This is a segment of the 0xResearch newsletter. Subscribe to read the full edition.

ETH is trading for from $1,600 today.

Can I pump ETH again? Wen Moon?

To get to the heart of this simple question, you need an inevitable detour to the boring and technical weeds (DAs) of data availability.

The ELI5 description of data availability is storage fees or bandwidth resources. All chains (L1 and L2) must work, but the main supplier is L1.

Here is a rough line of thoughts:

- What is the fate of ETH as an asset?

- This depends on how well Ethereum can generate the fee.

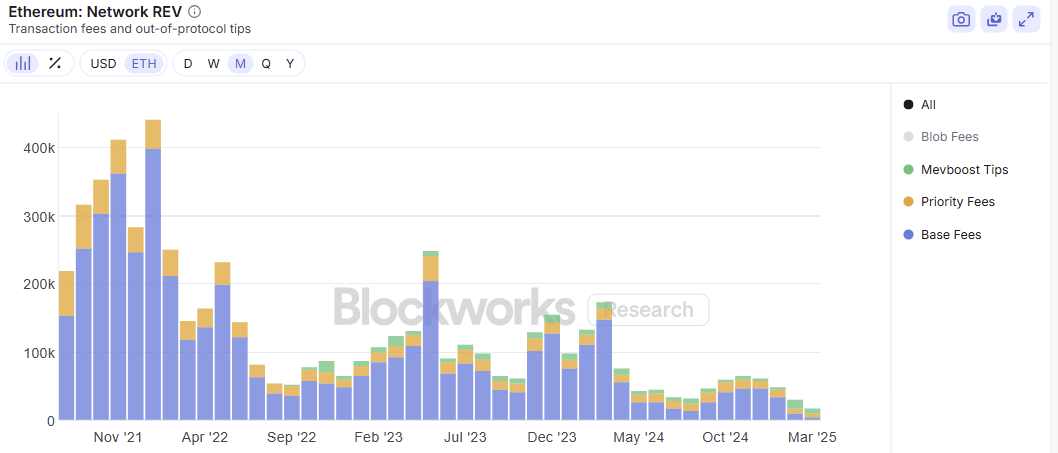

- Ethereum generates fees in three main ways: execution, MEV, and data availability.

- Following the intent of the roll-up-centered roadmap, execution fees (aka congestion fees) are largely given to L2.

- MEV fees are compressed with better research. More and more wallets and apps are finding better ways to keep MEVs and return them to users. The following chart of Ethereum's Rev (actual economic value) excluding BLOB fees is a rough proxy for how Ethereum's MEVs flow over time.

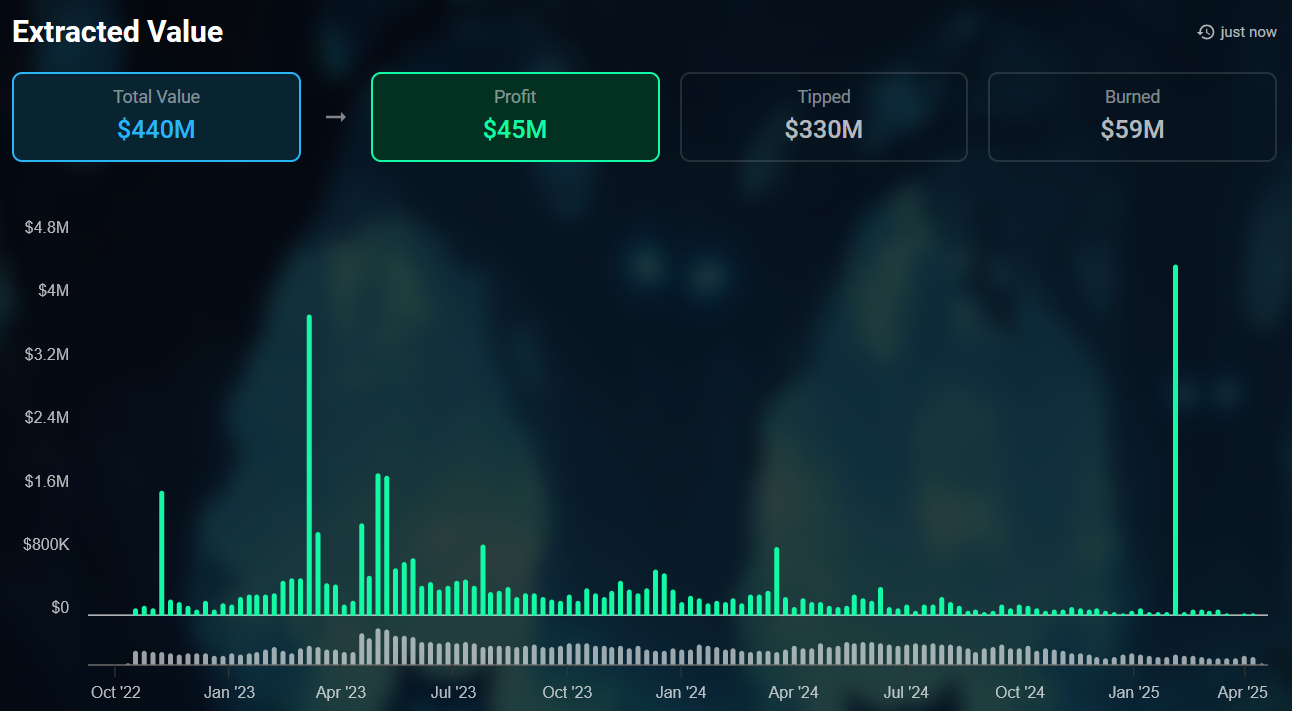

Another way to see the downtrend of MEV is the reduced extracted value of sandwich attacks. This is mainly due to the increased amount of Ethereum private transaction order flows not passing through public memory.

Source: libmev

- As more rollups are released, all chains need DA fees, so ETH's final values remain.

This has therefore established that data availability fees are essential for Ethereum's success.

That's not just my opinion. It's the explicit position of leading Ethereum researchers like Justin Drake. When he places it on the latest Ethereum Foundation Reddit AMA, the DA is “the only source of sustainable flow for L1S” and not a fee for execution or MEVs.

(I think this is a simplification. There are efforts to scale L1 and attract institutional capital to L1, but put that aside for now.)

So let's take a look at how much Ethereum will make from today's DA.

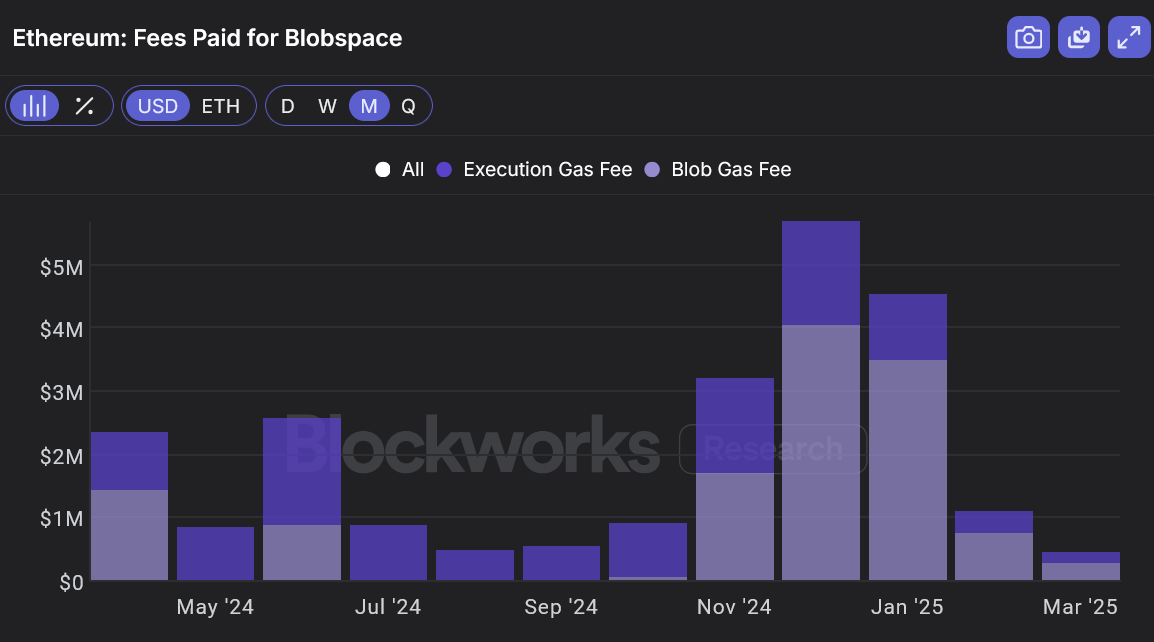

Unfortunately, it's not that much. Since the establishment of EIP-4844 in March 2024, Ethereum has generated a total of $26 million in fees.

Reaching that fee level is a function of both demand (roll-up) and supply (Ethereum L1 DA capacity).

Let's assume that Ethereum had sufficient user demand today. Still, Ethereum lacks supply.

EIP-4844 introduced blobs to the DA capacity of Ethereum in March 2024. BLOB capacity is approximately 384 kb or approximately 32 kb/s per slot.

In the context, alternative DA layers like Celestia currently have around 182% larger 8MB blocks. (Celestia is preparing for the 128 MB block.)

Yes, the BLOB capacity is expanding, but it's slow. The DA capacity is set to expand from three blobs to six blobs next month with the Pectra Hard Fork. The final plan is to expand the blob capacity to 48-72 with the Fusaka Hard Fork afterwards, but who knows when it will happen.

Now let's take a look at the DA market.

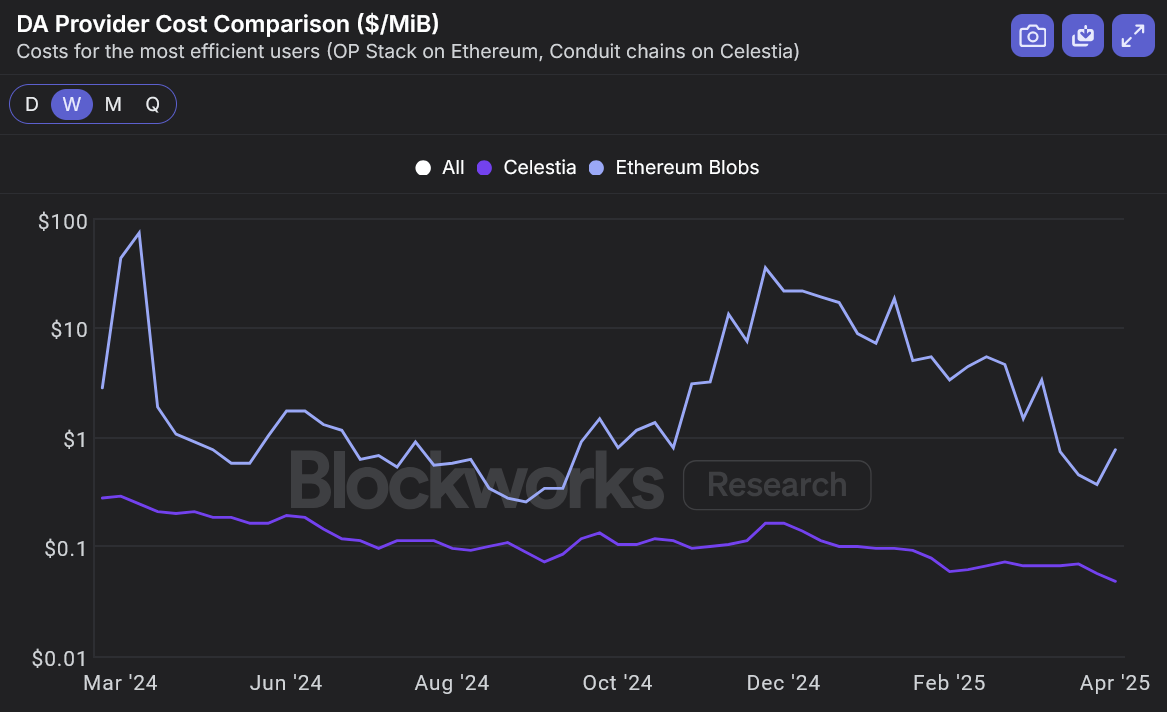

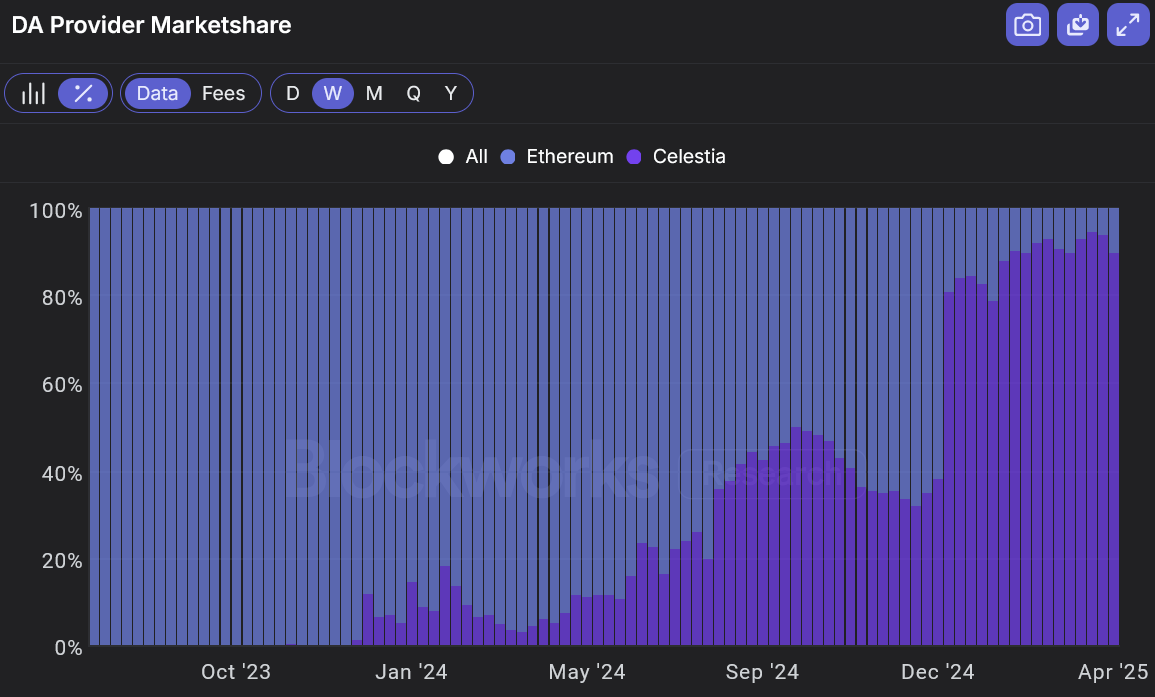

Even worse news. It's a highly competitive market. There are Celestia, Eigenda and Avail.