After a strong start to 2026, Ethereum (ETH) is facing downward pressure, with its price down nearly 3% in the past 24 hours.

In this context, analysts have highlighted key bearish signals that Ethereum must overcome before a confirmed breakout above the $3,300 level is possible.

Ethereum faces serious challenges due to deteriorating market conditions

According to data from BeInCrypto Markets, ETH ended 2025 down 10.9%. Nevertheless, green candles dominated the charts at the beginning of the year, with the altcoin gaining 11.3% from January 1st to January 6th.

However, since Wednesday, ETH has reversed its trajectory. Over the past day, the second-largest cryptocurrency has fallen by about 3%.

At the time of writing, it was trading at $3,113. The move is part of a broader market decline that saw the overall market capitalization of cryptocurrencies fall by more than 2.2%.

Ethereum (ETH) price performance. Source: BeInCrypto Markets

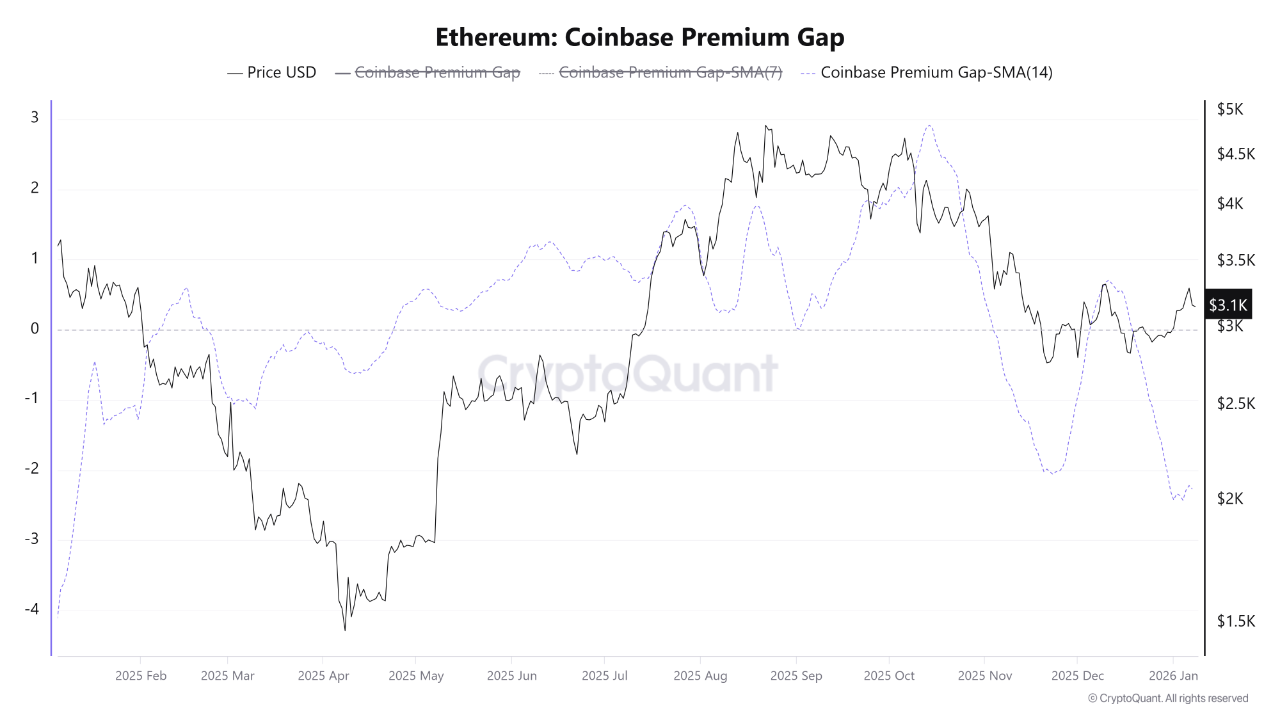

In a recent assessment, CryptoOnchain highlighted a significant bearish disconnect between Ethereum's price action and its underlying on-chain demand. Analysts pointed to a sharp deterioration in Coinbase's premium gap.

The 14-day simple moving average fell to -2.285, its lowest level since early February 2025. According to CryptoOnchain, this shows that demand from US institutional investors is weakening.

The Coinbase Premium Gap tracks the price difference between Coinbase, which is often used as a measure of US institutional sentiment, and Binance, which reflects broader global retail activity.

“This continued negative gap clearly indicates that the selling pressure, or more precisely the lack of buying interest, is significantly stronger on Coinbase compared to Binance,” the post reads.

Ethereum Coinbase Premium Gap. Source: CryptoQuant

The analyst added that historically Ethereum’s sustained rise has coincided with a positive premium for Coinbase. The current negative numbers suggest that institutional investors are largely on the sidelines at current price levels.

“This on-chain weakness is emerging as Ethereum continues to struggle below the heavy $3,300 resistance zone….The likelihood of a confirmed breakout above the $3,300 resistance remains low until the Coinbase-Binance price differential returns to positive territory and true demand reappears in the US spot market,” CryptoOnchain said.

Continued outflows from Ethereum spot ETFs further highlight weak demand. ETFs saw their biggest monthly outflows in November, totaling $1.42 billion. This was followed by another $616.8 million outflow in December.

On Jan. 7, the ETF recorded its first outflow of 2026, with $98.45 million out of the product, according to SoSoValue data. This was also reflected in outflows from Bitcoin and XRP ETFs on the same day, reinforcing weakness across the sector.

Bullish signals emerge despite weak demand from institutional investors

Although demand appears subdued, investor interest has not completely disappeared. BeInCrypto reported that Morgan Stanley filed an SEC Form S-1 for the Spot Ethereum ETF on January 6, following previous ETF filings related to Bitcoin and Solana.

Moreover, from a technical perspective, some market watchers are expecting further gains in ETH. Analysts have observed a hidden bullish divergence on the ETH chart along with valid support. If this condition holds, it could lead to further price increases. Another trader pointed to tightening Bollinger Bands, which could indicate a big move is imminent.

Once you expand your $ETH, there is no need to worry here either.

It's clearly an upside breakout and is currently providing a beautiful retest for the market.

It is very natural for such price patterns to occur at the beginning of a new trend.

It continues to remain above the 21-day moving average. pic.twitter.com/M6WsdAOspL

— Michael van de Poppe (@CryptoMichNL) January 8, 2026

The contrast between bearish institutional indicators and technical bullish signals creates uncertainty. While Coinbase’s premium gap and ETF outflows suggest institutional caution, technical setups point to a potential rally for Ethereum. It will become clear in the coming days which factors will ultimately be decisive.

The post What will it take for Ethereum to finally break above $3,300? appeared first on BeInCrypto.