After the Fed announced a rate cut, major whale wallets began pouring money into long positions in Ethereum (ETH). These movements indicate strong confidence in ETH's upside. It also increases overall risk.

Several factors suggest that without effective risk management, long positions could be liquidated quickly.

How confident are whales in their long Ethereum positions?

A whale's behavior clearly indicates its current emotions.

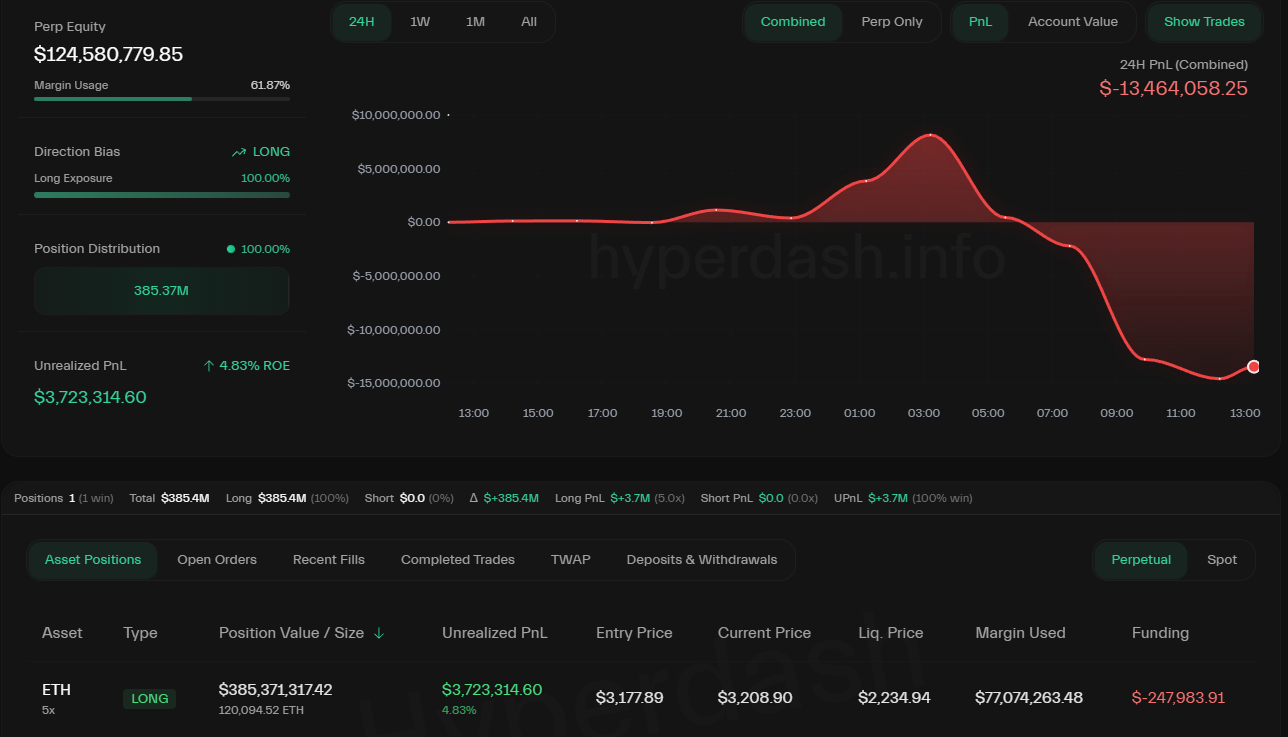

On-chain tracking account Lookonchain reported that a well-known whale believed to be Bitcoin OG recently expanded its long position in Hyperliquid to 120,094 ETH. The liquidation price is only $2,234.

This position is currently showing a P&L loss of over $13.5 million in 24 hours.

Whale's ETH long position in Hyper Liquid. Source: Hyperdash

Similarly, another well-known trader, Machi Big Brother, maintains a long position worth 6,000 ETH with a liquidation price of $3,152.

Additionally, on-chain data platform Arcam reported that the Chinese whale trader who caused the October 10 market crash now holds a $300 million long ETH position in HyperLiquid.

Whale activity in long ETH positions reflects expectations for near-term price appreciation. However, behind this optimism lies a significant risk due to Ethereum's leverage levels.

ETH leverage reaches dangerous highs

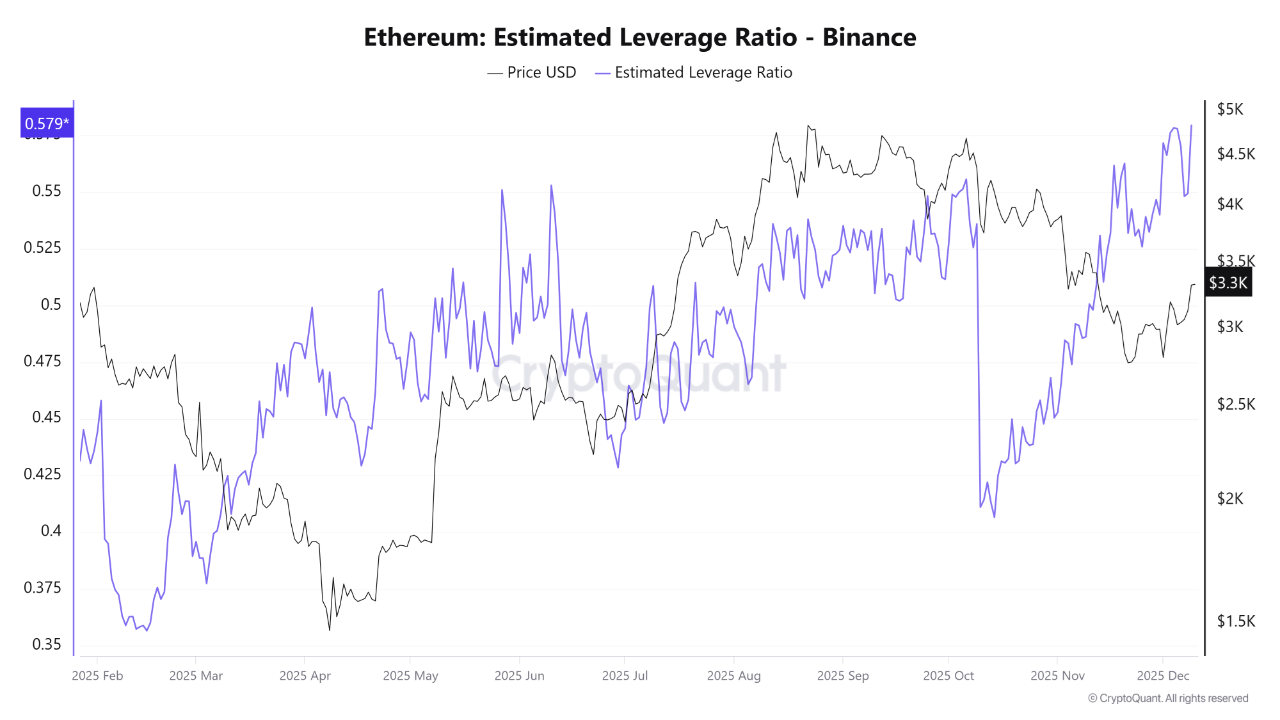

According to CryptoQuant data, the estimated leverage ratio of ETH on Binance reached an all-time high of 0.579. This level indicates very aggressive use of leverage. Even small price changes can cause a domino effect.

Ethereum Estimated Leverage Ratio – Binance. Source: CryptoQuant.

“Such a high leverage ratio means that the amount of open contracts financed by leverage is growing faster than the amount of actual assets on the platform. When this happens, the market becomes more vulnerable to sudden price movements, as traders are more susceptible to liquidations, whether in an uptrend or a downtrend,” said analyst Arab Chain.

Historical data shows that similar peaks typically coincide with periods of intense price pressure and often signal a ceiling in the local market.

Spot market weakness adds further risks

The spot market is also showing clear signs of weakness. Cryptocurrency market watcher Wu Blockchain reported that spot trading volume on major exchanges decreased by 28% in November 2025 compared to October.

November Exchange Data Report: Spot trading volume on major exchanges in November 2025 decreased by 28% compared to October. The top three exchanges by volatility were Bitfinex +17%, Coinbase -8%, and KuCoin -17%. The bottom three were Bitget -62%, Gate -44%, and MEXC -34%. … pic.twitter.com/oXgFKyrv6b

— Wu Blockchain (@WuBlockchain) December 10, 2025

Another report from BeInCrypto highlighted that stablecoin inflows to exchanges have fallen by 50%, dropping from $158 billion in August to $78 billion as of today.

The combination of low spot purchasing power, high leverage, and decreasing stablecoin reserves reduces ETH's ability to recover. These circumstances could expose long whale positions to significant risk of liquidation.

The post “Whales go all-in on Ethereum — but record leverage puts longs at risk” originally appeared on BeInCrypto.