Ethereum (ETH) is showing signs of spot buying once again. Anonymous Whale is still active, but this time you can trace some of your purchases to the US market based on ETH Coinbase Premium.

Ethereum (ETH) showed that accumulation was accelerated and US-based whales were driving the trend. Coinbase Premium, which remains significant in the second quarter, has shocked to a level not seen since January.

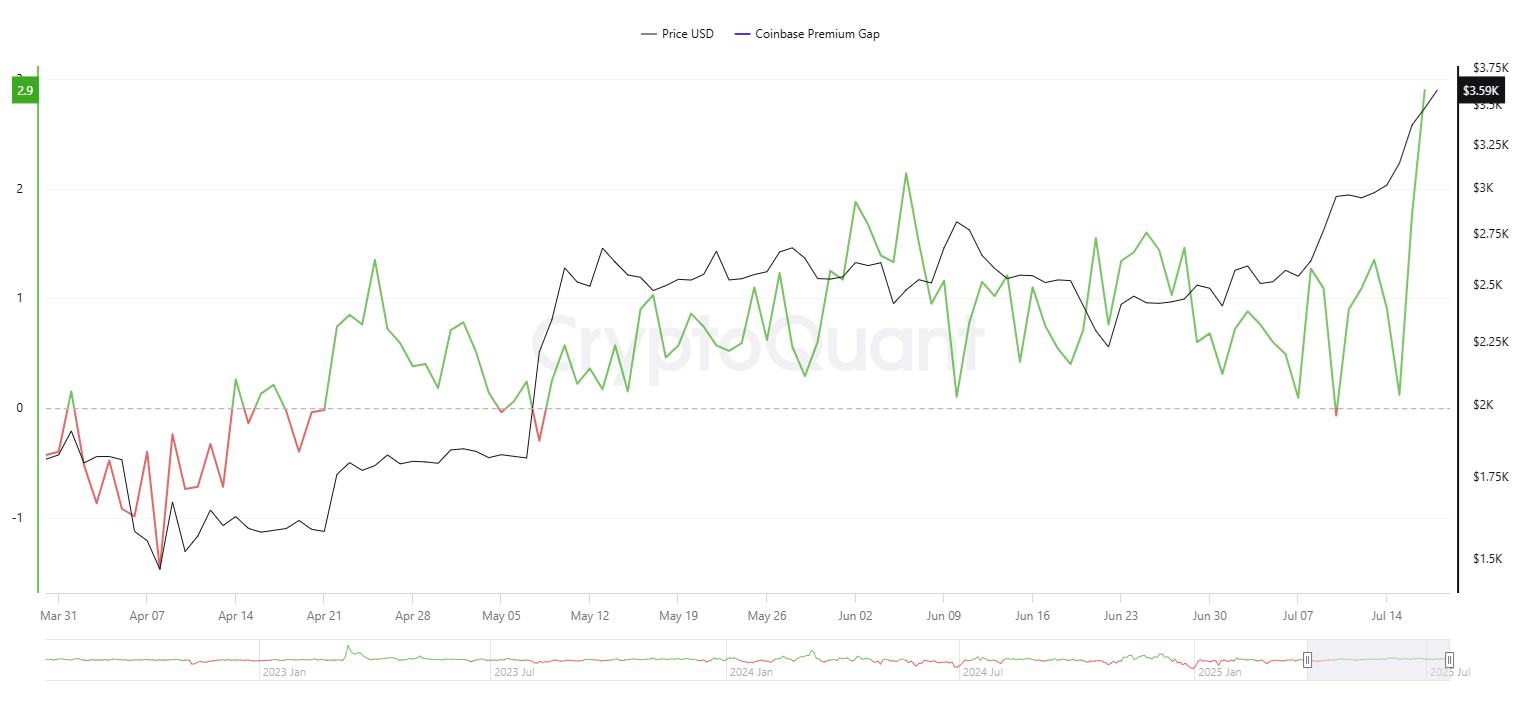

Coinbase premiums have skyrocketed in past days, rising to their highest levels in months as US-based whales accelerated their purchases. |Source: Cryptoquant

The whale accumulation continued as ETH moved to a higher price range. Based on the encrypted data, ETH Rally coincided with a very active purchase from Coinbase, increasing its ETH Premium.

ETH has yet to reach premium levels comparable to the last quarter of 2024, when US-based deals were driven by hype and the effects of the presidential election. Coinbase Premium is usually short-lived and takes several weeks to return to baseline. This time, ETH has held a small premium over the past few months, coinciding with a period of quiet whale accumulation.

Eth Exchange reserves remain at low pressure

Recent purchases have brought Coinbase reserves closer to their all-time lows. Coinbase, which is aimed at whale buyers, offers around 4.8 million ETH, but all spot exchanges have an ETH of about 9m. Depleted reserves follow recent statements Winter Mute Market makers have run out of OTC desks.

As ETH is now considered a valuable store, the low reserves are due to increased spot demand. Additional demand could come from ETH collateral requirements for exchanges or lending protocols. Demand to cover leveraged positions increased last week as open profits for ETH derivatives increased.

Although ETH supplies are not rare, sellers may not be prepared with sufficiently freely available supplies. A significant portion of ETH is locked for staking, liquid staking, and other defi vaults and liquidity pools, making it unavailable.

Individual whales come back for more ETH

ETH purchases continue, with some notable whales moving in the past 24 hours. On-chain data shows that the two whales have acquired over 13,000 ETH and entered the market at $3,448.

Whale accumulates $eth

– Whale, “0x52e” spent $36.5 million in USDT to buy $10,587.4 ETH for $3,448.

– Whale, “0xdfc” spent 998mm $USDT to buy a $2,895 ETH for $3,448.

address:

-0x52E02F0A43EA75D3C8B78745C99DDC33BFA26

-0XDFCAF20A17521A761036AF8A3A758FCD91DFC07 … pic.twitter.com/3becoqcwzg– July 18, 2025, On-ChainLens (@onchainlens)

This kind of whale movement is similar in value to the activities of corporate buyers. Demand for anonymous whales continued to have Sharplink games Added Another 18,712 ETH to the Ministry of Finance.

The whales also do not fully absorb all available ETH. Some wallets will send tokens in exchanges to lock profits. Whale accumulation in May and June was noteworthy as whales were buying at lower prices at average prices. Over the past few months, whale sentiment has been even more bullish towards ETH, but retailers have mostly abandoned their networks.

Ethereum also shifted use cases after meme tokens shifted to other networks while games and NFTs lost their user base. Currently, Ethereum features high value defi activity and is one of the largest lending and liquidity hubs. Ethereum's network is also important when carrying Stablecoins, supporting the most liquid versions of USDT and USDC.

In the past few hours, the whales send their tokens back to OKX and Coinbase institutions, making the biggest deal 20,908 ETH.

Whales are also on their side in the derivatives market. High lipids counted 321 large ETH positions, with 301 whales making long trades and 319 trying to shorten ETH.