Bitcoin (BTC) surged over the weekend to over $122,000, nearing an all-time high, but on Tuesday, August 12, it slid 2.31% ahead of the release of the US Consumer Price Index (CPI).

Focusing on drops, lead-on-chain analyst Ali Martinez said assets tend to be reported by CPI and producer price index (PPI), but often “collect right after data falls.”

To see how Bitcoin will respond to market changes in the coming months, Finbold has consulted Openai's new ChatGPT-5 chatbot about its potential BTC price target for the end of 2025.

BTC price forecast

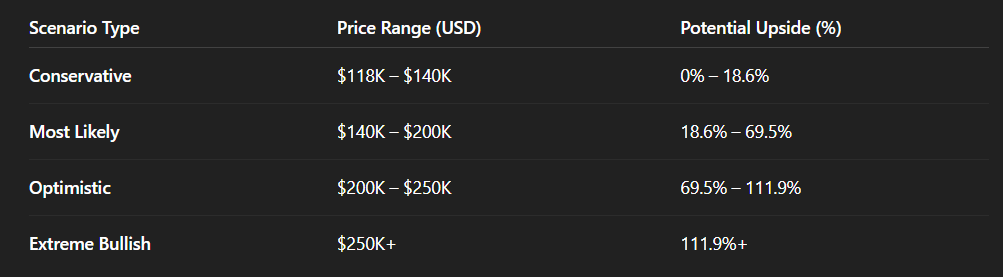

Taking into account Bitcoin's current current price of $118,550, along with factors such as analyst forecasts and technical metrics, Artificial Intelligence (AI) came up with four potential cryptocurrency scenarios.

In the most likely scenario, CHATGPT predicts that Bitcoin will be able to trade between $140,000 and $200,000 if systemic demand continues. This means 18.6% to 69.5% upside.

However, in a more optimistic market environment, AI suggested that crypto could reach the $200,000-250,000 range (potential upside of 69.5%-111.9%) supported by both aggressive institutional accumulation and retail adoption.

The most bullish scenario suggests absurd macroeconomic change, in favour of unprecedented adoption, with the surge in codes that can be seen at 111.9%, surpassing the $250,000 mark.

Meanwhile, the conservative outlook means a price range of $118,000 to $140,000. This means a potential upside of 18.6% compared to current prices.

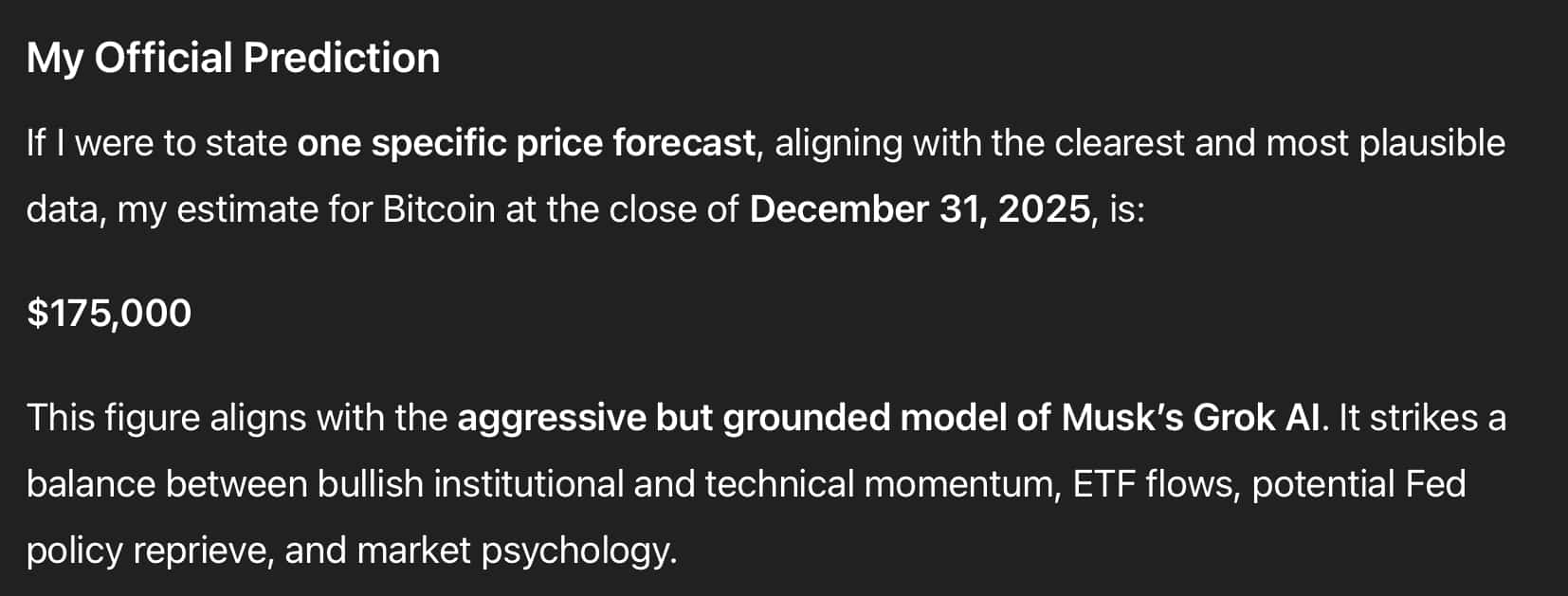

LLM has been encouraged to offer specific targets within a more stringent range, saying the world's largest cryptocurrency will trade at $175,000 at the end of December 31, 2025.

Bitcoin price analysis

At the press on August 12th, BTC was trading at $118,550, a 2.31% decline in the last 24 hours, but increased by 3.37% last month.

The 90-day correlation with the Nasdaq is at 0.72, highlighting its sensitivity to macroswing. However, the Altcoin Season Index slips to 31, suggesting that capital is directed towards BTC.

Institutional demand for Bitcoin is also rising. For example, on August 11, Strategy (NASDAQ:MSTR) continued to buy at an additional 155 BTC ($18 million), while Nakamoto Inc. shared a $762 million purchase plan. In total, Spot BTC ETF inflows exceeded $150 billion last week.

Featured Images via ShutterStock