Ethereum Investors appear to be pulling back again, doubling down on the leading altcoin even as the price struggles to post another significant rally. This renewed buying pressure from major investors is evidenced by the recent surge in the number of coins acquired by cumulative wallet addresses.

Ethereum Slow Price Momentum Behind

Ethereum price may be performing poorly on the surface, but behind the market noise there are issues: a noticeable change In investment sentiment. Currently, ETH investors are increasing at a rapid pace in an unstable cryptocurrency environment.

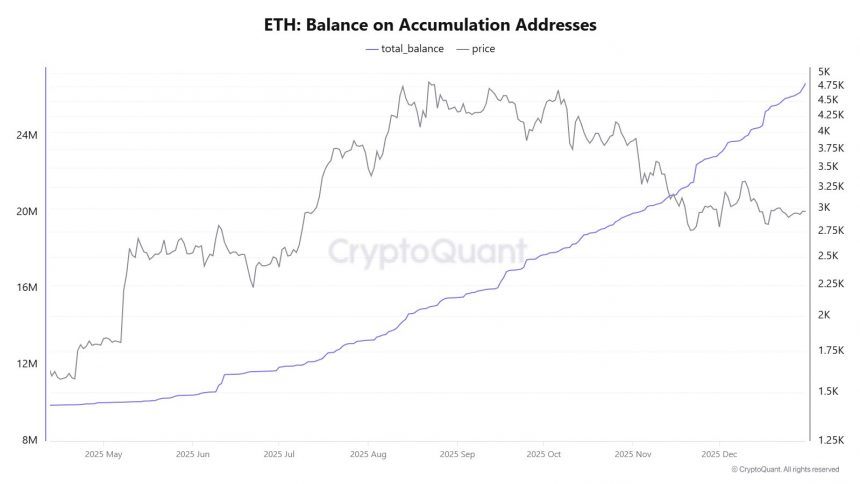

CW, a cryptocurrency analyst and data analyst, reported There has been increased buying activity as observed in the rise in the ETH balance indicator for accumulating addresses, which have historically been associated with long-term holding behavior. Investor activity opposing the price action indicates growing confidence among patient participants. Moreover, these differences indicate that strategic accumulation is at a stage of maturity, even though widespread sentiment indicates continued caution.

CW emphasizes that after the altcoin price reached around $2,800, it showed a rapid rise, with the number of ETH held by cumulative addresses increasing by 5.2 million ETH. Looking at the chart, we can see that the cumulative coin holdings of investors have increased to over 27 million ETH.

Following the downward trend Ethereum priceBuying activity by large investors or whale holders accelerated, bringing total holdings to 26.78 million ETH. This increase in whale accumulation suggests that the group is showing renewed confidence in the long-term behavior of altcoins.

CW said the buying activity is a positive sign for the Ethereum market. This action is being observed in the broader cryptocurrency market as massive accumulation is currently taking place. different coinsLike Bitcoin. As a result, the expert is confident that the market is still in an upward phase.

Large Holder Doubling ETH

According to a report by market expert Milk Road, there is a clear move towards Ethereum with large holders piling up the leading altcoin. milk road determined We do this across cohorts by examining ETH balances by holder value.

Milk Road's research primarily focused on wallet addresses between 10,000 ETH and 100,000 ETH. Data from the metric shows: accumulation The group's parabola has emerged over the past few days. This change means that strategic players can position themselves ahead of larger market movements, even though short-term price movements have been suppressed.

After years of steady decline, experts noted that these wallets are rising rapidly again and are now near all-time highs. Simply put, the biggest Ethereum Whale Back in the market, we are aggressively increasing our holdings. If this accumulation continues, it could lay the foundation for the next significant trend in ETH.

Featured image from Getty Images, chart from Tradingview.com

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards and each page is diligently reviewed by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.