January began with a notable shift in the liquidity dynamics of the crypto market, with net stablecoin inflows to Binance exceeding $670 million in just one week.

The return of capital to the world's largest exchange by trading volume signals a change in investor position. This came after a difficult December marked by heightened risk aversion across the crypto market.

Stablecoin flows reflect shifts in market confidence

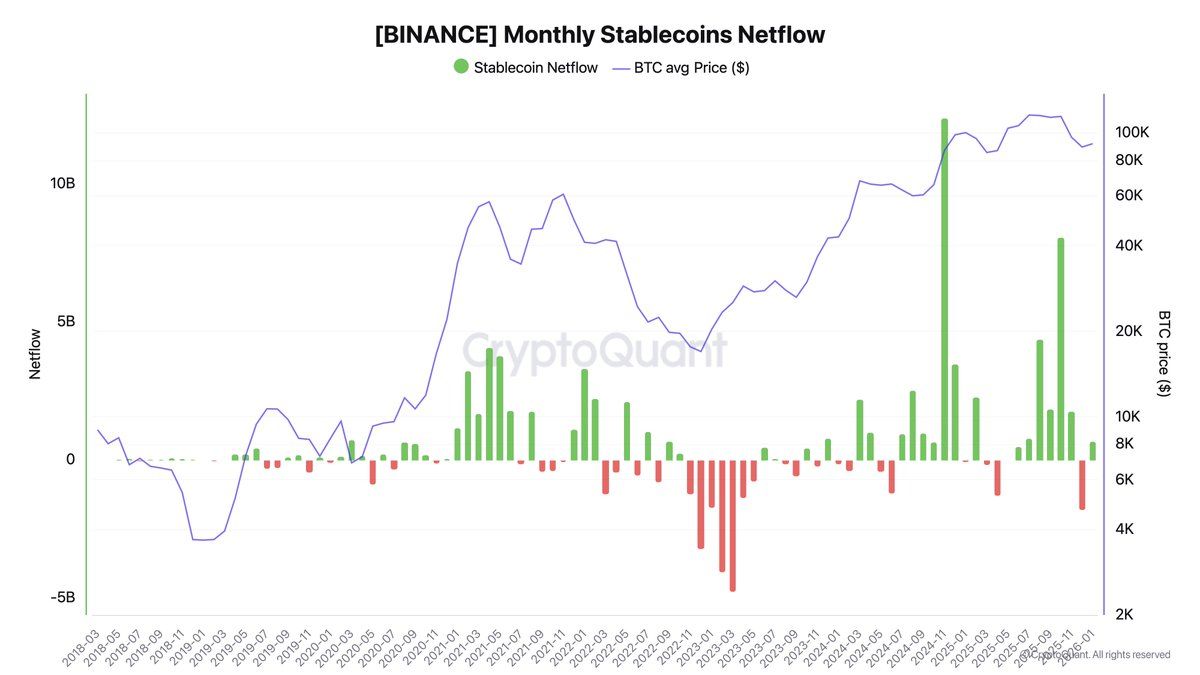

In a recent post, on-chain analyst Dirkforst explored how stablecoin activity on Binance has evolved over the past few months and provided insight into the shift in investor behavior. The analyst said October was an exceptional period for liquidity. Net stablecoin inflows to the exchange exceeded $8 billion.

“Such levels are rarely observed, and the collapse that occurred on October 10 in particular created attractive opportunities,” the analyst said.

However, in November, the momentum weakened. Net inflows decreased to approximately $1.7 billion. This suggested a slowdown in demand and a more cautious approach by market participants.

In December, the trend completely reversed, with Binance recording stablecoin net outflows of over $1.8 billion. These outflows typically indicate a decline in risk appetite, as investors prioritize preserving capital over taking new positions.

“Binance itself may have contributed to these outflows, as the exchange may have reduced some of its stablecoin holdings to adjust reserve levels due to weaker demand,” the post reads.

However, analysts noted that January started in a completely different situation. Binance experienced net stablecoin inflows of over $670 million in one week.

Dirkforst interprets the new liquidity flowing into Binance as an early sign that investors are starting to reposition their positions, perhaps in anticipation of new trading opportunities.

“When stablecoins flow into an exchange, it typically reflects purchase intent or highlights demand that the exchange needs to meet,” the analyst said. “This suggests that interest is slowly returning to the most heavily traded platforms and some liquidity is starting to be redeployed in view of new opportunities.”

Stablecoins are flowing into Binance. Source: CryptoQuant

Beyond recent inflows, other indicators suggest that inactive capital may be starting to re-enter the market. In a separate analysis, Dirkforst observed that Binance’s Bitcoin to stablecoin ratio is trending upward again.

This indicator is typically used to measure the amount of purchasing capacity available on an exchange, and its recent movements indicate a possible early stage in liquidity deployment rather than continued sidelines.

“This ratio is starting to rise again. This change could signal the early stages of a gradual rollout of liquidity, which would be a very positive signal for the market,” the analyst said.

Solana Ecosystem Posts Record Growth for Stablecoins

While the inflows into Binance have garnered attention, Solana has witnessed an even more dramatic spike in stablecoin activity. According to data from The Kokuissi Letter, the network's stablecoin supply increased by more than $900 million in just 24 hours.

This rapid influx outpaced changes on other networks and contrasted with declines on platforms such as Tron. Two major developments coincided with the surge in Solana stablecoin supply.

Jupiter has launched its own stablecoin. Additionally, Morgan Stanley has filed initial applications for three crypto exchange-traded products, including the Morgan Stanley Solana Trust, indicating significant institutional investor interest in Solana.

Analysts highlighted that the network's low costs and quick finality will allow it to quickly leverage incoming liquidity.

“In practical terms, more $SOL stablecoins means more funds available for trading, payments, and application activities,” Milkroad said.

Therefore, the convergence of new stablecoin inflows to Binance, the increase in on-chain stablecoin supply, and the overall growth in market capitalization indicate the early stages of capital re-engagement across the crypto market.

The key question is whether these inflows reflect a sustained shift in market positioning or simply a short-term tactical adjustment amid continued volatility.

The post What $670 Million in Stablecoin Inflows Means for the Crypto Market first appeared on BeInCrypto.