- The White House Report omitted the Bitcoin Reserve Update.

- The BTC is stable at nearly $118K using bullish technical signals.

- ETF inflow and optimism about low-selling pressure fuel prices.

Bitcoin (BTC) entered its strength position in August 2025 despite growing expectations for a missed opportunity in Washington.

On July 31, the White House released its long-awaited crypto policy report, but due to disappointment from Bitcoin supporters, there was no substantial update on the strategic Bitcoin Reserve initiative originally announced in March.

Nevertheless, as the federal silence remained, market metrics revealed that BTC may be preparing for another bullish breakout.

This disconnect between regulatory direction and market performance is reconstructing emotions as traders consider both political clues and chain metrics.

The White House will not be made clear with BTC reserves

For months, Bitcoin supporters have been looking forward to the crypto policy report in July, particularly after the Trump administration signaled the pro-Bitcoin stance earlier this year.

In March, the executive order established a strategic Bitcoin Reserve, comparing it to El Salvador's bold accumulation strategy.

We were hoping that the report outlined further steps to protect or expand future BTC acquisitions by the US government.

However, the 166-page report only briefly mentions the spare initiative. Hidden in the final section, the mentions served as a summary rather than an expansion plan.

The document introduced detailed proposals on regulations, access to banks and tax reform, but failed to address whether the US would actively purchase Bitcoin as a strategic asset.

The omission has disappointed many people in the crypto community. Several analysts call it a missed opportunity, especially given the growing height of Bitcoin on the Global Assets Leaderboard.

Still, others view the tone of the report as a step forward, and Bitcoin is currently being debated independently of other digital assets. This is a clear indication of evolving awareness.

Bitcoin (BTC) is resilient despite political ambiguity

Bitcoin's performance remains strong even without direct government support from spare accumulation.

Cryptocurrency surged to a new all-time high of around $123,000 on July 14th.

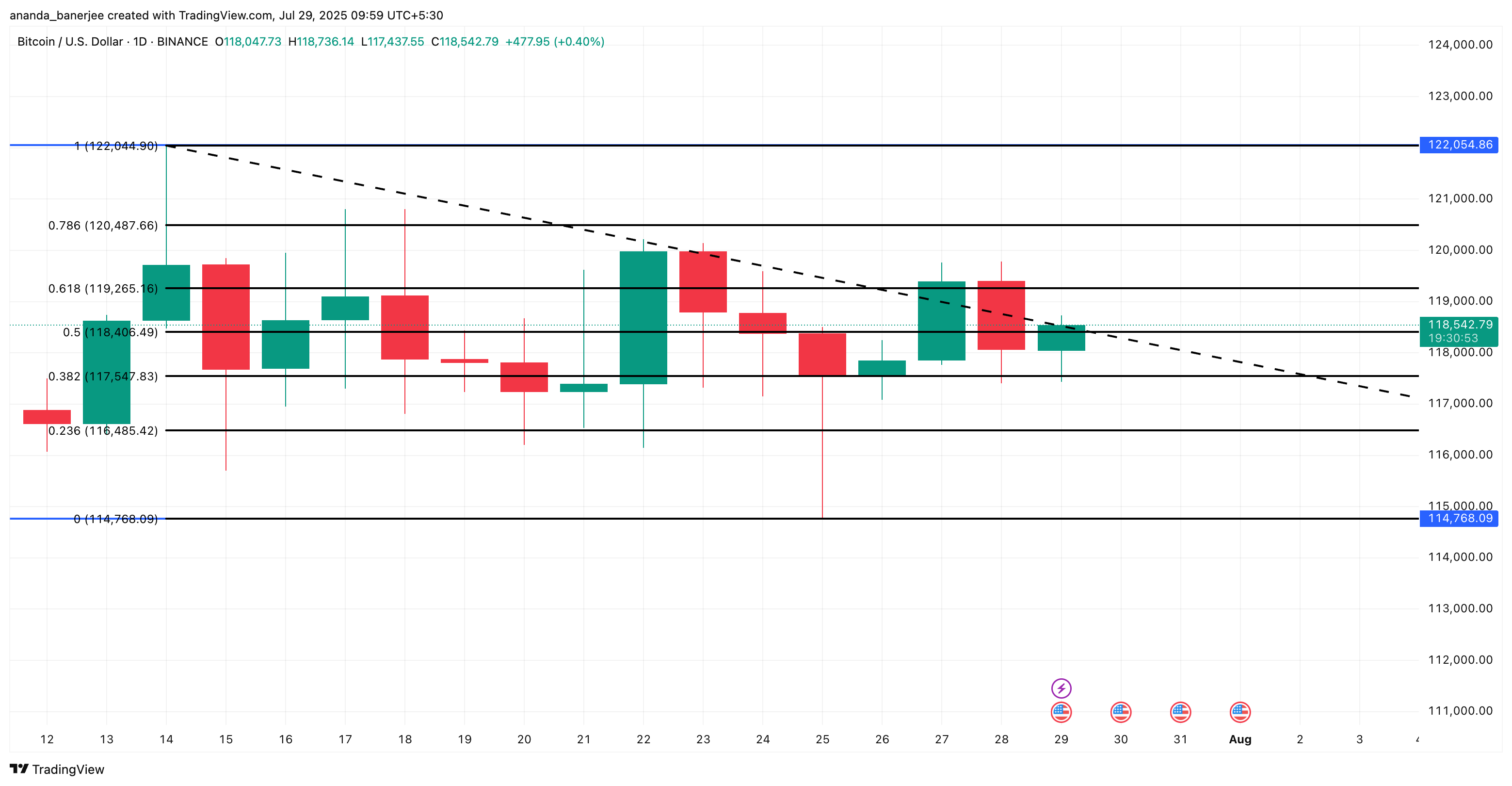

After a modest fix, it has been consolidated in a tough range of $117,000 to $118,000 and is currently trading at $118,383.

This stable behavior even comes despite the wider crypto market experiencing more dramatic fluctuations.

This contrast sparked speculation that Bitcoin prices were preparing for a sharp move. Given the current low sales pressure and growing institutional interest, upward changes could quickly gain momentum.

The Genius Law, which recently signed the law, was added to Bitcoin's Tailwinds by making Stablecoins more accessible.

Rate reductions were not realized in the latest Federal Reserve decisions, but a stable macro environment appears to provide BTC rooms for independent gatherings.

ETF influx and technical signals remain bullish

The market structure continues to support bulls. Spot Bitcoin ETF saw a massive influx in mid-July, and in just two days more than $2 billion entered the market.

BlackRock's IBIT alone holds over $80 billion in assets under management. These ETFs are currently one of the largest Bitcoin holders and own around 1.4 million BTC. This is about 6.6% of the total supply.

Technically, the MVRV ratio is currently 2.2 near the 365-day average, historically ahead of major gatherings.

The Bollinger band is tightened, with the RSI remaining neutral at 42.65, suggesting there is still room for price expansion.

Going into technical analysis, if BTC exceeds $119,900, a return to an all-time high could be quick.

Trade volumes also support this outlook. In the last 24 hours alone, Bitcoin volume has risen 12% to $700.3 billion.

This growing activity is combined with strong retention behaviour among long-term investors, indicating that upward pressure could be strengthened in the coming days.