After a relatively flat April in April due to a decline in network demand and a decline in horizontal price action, the second largest cryptocurrency (ETH) may be placed for shifts.

ETH owners are optimistic about May. This optimism is supported through the Spot ETH Exchange-Traded Funds (ETFs) by strengthening basics, expected Pectra upgrades, and renewed interest from institutional investors.

ETH struggled in April, but may bring some faint hope

In April, on-chain data showed a decline in user activity across the Ethereum Network, but wider market stagnation left ETH below major resistance levels.

According to Artemis, user demand for Ethereum plummeted over the 30-day period, with fewer active addresses, daily transactions and as a result, network fees and revenues.

This and the wider market slump impacted ETH performance, bringing major Altcoin prices below $2,000 throughout April.

However, in an interview with Beincrypto, Intotheblock research analyst Gabriel Halm said ETH prices could surpass the $2,000 price mark in May and could stabilize above that.

For HALM, improved capital flows into the ETH Spot ETF. Ethereum's domination in the Decentralized Financials of Coins (DEFI) vertical, and future Pectra upgrades will help us achieve this.

ETF influx, Defi domination, and Pectra: Ethereum triple boost in May

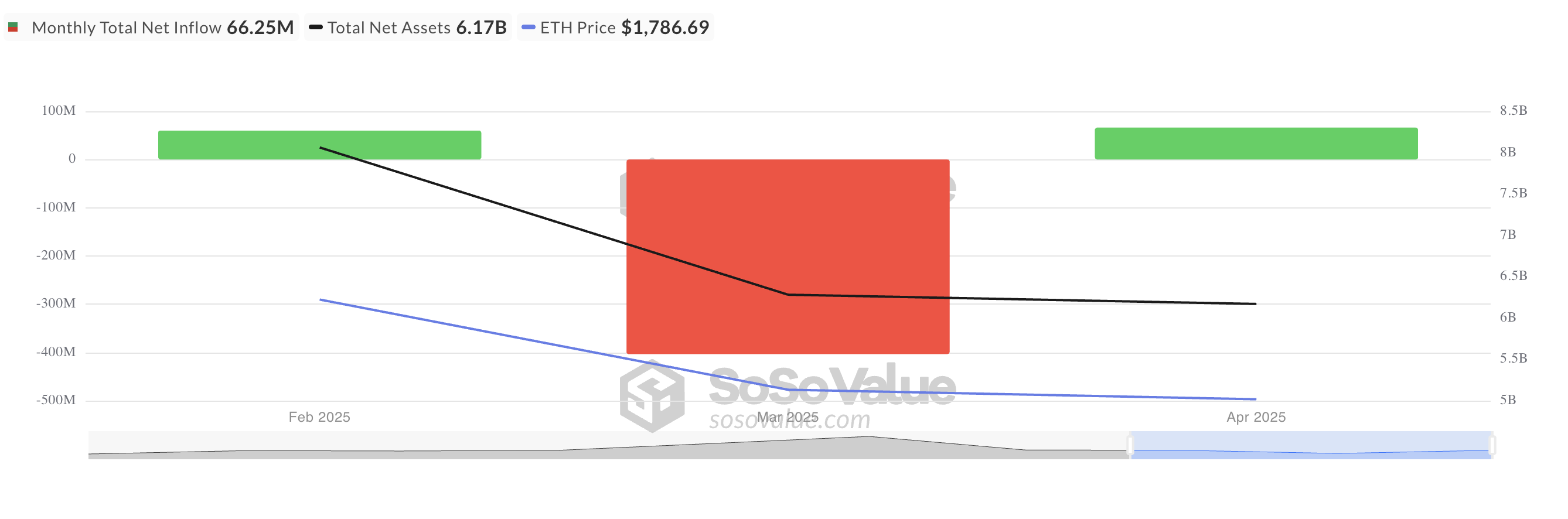

According to Sosovalue, the monthly net inflow to ETH ETFs totaled $66.25 million in April, indicating a shift in market sentiment compared to the net outflow recorded in March of $403.37 million.

All Ethereum spot ETF net flow. Source: SosoValue

This reversal from heavy drains to modest inflows suggests that investors' trust in Altcoin is gradually returning. This shows that institutional players may be positioned for long-term rebounds, especially as the Ethereum network foundations begin to improve.

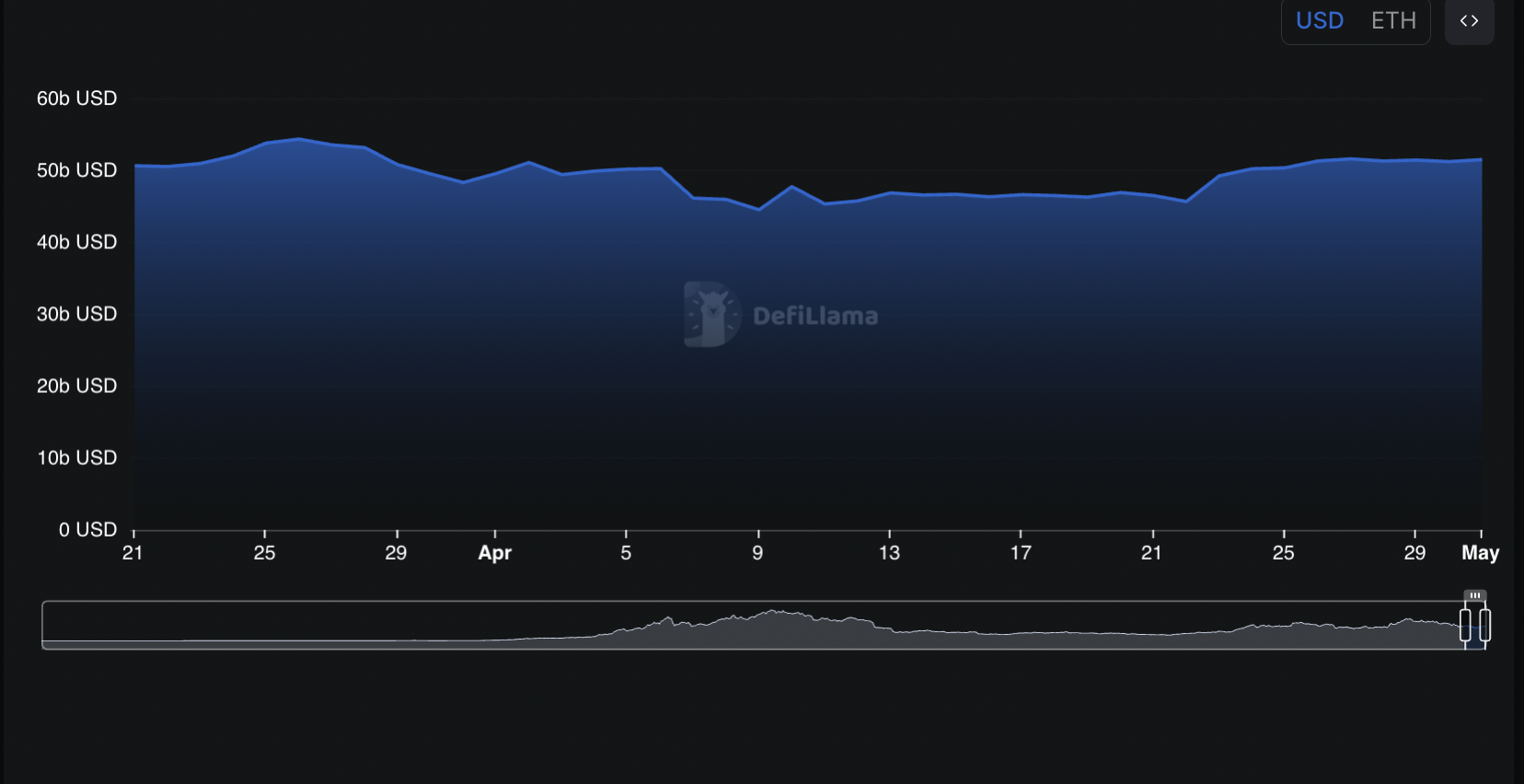

More than 50% of the total locked value (TVL) of the Defi protocol is still in the Ethereum blockchain. This means that Layer-1 (L1) remains the settlement tier that is preferred for a variety of financial applications, including lending, staking, yield agriculture, and decentralized exchanges.

Defi tvl from Ethereum. Source: Defilama

Therefore, if broader market conditions begin to improve in May, updating capital inflows into the Ethereum debt sector could increase demand for ETH and support price rallies.

Additionally, according to Halm, the upcoming Pectra upgrades of Ethereum, scheduled for release on May 7, 2025, can further support ETH price performance this month. Upgrades promise to improve network scalability, reduce transaction fees, improve security and introduce smart account features.

These improvements could potentially drive a surge in user demand during May, potentially increasing ETH prices if macroeconomic conditions remain favorable.

ETH's growth depends on the stability of the wider market

Nonetheless, broader economic pressures pose a major risk to ETH in May. “The upcoming CPI report on May 13 is particularly important and could affect market sentiment and contribute to this volatility,” Halm said.

This is because inflation or Hawkish signals from the Federal Reserve could exacerbate risk-off sentiment in the crypto market and put pressure on ETH prices.

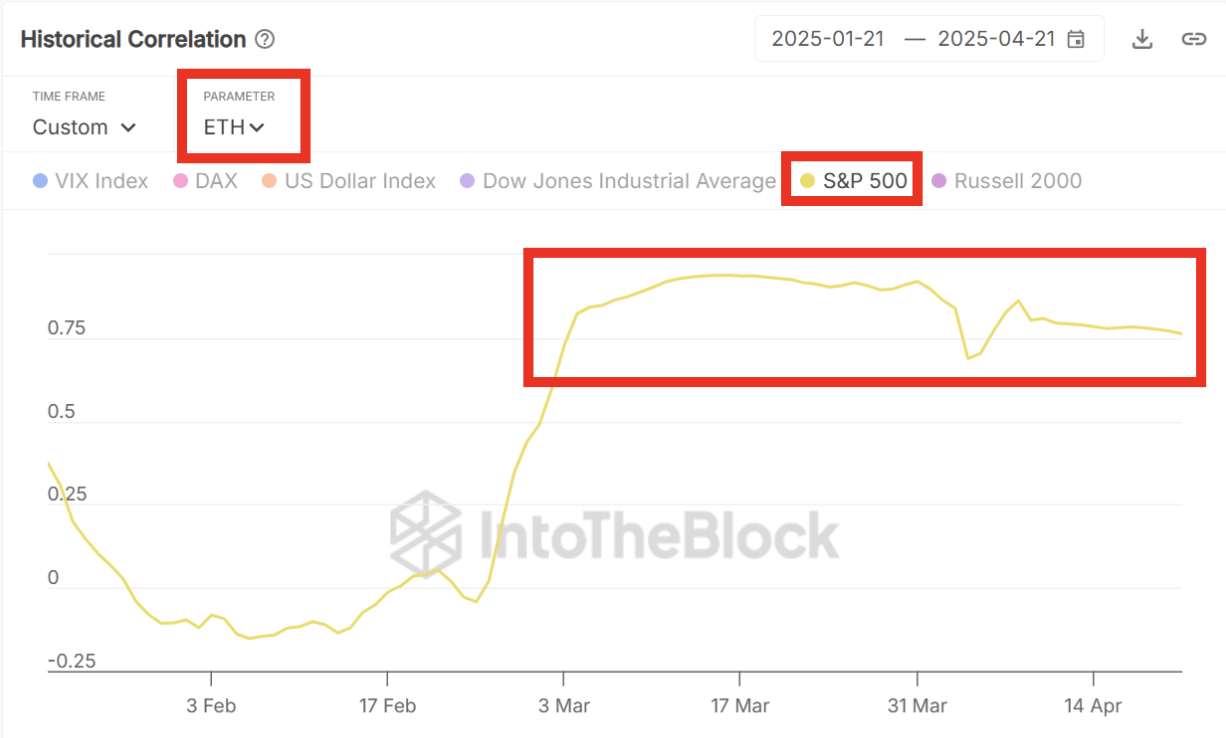

Halm also noted that ETH prices are closely correlated with US stocks. So, if the stock market is facing new stress this month due to fears of inflation and expectations of rate hiking, Altcoin could be subject to similar pressures.

Historical correlation of ETH with the S&P 500. Source: IntotheBlock

“If this high correlation continues in the coming May, Ethereum's vulnerability to market slump is likely to be similar to the vulnerability of traditional risk assets like the S&P 500.

While a lasting push above $2,000 is still possible, rally can depend on inflation trends, traditional market risk sentiment, and how closely it is tied to stocks.