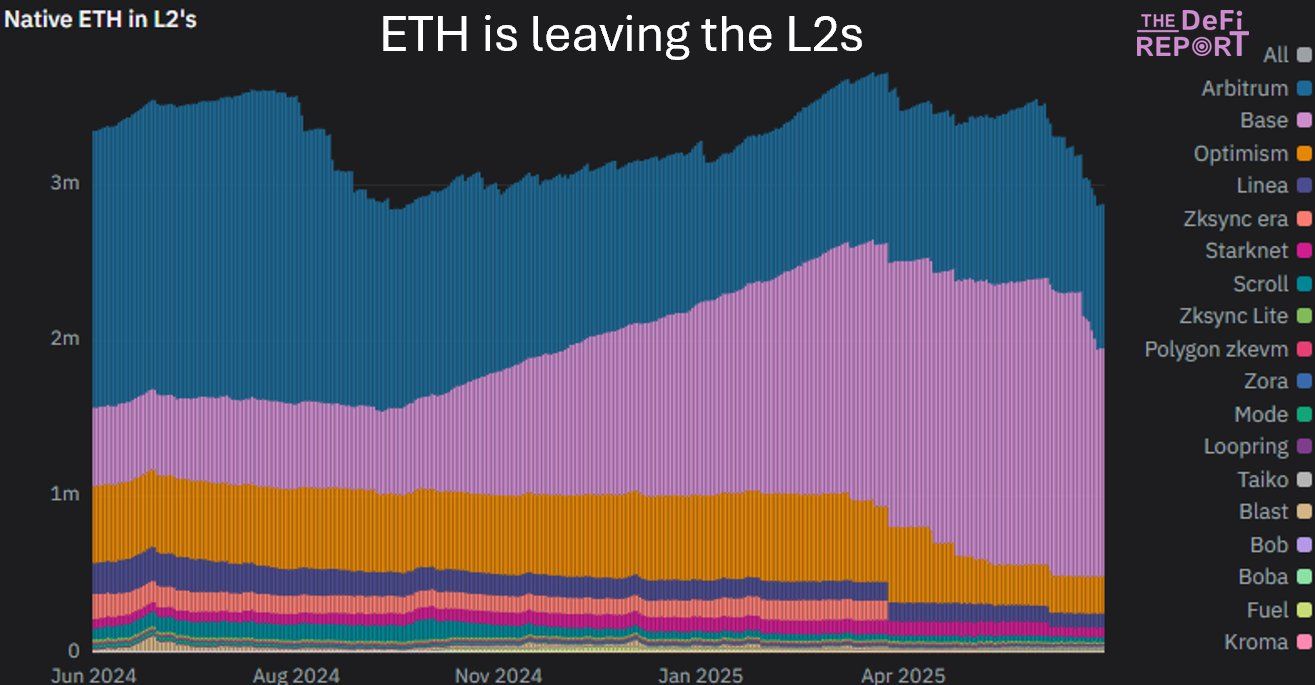

Over the past few months, Ethereum (ETH) in the Layer 2 (L2) network has been reserved, with the overall ETH balance down by around 25%.

ETH on optimism has fallen by 54% since March, but Arbitrum and Base have seen a decline of 17% and 14%, respectively.

What is driving this decline?

The Defi report chart clearly shows this trend. Especially since early 2025, when major L2 networks such as optimism and bases witnessed a significant withdrawal of ETH. The analysis shows that the price of native Ethereum L2 tokens is a key factor.

ETH reserves on the L2 network have plummeted. Source: defi report

Tokens such as optimistic OPs have fallen by more than 38% over the past 90 days. Meanwhile, Arbitrum's ARB has fallen by 21%. The recession has reduced investors' appeal and has led to them moving to other platforms.

At the same time, some of the ETH is back to Ethereum Mainnet.

Furthermore, the amount of ETH and the number of long-term holding addresses have reached new highs, indicating that investors prioritize value conservation strategies over Ethereum L2 trading.

Another potential factor is the movement of ETH from the accumulation address. Data from encryption shows that large wallets are reallocating assets, increasing sales pressure on L2.

The accumulated addresses (holders with no history of sales) are at an all-time high, and currently holds 22.8 million ETH. Many public companies include ETH as a reserve asset.

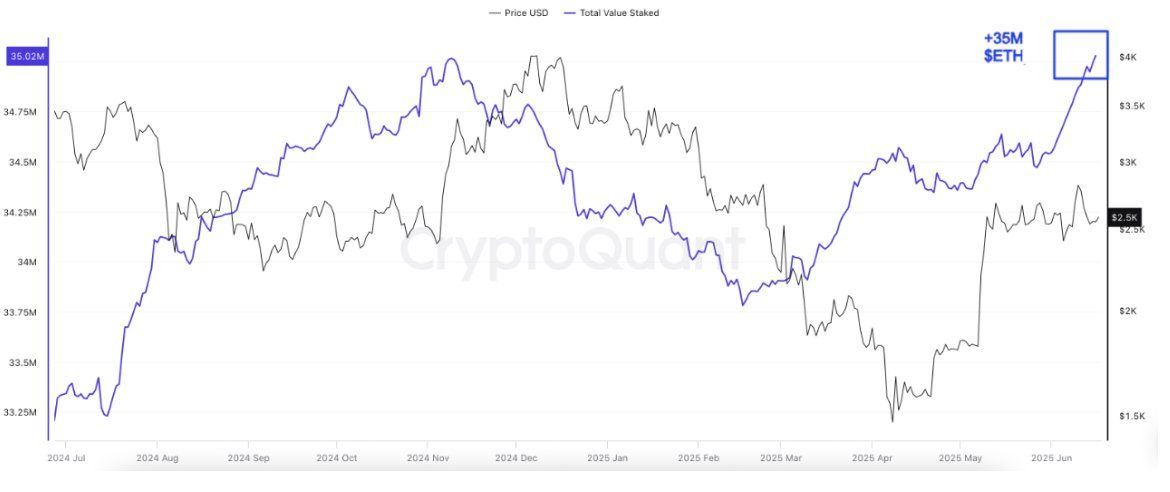

The total amount of the ETH was staked. Source: Cryptoquant

“In early June, more than 500,000 ETHs were staked, pushing the total locked amount to a new height of ETHs of over 35 million. This growth indicates a growing confidence and a continuous decline in liquid supply,” said the crypto analyst.

Impact on the Ethereum ecosystem

This decline marks a shift from 2024 when L2 was seen as a threat to the mainnet due to its ability to attract users and transaction fees. However, the opposite trend has been unfolding as mainnet records increase activity.

This has strengthened Ethereum's position, improved performance and reduced costs, particularly after the successful Pectra upgrade last month. However, L2s like optimism and bases need to be improved to regain trust. Otherwise, they risk losing their important role in network scaling.

ETH's departure from L2 could continue to continue into the successful Pectra upgrade or strategic adjustment this month amid market volatility. However, to recover, L2S needs to focus on improving liquidity and reducing reliance on easy-to-operate tokens.

Developers can consider implementing more transparent incentive mechanisms while working closely with centralized exchange to stabilize capital flows.

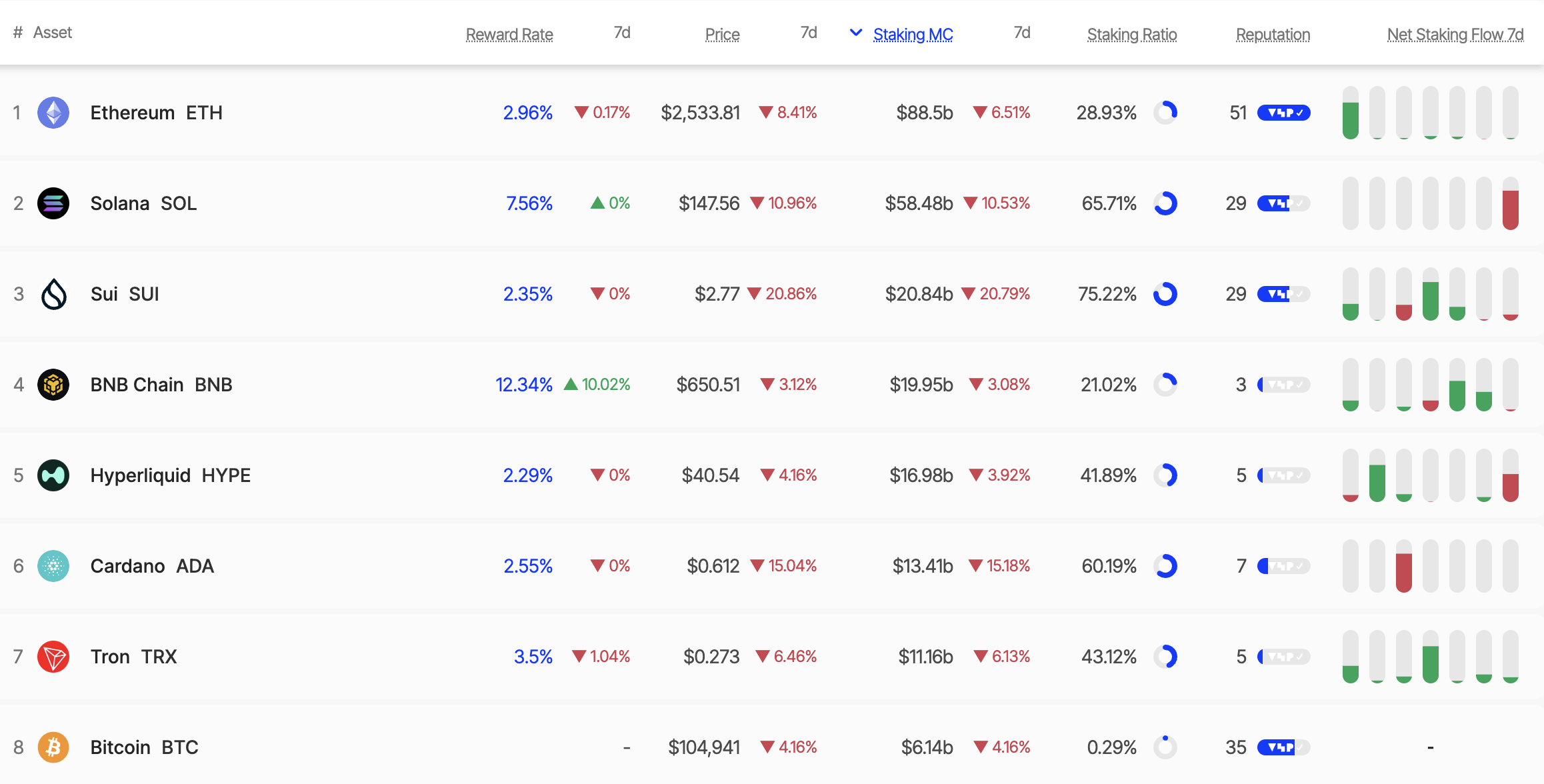

ETH staking ratio. Source: Staking Rewards

Furthermore, ETH staking growth (currently accounting for nearly 29% of total supply) reflects long-term trust in Ethereum. If the L2S is unable to adapt quickly, the mainnet could become more competitive while solidifying its main position.