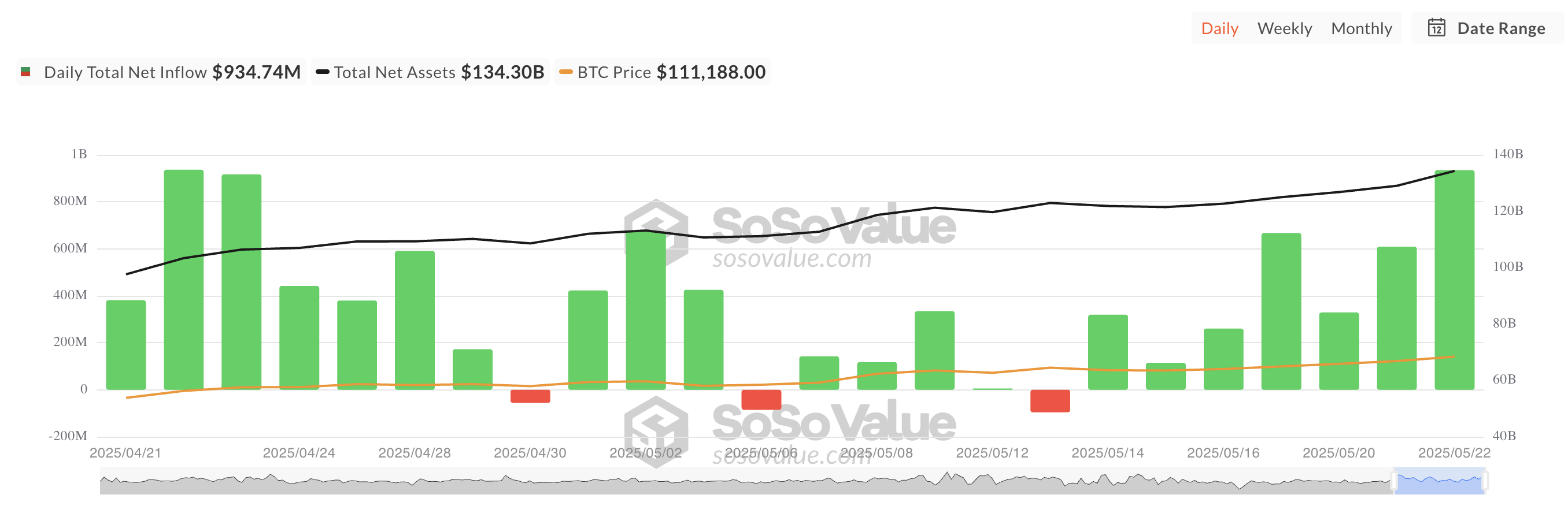

Major Bitcoin extended the rally yesterday, reaching a new all-time high of $111,968. Price performance sparked a wave of investor enthusiasm, driving more than $900 million in capital inflows into spot Bitcoin ETFs.

This marked the largest daily influx since April 22nd.

Floods on $934 million Bitcoin ETFs in a day

Yesterday, inflows into the BTC-backed fund totaled $93,474 million, the highest daily inflow since April 22nd. It also marked a seventh consecutive day of positive infringement, marking a strong revival of institutional trust this week.

Total Bitcoin Spot ETFs inflows. Source: SosoValue

This week's positive price performance of BTC served as a catalyst for new interest in ETFs. The sustained inflow suggests that investors are not only responding to short-term momentum, but also are confident in the long-term potential of their assets.

On Thursday, BlackRock's ETF IBIT recorded its biggest net inflow every day, totaling $877.18 million, bringing its total cumulative net inflow to $475.5 billion.

That day, Fidelity's ETF FBTC witnessed the second highest net inflow, attracting $48.66 million. The total historical net inflow of ETFs now reaches $11.88 billion.

BTC is pulled slightly back when traders lock their profits

BTC is currently trading at $110,752, focusing on a modest 1% decline over the past 24 hours. The slight pullback appears to be driven primarily by profitable waves following yesterday's surge to a new all-time high.

As the coins were climbing the best new ever, many short-term traders seized opportunities to lock profits, prompting a continuous decline in prices.

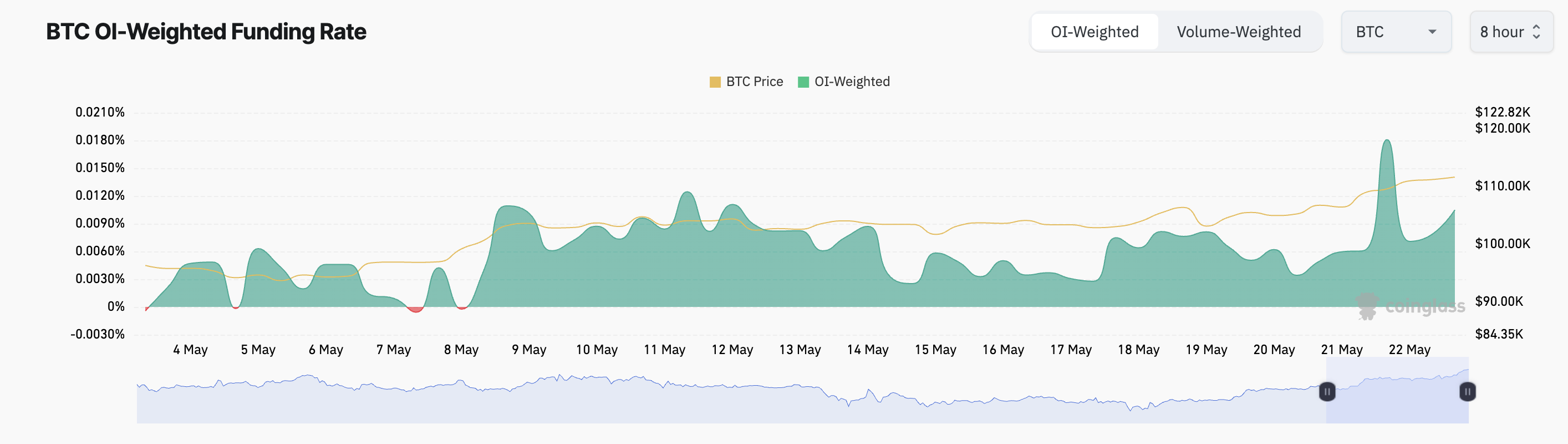

However, despite the short pullback, futures market participants have shown strong resilience and bullish confidence. This is reflected in BTC's consistently positive funding rate, indicating that traders are willing to pay premiums to hold their long positions. At press, this is 0.0105%.

BTC funding rate. Source: Coinglass

The sustained demand for leverage suggests that market participants are hoping for further increases, reinforcing the theory that recent DIP is a healthy integration rather than a bearish change in trends.

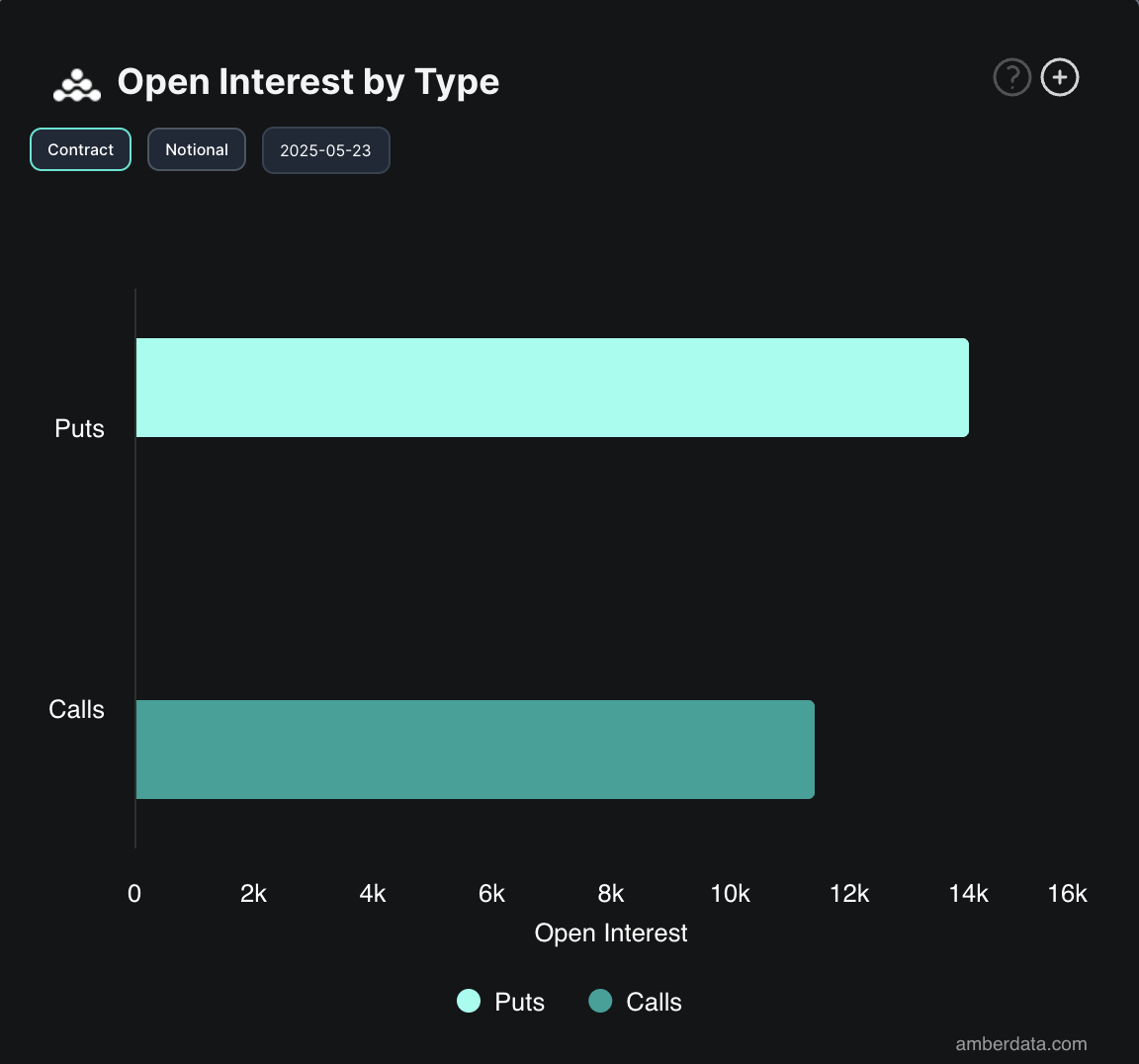

However, emotional checks in the options market make for a more careful picture. On-chain data shows that there is a greater amount of put options than today's calls, indicating that many investors are engaged in downside risk or hedging activities.

Interested in BTC options. Source: Deribit

These trends present situations where short-term attention coexists with long-term institutional optimism.