer told Cointelegraph.

She added that market maturity slows pre-seed investments as VCS focuses attention on established projects using a clear business model. Oberholzer said:

“It's about predictable revenue models, institutional dependence, irreversible adoption. So what we're looking at now is that crypto is not driven by the mimecoin frenzy or other trends, but that's about institutional adoption.”

The change in VC activity focuses on the digital asset business that generates wider trends in institutional crypto investment and revenue, as opposed to price speculation that encouraged investment during the previous crypto cycle, including the 2021 bull market.

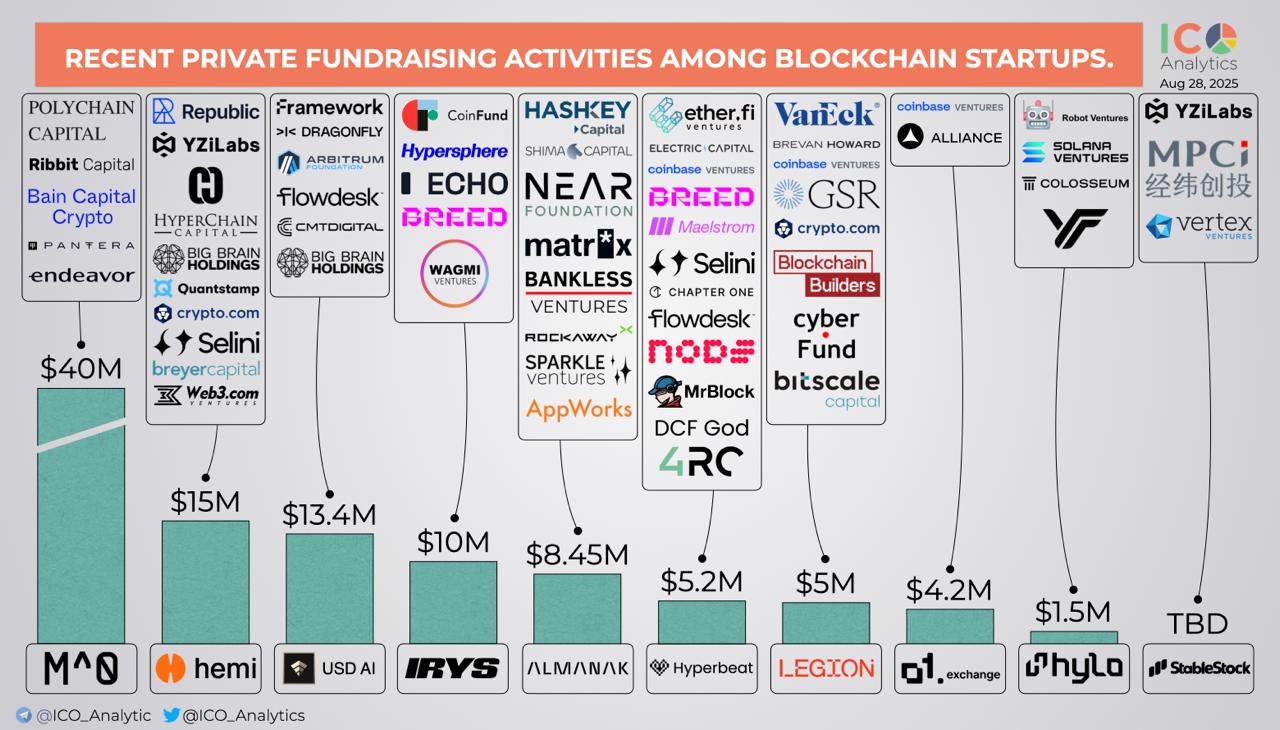

This week, a private donation agreement between blockchain startups. sauce: ICO analysis

Related: VC Roundup: Bitcoin obstacles skyrocket, but tokenization and stablecoins get steam

The traditional financial world demands crypto businesses that generate yields and revenues

Traditional financial investors, including Wall Street companies, venture capitalists and institutional funds, are demanding crypto projects that provide an established and predictable revenue stream.

VC companies are focusing on Stablecoin projects and investing in other forms of payment infrastructure that can generate fees, Oberholzer said.

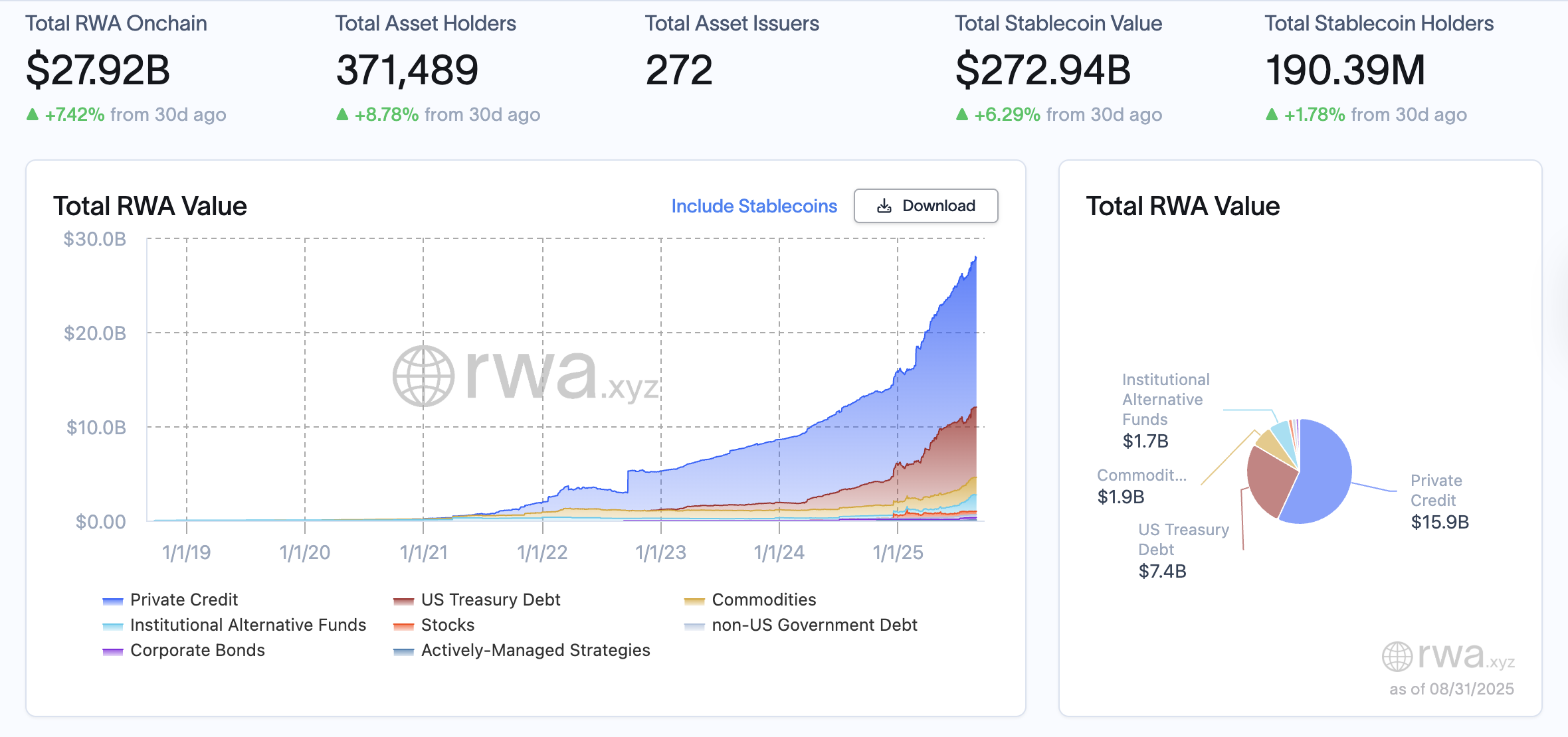

The Real World Asset Tokenization (RWA) platform is also featured on the VC company's radar due to its revenue model related to the minting and management of tokenized RWAS Onchain.

The tokenized RWA market continues to grow. sauce: rwa.xyz

Matt Hougan, chief investment officer at investment firm Bitwise, recently told Cointelegraph that the quest for yields is driving Wall Street investments in Ether (ETH).

“If you receive a billion dollars of ETH, put it in your company and suddenly you bet on it, you're making a profit. And investors are used to being a company that really generates revenue,” says Hougan.

The Smart Contract Layer-1 Blockchain hosts the majority of Stablecoin, RWA markets and Decentralized Financial (DEFI) activities that generate stable revenues through owner fees and other forms of financial rent.

magazine: Tradfi is building Ethereum L2 to tokenize trillions in rwas: Internal Story