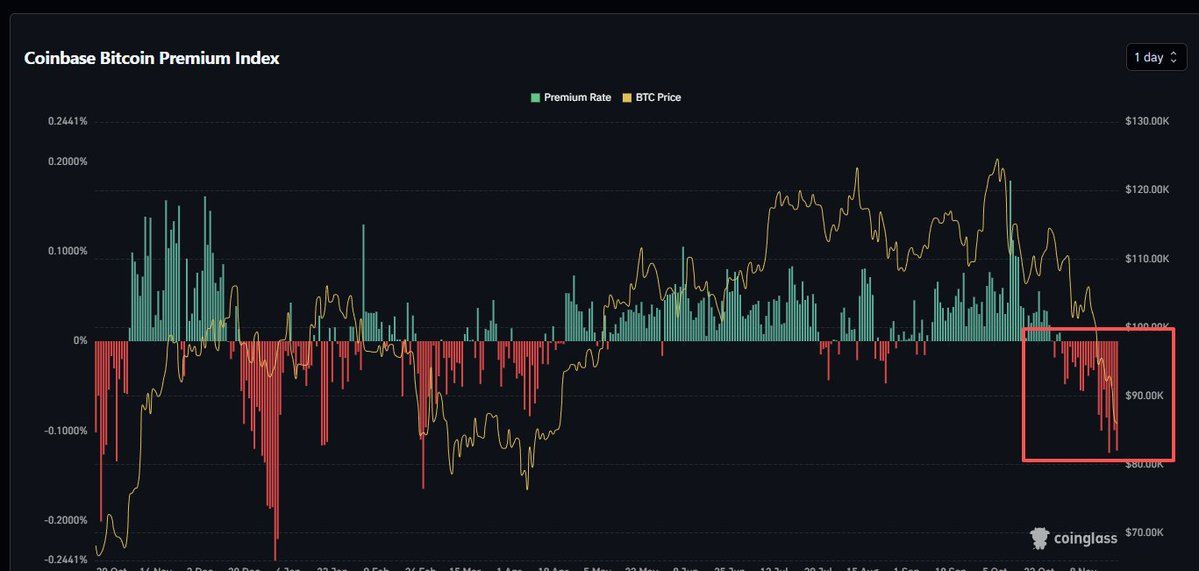

The Coinbase Bitcoin Premium Index has remained negative for 21 consecutive days, the longest negative streak in the current cycle. The index has been below zero since early November, reflecting Bitcoin's fall from nearly $120,000 to around $84,000, according to Coinglass data.

This negative premium reflects US institutional investor sentiment and indicates continued selling pressure on US-based exchanges. Analysts suggest that the market may not find a clear bottom until this trend reverses.

Understanding Coinbase Premium Index

The Coinbase Premium Index tracks the percentage difference between Bitcoin prices on Coinbase, a major US exchange that trades in USD, and Binance, where many retail traders primarily trade in USDT. A positive premium highlights the strength of US investor demand and institutional buying. In contrast, negative numbers reflect selling pressure or a decline in U.S. demand for global markets.

Coinbase Bitcoin Premium Index Continues Negative Readings, Coinglass

The current 21-day negative streak represents unprecedented growth. Typically, the index fluctuates between positive and negative territory. The Coinglass chart will display a continuous red bar, indicating continuous negative readings during this cycle. This prolonged negative situation reflects the weakness of the Bitcoin price. BTC rose above $120,000 but fell to $84,500 as of November 24, 2025.

Institutional psychology and sustained sales pressure

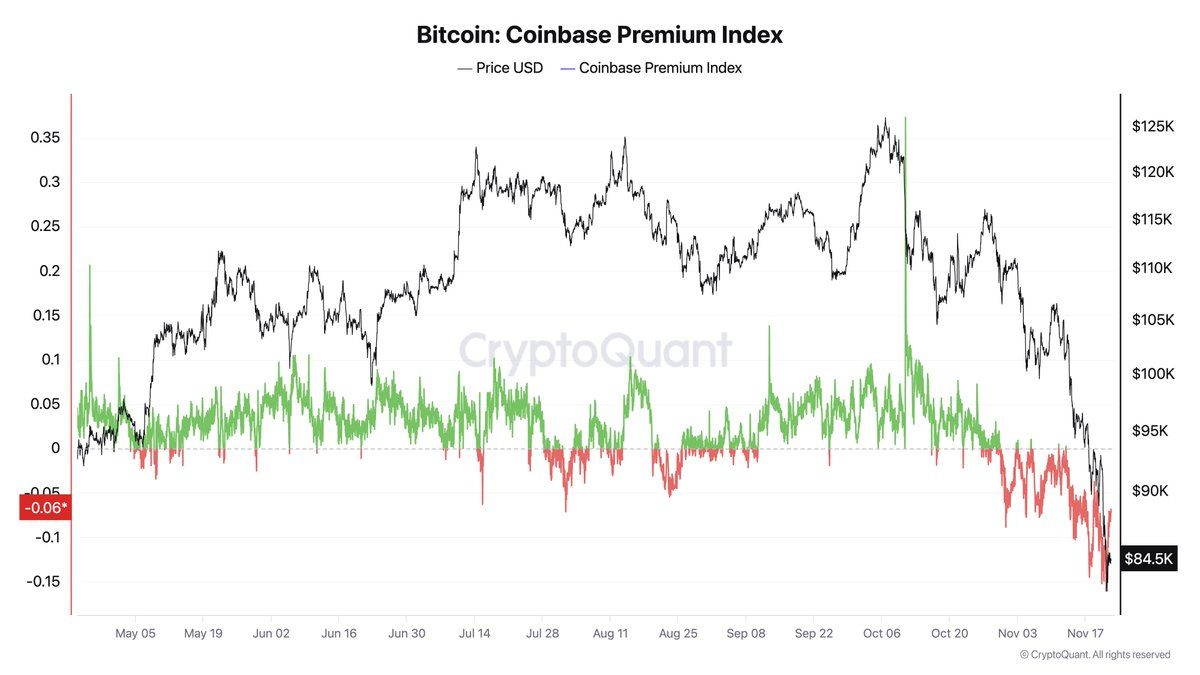

CryptoQuant CEO Ki Yong-joo emphasized that US institutional sentiment remains subdued. CryptoQuant data shows an hourly Coinbase premium of -0.06, underscoring the continued vigilance of major domestic players. The corresponding chart shows a recent sharp decline after a previous sideways movement.

The hourly Coinbase Premium Index has been trending negatively recently. Source: CryptoQuant via Ki Young Ju

Meanwhile, analyst Yanis said the recent decline was mainly due to aggressive selling by institutional investors on Coinbase rather than a retail panic. He pointed out that global buyers have not been able to absorb the selling pressure, which is hindering Bitcoin's foundation formation. Historically, reversals tend to occur when premiums return to neutral or positive, suggesting continued downside risk at this time.

Open interest data reinforces this movement, rising from below 20,000 contracts in late October to around 70,000 contracts in mid-November. An increase in open interest as the price declines typically indicates growing short positions and bearish market sentiment. These trends highlight concerns about continued selling pressure.

Weekend effects and mean reversion patterns

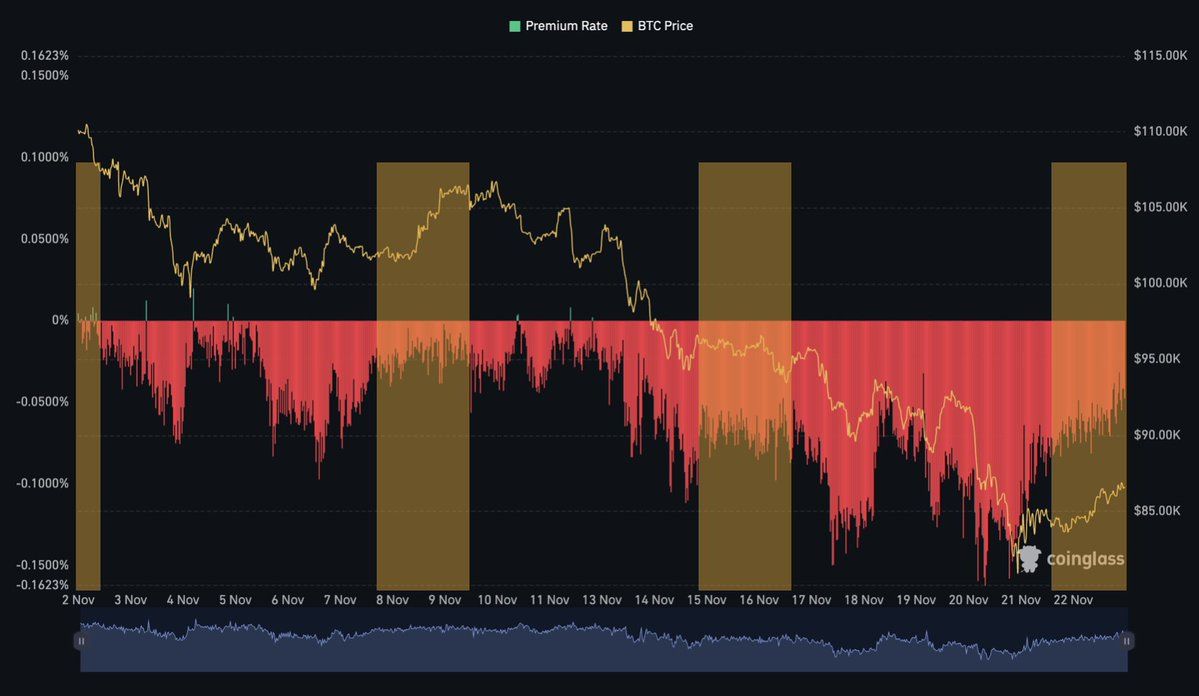

Not all analysts view negative premiums as completely bearish. market watcher crypto condom Note that there are many weekends Promote mean reversion of Coinbase premium. When ETF activity and US-based sellers pause over the weekend, premiums frequently approach zero, supporting price stability or modest increases.

Coinbase Premium shows a mean reversion pattern over the weekend. Source: CryptoCondom

This repeating weekend pattern has been emerging in recent weeks, with the shaded area on the chart indicating rising premiums and rising prices. The contrast between the “weekend rally” and the “weekday decline” highlights the impact of trade flow on Bitcoin’s short-term volatility. However, the overall weekday trend remains negative as financial institutions' activities intensify selling pressure.

These weekend effects highlight the influence of US institutions on Bitcoin's structure. A pause in demand will temporarily ease global demand. But when financial institutions re-enter the market during the week, selling resumes, often overwhelming global buyers and perpetuating the downward trend.

Market outlook and bottom price formation

The continued negative Coinbase premium indicates that Bitcoin has not yet formed a sustainable bottom. Historically, trend reversals have tended to occur after premiums have rebounded, indicating a change in institutional behavior. Until that happens, the rebound could be subdued or quickly reversed by renewed selling from the US.

Market participants are facing a difficult scenario. The current situation is similar to past capitulation phases, but the continued negative premium suggests that the selling has not yet been exhausted. Traders need to determine whether these prices indicate long-term accumulation or just a pause in a longer-term downtrend.

If Coinbase Premium turns neutral or positive, it would be a turning point indicating the end of the institutional sell-off and new demand. Until then, caution will prevail in Bitcoin trading strategies.

The post Where is the Bottom? Coinbase Bitcoin Premium Hits 21-Day Negative Streak appeared first on BeInCrypto.