Lighter (LIT), a decentralized perpetual contract exchange token used for trading, governance, and staking in DeFi, is gaining market attention among cryptocurrency users, according to data revealed by market analyst Onchain Lens. According to data posted by analysts today, 7-day old wallets deposited $2 million in USDC to the Writer's Decentralized Perpetual Futures Exchange to increase the size of the LIT token, a solid indicator of confidence in the capabilities of the digital asset.

Transactions reported by analysts show that over the past seven days, Whale has deposited $4 million USDC on the Lighter trading platform and purchased a large amount of 1,285,010 LIT tokens for $3.8 million at an average price of $2.96. On-chain analysis shows that the whale still has $193,717 USDC remaining in its wallet, highlighting the trader’s intention to purchase more LIT tokens.

7 days ago wallet deposited $2M $USDC into #Lighter to increase LIT size.

In the last 7 days, Whale deposited 4 million $USDC and bought 1,285,010 $LIT for $3.8 million at a price of $2.96. You still have $193,717 $USDC left to buy more. https://t.co/xpT35N9U7C pic.twitter.com/9BswQ8GeoU

— Onchain Lens (@OnchainLens) January 7, 2026

What promotes the accumulation of whale writers

Whales’ active buying activity shows strong confidence in the LIT cryptocurrency. Recently, several factors have attracted large-scale investor appetite for Lighter tokens. The first is that Reiter is one of several perpetual futures exchanges that have garnered interest from crypto investors in recent months. Lighter, a new perpetual futures DEX platform launched last year, made its native token public on December 30, 2025. This is why smart investors are eager to invest in this new digital asset for possible future price increases.

By acting as a DEX perpetual futures exchange, Lighter is a platform that allows traders to speculate without directly owning assets, making it an attractive platform for both institutional and retail investors, thus attracting investor interest. This platform allows customers to bet on the price movements of cryptocurrencies, usually with high leverage, which can yield high returns and high risks.

Similar to competitors such as Hyperliquid, Aster, and EdgeX, traders prefer the lighter weight decentralized perpetual exchange as it is a platform that allows users to achieve fast execution without giving up control of their assets. Additionally, the platform combines transparency, features of CEXs (centralized exchanges) like Binance, and DeFi self-custody in one interface, making it convenient for cryptocurrency traders.

The second factor attracting investor interest in the Lighter trading platform is the exchange’s recently launched buyback program to maximize the long-term value of the tokens to asset holders.

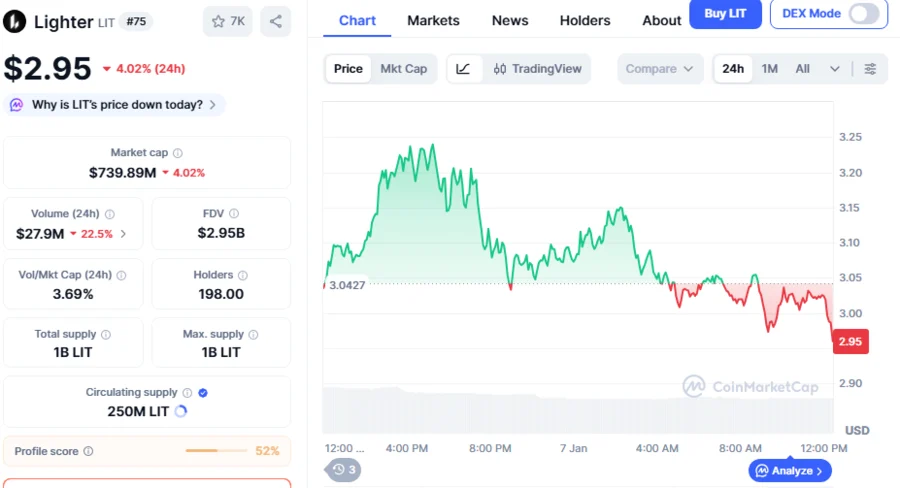

The current price of the lighter is $2.95.

LIT Price Pump and Token Buyback

Currently trading at $2.95, LIT price is down 0.8% over the past 24 hours, but up 11.0% over the past 7 days, the first week of trading. This week's price increase reflects continued enthusiasm from both large traders and retail investors.

Yesterday, January 6, 2026, the writer launched its scheduled buyback program. It used the proceeds from exchange products to purchase LIT tokens on the open market in order to reduce the supply of tokens, create value for investors, and increase market confidence.

Transaction fees, protocol services, and other on-chain activities are typically the main sources of revenue for some crypto projects. By leveraging such sources to buy back their LIT tokens, writers are demonstrating their commitment to supporting future price appreciation of the tokens. Lighter appears to be copying a strategy some of its competitors have recently deployed. In September 2025, Hyperliquid launched a similar token buyback mechanism to foster growth of the HYPE token.