The second-largest cryptocurrency has experienced a 12% price increase over the past week, reaching around $4,700. The question is whether it can continue its strong performance throughout this month and achieve a new record valuation.

The odds look good

Many analysts believe that Ethereum could break through its all-time high near $5,000 as early as October of this year. To add an interesting twist to the discussion, we asked three leading AI-powered chatbots to make predictions and interpretations.

ChatGPT argued that ETH has a realistic chance of doing so. Grayscale recently launched the first Ether staking ETP in the US, noting that it is a product that allows investors to gain exposure to ETH while benefiting from staking rewards. This investment vehicle could reignite institutional investor interest and push prices to new highs.

The chatbot also pointed out that Ethereum is likely to follow in the footsteps of Bitcoin (BTC), which surpassed a new ATH value of $126,000 on October 6th. However, he also warned that ETH would first have to overcome the heavy resistance at $4,800.

Grok, a chatbot built into social media platform X, shared similar estimates. He argued that ETH is likely to reach $5,000-$5,500 by mid-month due to historical seasonality, strong inflows into spot ETFs, and other factors.

“Cryptocurrencies are volatile, and position sizing and stops are key. If bullish, a drop to $4,375 is a buy zone. If cautious, keep an eye on support at $4,450,” he added.

Perplexity estimates that the probability of ETH surging to a new record within this month is around 70%. He further predicted that if the market's positive momentum continues, the price could explode to $7,500. To explore additional factors that suggest Ethereum may be on the verge of a massive rally, check out our dedicated article here.

$10,000 coming in?

Earlier today (October 7), Crypto Rover predicted that ETH could soon soar to $10,000. User X, who has over 1.3 million followers, made a prediction based on the possibility of a US interest rate cut.

You may also like:

- Bitcoin breaks weekly inflow record with $3.55 billion surge

- Why Ethereum (ETH) could be the biggest winner of the global liquidity surge

- This textbook chart pattern could send ETH price soaring to $12,000: Analyst

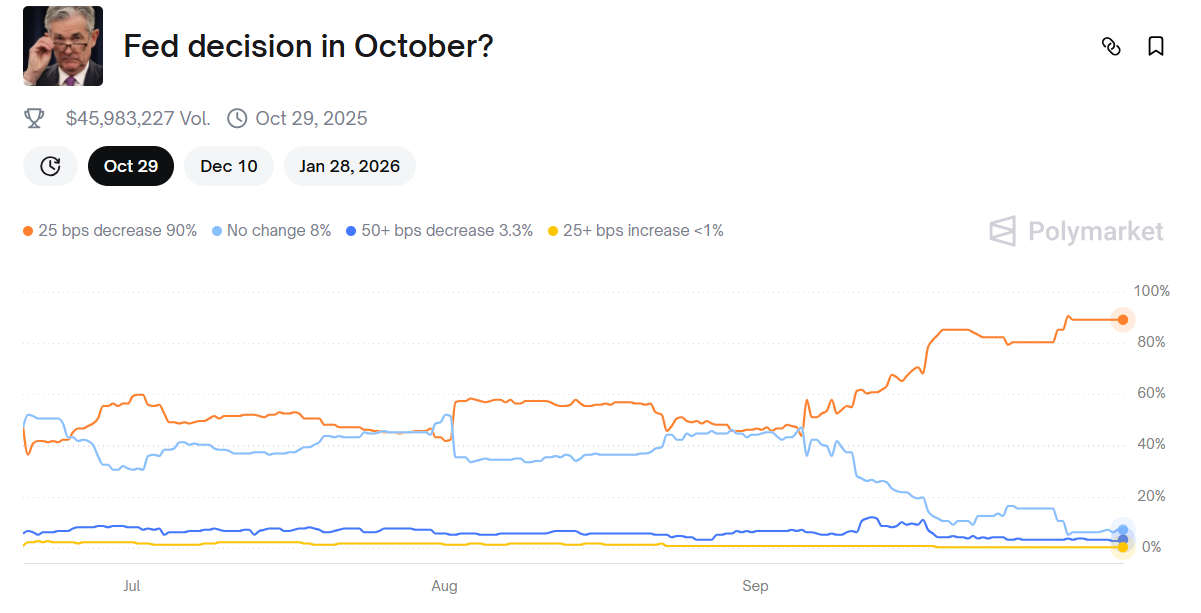

The Fed is scheduled to hold its next FOMC meeting on October 29th, and according to Polymarket, there is a 90% chance that the benchmark interest rate will be cut by 0.25%. These developments will make borrowing cheaper, and many experts believe it could increase interest in risk-on assets such as cryptocurrencies.