Wall Street is increasingly betting on US interest rate cuts by the end of 2025. At the same time, political pressure from Donald Trump is growing.

With inflation cooling and markets adjusting expectations, crypto could be able to get the most out of loose monetary policy.

Trump hopes to lower interest rates to 1%

Today, Trump updated his attack on Federal Reserve Chairman Jerome Powell. He called for a 3% point rate cut, claiming it would save $1 trillion a year to the US economy.

The US president also accused Powell of keeping the price high for “political reasons.”

The Fed has been stable at 4.25%-4.50% since June, but estimates have risen. Goldman Sachs is hoping that the first cut will arrive in September.

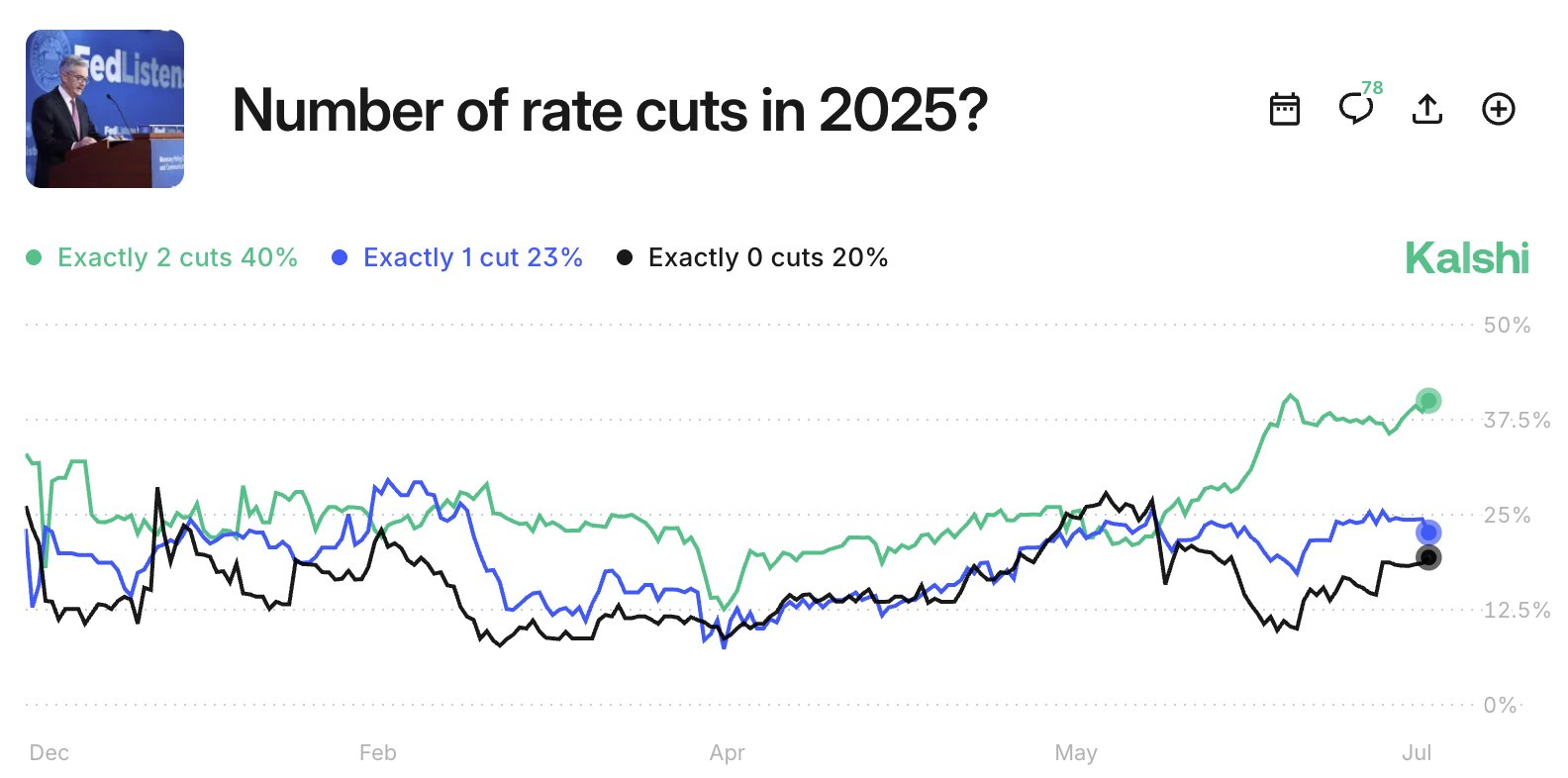

Meanwhile, forecast market trader Kalshi looks at a 40% chance of two cuts before the end of the year.

Calciods of the 2025 Federal Reserve Reduction

This change follows a sharp decline in US inflation expectations. Consumer expectations for the year fell to 4.4% in July, the lowest since February. This shows a 2.2 points drop in just two months. This is one of the biggest two-month declines in history.

Long-term inflation expectations have also been eased. The five-year outlook fell 0.8 percentage points in the last quarter and currently sits at 3.6%.

Overall, these trends suggest that there is room for the Fed to facilitate more time without causing fear of a price spiral.

The crypto market is taking great care.

Bitcoin is over $118,000, while Ethereum holds nearly $3,700. Both assets have historically rallyed after Fed rate cuts, benefiting from increased liquidity and investor risk appetite.

Can a major cryptocurrency run begin?

Historically, interest rate cuts have launched a strong code bull market.

After the Fed was cut in March 2020 during the Covid-19 crisis, Bitcoin has surpassed $60,000 to less than $10,000 within a year. Ethereum continued, supported by the growth of defi and NFTs.

A new rate reduction cycle begins in September could result in similar conditions. A decline in yield pushes investors towards risk-on assets, including crypto.

Capital can also be rotated from bonds and cash to Bitcoin, Ethereum and altcoins with high convictions.

Furthermore, lowering inflation expectations and improving clarity in regulation can strengthen investors' trust, such as genius and clarity behaviour.

This convergence of macros and policy signals could extend the current cycle beyond previous history highs.

However, timing is important. As ciphers are already close to record levels, momentum can depend on the speed and depth of the cut. Delays or shallow responses from the Fed can be restricted to upside down.

Important dates to see

The next Federal Reserve Policy Conference will take place July 29th-30th. The market is not expecting any change, but the Fed's commentary will be closely analyzed against the signal from around September.

The next important date is September 16th-17thwhen FOMC reunites. This is widely seen as the first realistic window of rate reduction, especially when inflation continues to decline.

Other important metrics to monitor:

- July CPI Print: In early August, this forms expectations for the September decision.

- Jackson Hole Symposium (August 22-24): Powell's speech here can change emotions significantly.

- US Job Report (August and September): Work softness may strengthen the case of reduction.

For crypto traders, these dates provide clues to potential market inflection points. Verified Fed pivots can cause renewed purchasing pressure, particularly for Bitcoin, Ethereum and hyperfluid altcoins.