Ethereum currently shows bearish behavior highlighted by differences between price action and RSI indicators. The market appears to be in the consolidation phase, and a critical breakout is likely to determine the next important move.

Technical Analysis

Shayan Market

Daily Charts

ETH is stuck in the integration phase and is trading just below the critical $2.8K resistance zone and 200-day moving average. Price actions within this area lack the upward force, and the market is gradually forming a flag pattern in ascending order. The range is clearly defined by support near the demand zone of $2.4,400 with resistance of $2.8k.

A clear divergence of bearish occurs between the price and RSI, weakening bullish momentum and indicating an increase in the presence of sellers. This difference suggests that current gatherings could lose steam and potentially lead to deeper corrections.

Ethereum has already lost support in the 200-day MA and is now on track to retest the lower boundary of the flag, near 2.4k. A critical breakout from this structure could shape the next major movement:

4-hour chart

In the lower time frame, Ethereum was repeatedly denied from the flag's limit of approximately $2.8,000. This has proven to be a strong zone of resistance. These rejections led to a sudden retreat towards the lower edge of the flag. After reaching support of nearly $2.4k, Ethereum rebounded slightly, returning to the 0.5-0.618 Fibonacci region between 2.6k and 2.7k dollars, generally considered a technical correction zone.

This retracement could probably represent a pause before another bearish push. Another move to the 2.4k level is expected in the sales pressure mount. When Ethereum fails to retain this critical support and breaks under the lower boundary of the flag, we can see the beginning of a wider corrective phase.

On-Chain Analysis

Shayan Market

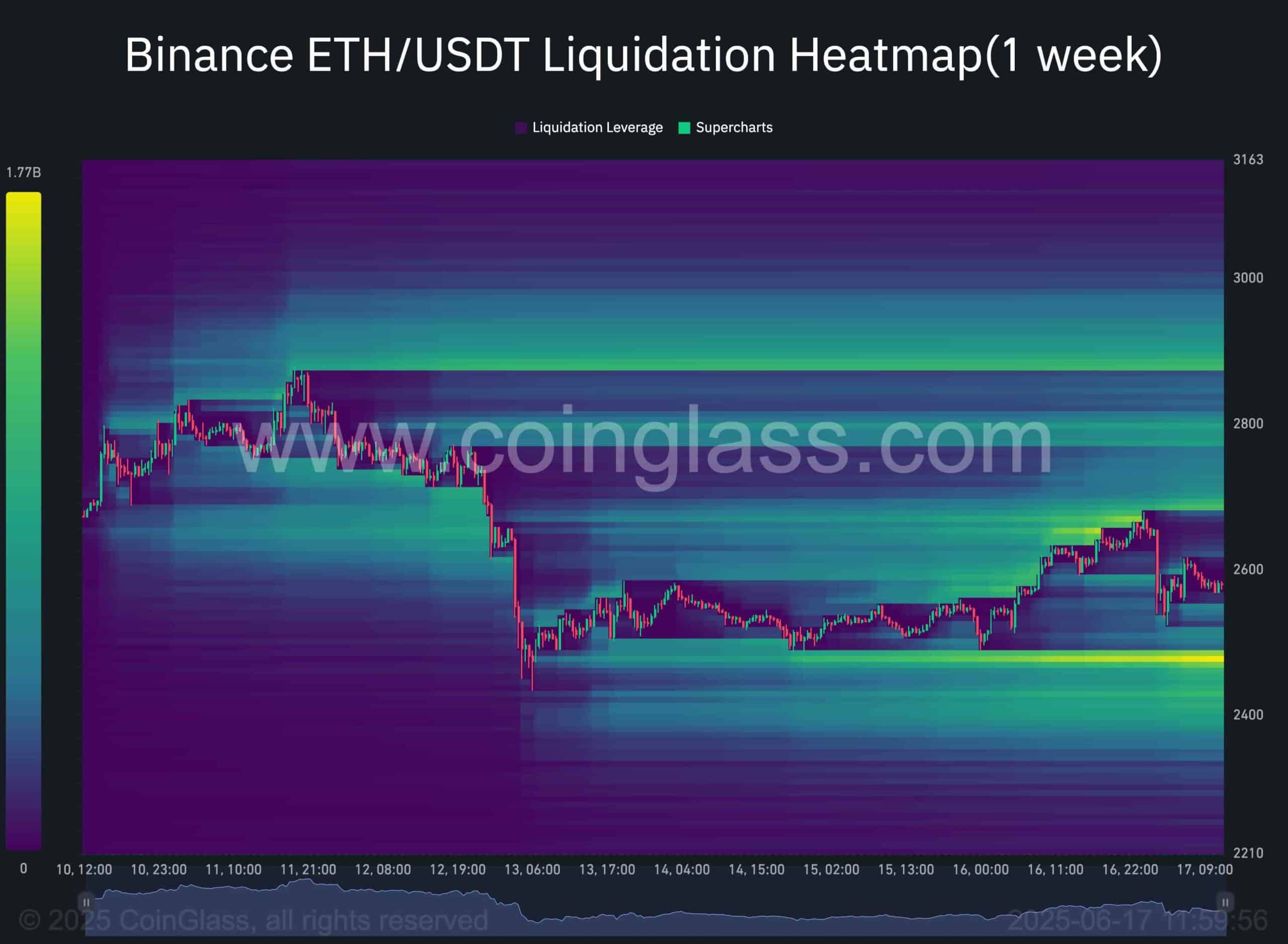

The Binance Clearing Heatmap continues to shed light on Ethereum's current market behavior and the potential for next move. After pushing up a sharp push, ETH touched the 2.8k level, a zone with a short liquidation level. The move caused a wave of forced short closures, flushing out fluidity and fueling the gatherings.

Historically, when the recovery stage or bullishness is strengthened, the market often searches for these unburned areas. Institution players and smart money tend to use forced liquidation to promote price momentum.

Currently, Ethereum is pulled back and is stable beyond the 2.4K support zone. However, the heatmap shows significant clearing clusters below this level, meaning an increase in vulnerability to negative sweep. This could attract strategic moves by large players, aiming to trigger stop hunts or accumulate at a better price.

In the short term, $2.4K support remains at a critical level to watch. If it is held, there could be a rebound. If it breaks, expect fluidity-driven penetration towards the cluster of stops just below the next stop.