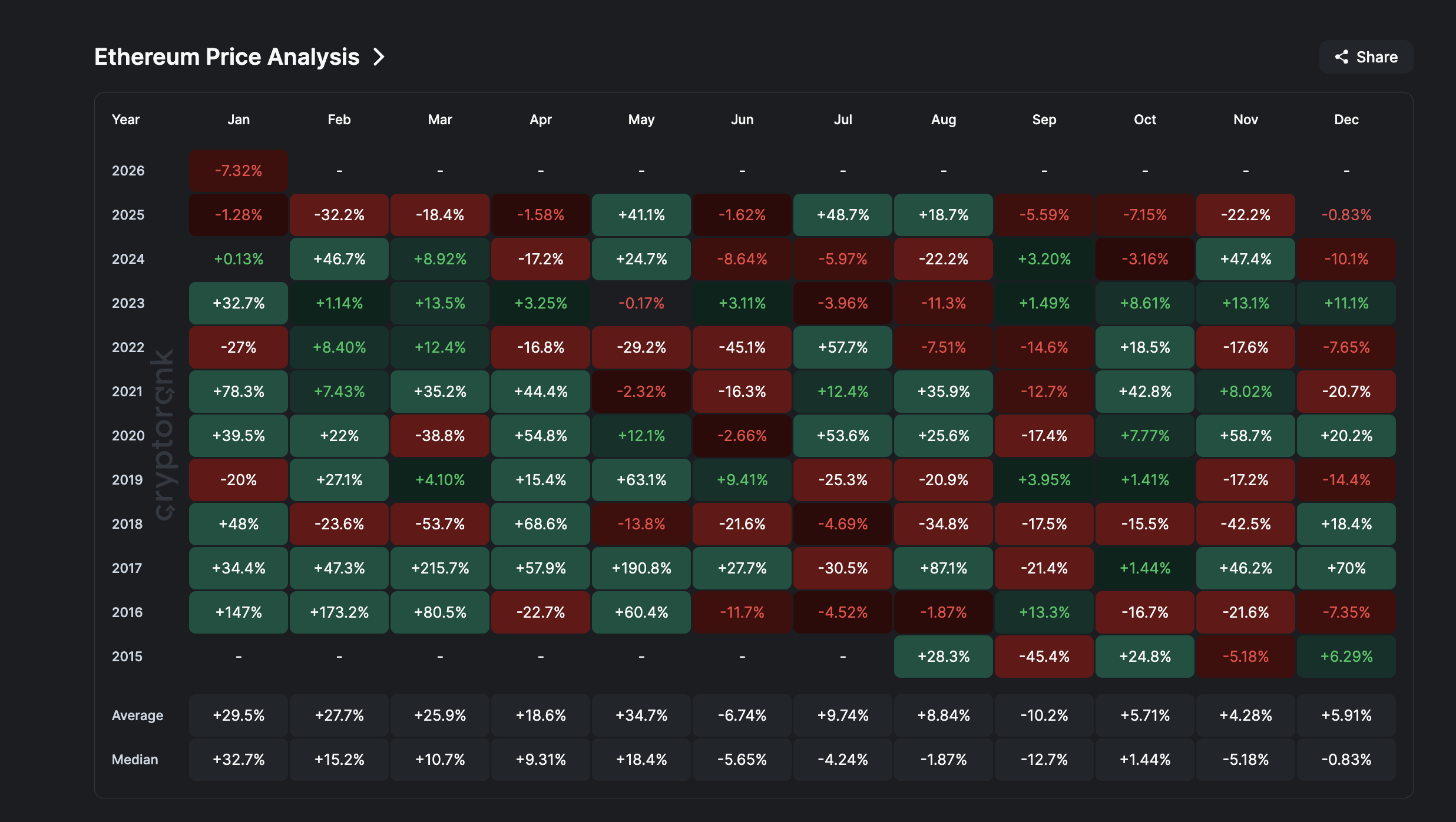

Ethereum price is approaching a critical crossroads in February 2026. After falling nearly 7% in January. $ETH We are ending the month in clear contrast to previous trends. The median January return is near +32%, but this year has moved in the opposite direction. Meanwhile, February saw a median increase of approximately +15% since 2016.

The last time Ethereum entered February in a similar situation was in 2025. That year's slump widened to a monthly decline of 32% to 37%. Whether 2026 follows that path or breaks away from it will depend on how technological structures, on-chain data, and organizational flows interact in the coming weeks.

Ethereum’s February history and falling wedge poses a high-stakes challenge

Looking at long-term data can help you make predictions. Since 2016, Ethereum’s median February return has been approximately +15%. It wasn't the best month, but we had more gains than losses.

This January tells a different story.

Instead of following a median gain of +32%, $ETH The closing price for January 2026 will be approximately 7% lower. This brings us closer to the 2025 pattern, where an early slump led to a February decline.

History of Ethereum: CryptoRank

Ethereum therefore enters February at a crossroads.

However, not all analysts believe seasonality should be treated as a reliable guide.

The analysis team at B2BINPAY, an all-in-one crypto ecosystem for enterprises, warns against relying too much on past patterns.

“Historical patterns are not something to be trusted blindly; most of them exist for fairly obvious reasons,” they said.

they also added $ETH There is currently a lack of immediate growth promoters

“However, there is no real reason to think February must bring growth. On this basis, there is little sense in expecting February to maintain its 'historic' bullish significance,” they stressed.

They also point to last year as evidence.

“If we look at February 2025 as an example, Ethereum has fallen by 37%,” they said.

That skepticism is reflected in the current chart structure.

For a period of 2 days, $ETH Price remains inside the falling wedge. A descending wedge is formed when price cuts lower highs and lowers lower lows. It often signals weakening selling pressure or a possible reversal.

In this case, the wedge is wide and unstable. If the breakout is confirmed, we can expect an increase of around 60%. This is a maximum goal, not a prediction.

Momentum adds an extra layer.

From December 17th to January 29th, the price of Ethereum is about to reach further lows. During the same period, the Relative Strength Index (RSI) remained around 37. RSI measures whether buyers or sellers are in control of momentum.

Price structure: TradingView

If the RSI does not fall even though the price falls, selling pressure is weakening. This results in an early bullish divergence.

If it's next $ETH The price candlestick holds above $2,690, the RSI stabilizes, and reversal odds improve once the price low is confirmed. However, it has not been confirmed yet. Therefore, on-chain data becomes important.

On-chain data supports rebound, but confidence is fading

On-chain metrics provide the first major validation test. One important metric is Net Unrealized Gains and Losses (NUPL). NUPL measures paper profit and loss.

Ethereum’s NUPL is currently hovering around 0.19, in the “hope and fear” zone.

This level is historically significant. In June 2025, NUPL has fallen to nearly 0.17. $ETH It traded for about $2,200. The following month, the price soared towards $4,800, an increase of over 110%.

Therefore, NUPL is consistent with what the wedge and RSI are suggesting. Selling pressure is easing. Unrealized profits are decreasing. This creates upside room.

But the signal is incomplete. A true market bottom typically occurs when NUPL goes negative. In April 2025, it dropped to around -0.22, indicating complete capitulation.

NUPL remains high: Glassnode

Today's reading is still well above that, meaning there is more room to sell. This suggests a redemption rally rather than a cycle reset.

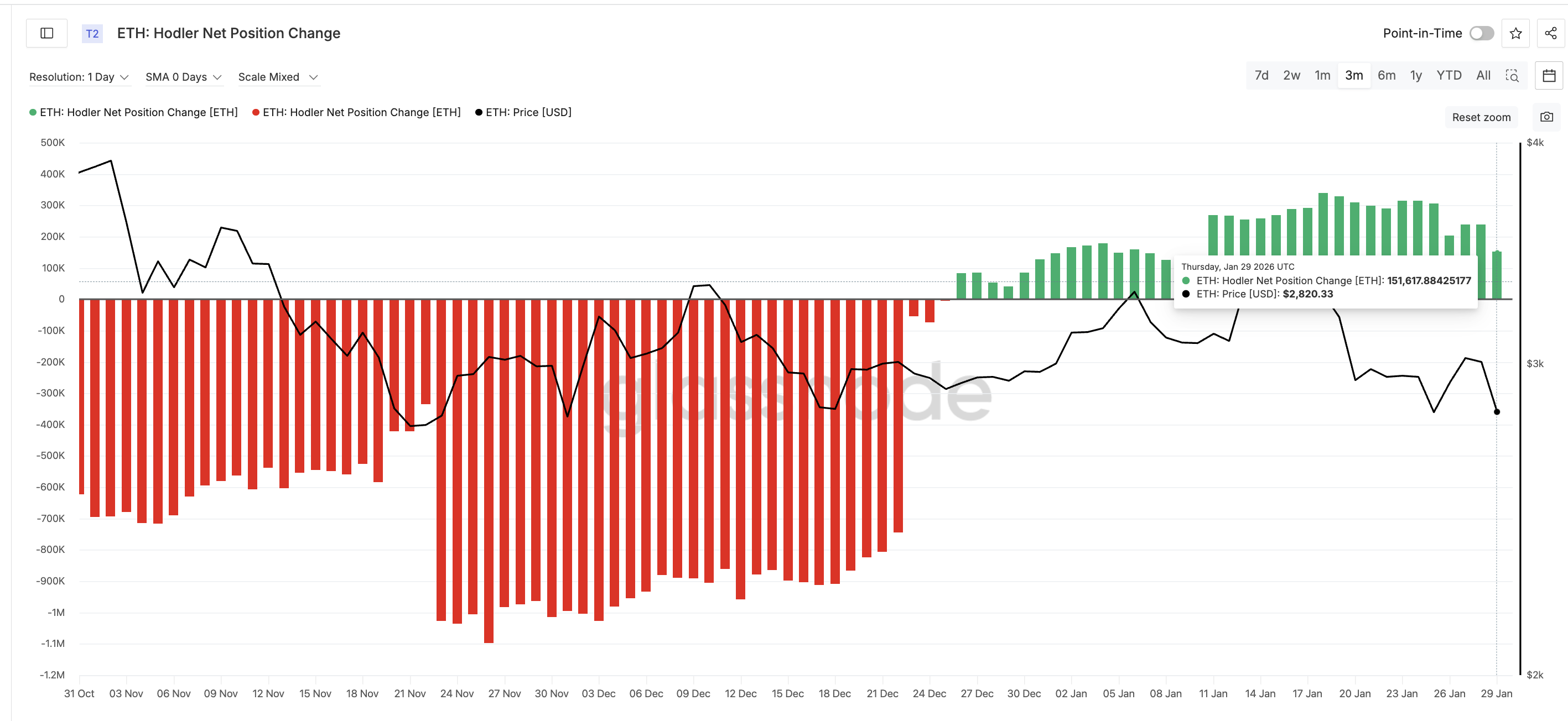

The actions of HODLers reinforce this complex situation. The Hodler Net Position Change Indicator tracks whether long-term investors are accumulating or distributing. Throughout January, this indicator remained positive.

The cumulative total peaked at approximately 338,700 on January 18th $ETH. By January 29, the number had fallen to about 151,600. $ETH. This represents a reduction of more than 55%. So holders are still buying, but with much less conviction.

Long-term investors are not so active in buying: Glassnode

This is consistent with how B2BINPAY analysts describe the broader market environment.

“Currently, supply and demand are in balance. Buyers want to buy at about the same level that sellers want to sell. …The market needs a clear impulse to the upside or downside for the picture to become clearer,” they said.

Taken together, NUPL and holder activity validate the rebound case, but indicate weakening conviction.

The focus then shifts to the next decision group: the big bucks.

Whales are on the rise, but ETFs are still scarce

Large shareholders are sending stronger signals than institutional investors.

Data on whale supply shows steady accumulation in January. As of the beginning of the month, whales controlled approximately 101.18 million individuals. $ETH. By the end of the month, that number had increased to about 105.16 million people. $ETH.

An increase of nearly 4 million $ETH. This reflects aggressive buying during the economic downturn.

$ETH Whale”>

$ETH Whale”>

$ETH Whale: Santiment

Although prices have fallen from mid-January highs, large wallets continued to increase their exposure. It is supported by $ETH Rebound case proposed by NUPL and Wedge.

This is in sharp contrast to 2025.

As of the end of January 2025, the whale stock reached nearly 105.22 million. $ETH. By the end of February, that number had fallen to about 101.96 million. $ETH. This distribution coincided with Ethereum's 32% collapse in February. Whales sold well last year. This year they are accumulating.

$ETH Whale sold last year: Santimento

But inconsistent ETF flows tell a more cautious story. Several days of heavy inflows were followed by massive outflows. In late January, the number of withdrawals exceeded 70,000. $ETH Equivalent product.

ETF Flow: Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This means that ETFs are not decisively participating in the rebound trade.

John Murillo, chief business officer at B2BROKER, a global fintech solutions provider for financial institutions, argues that ETF movements in January reflect tactical positioning rather than a complete exit.

“The outflow from the spot in mid-January was$ETH ETFs look more like a tactical rebalancing than a structural exit. The late-month reversal, driven by large inflows into Fidelity's FETH, suggests that institutional investor behavior is becoming increasingly dual-pronged.

…Rather than significantly reducing risk, it appears to be fragmenting flows across issuers,” he said.

In Murillo's view:

“ETF trends in January indicate maturity rather than a complete setback,” he said.

Murillo warns that if this situation continues, derivatives could take over the lead in price discovery and become a major risk to prices.

“While derivatives trading continues to expand, if Feral Array introduces disruptions or curtailments to ETF flows, the balance of influence could shift from spot demand to leverage-driven price discovery.

“February will likely test whether Ethereum's price is locked in by spot allocation by institutional investors or derivatives momentum,” he said.

For now, Whale is optimistic. Educational institutions remain cautious. This combination supports rebound, but sustainability is limited.

Ethereum price level determined in February 2026

The NUPL mentioned earlier shows that this is not a confirmed bottom. Downside risks still remain.

first critical $ETH Price support is located near $2,690.

This is consistent with the recent two days of support and previous integration. A clean close below $2,690 would signal sellers to regain control. This will open the downside towards $2,120.

On the upside, Ethereum requires you to collect $3,000 first. This is a psychological and structural barrier. Price has repeatedly failed here since December.

A sustain above $3,000 will signal a return of confidence.

Ethereum Price Analysis: TradingView

The next resistance level is near the $3,340 level. This level is the upper limit of the rise since December 9th. A breakout would indicate a meaningful change in the market. $ETH price structure.

Beyond that, $3,520 becomes significant. A sustained break-and-hold above $3,520 will confirm a recovery in momentum and open an upside towards $4,030.

The post Ethereum Price Prediction: What to Expect $ETH first appeared on BeInCrypto in February 2026.