Recent claims of a large-scale Bitcoin mining crackdown in China's Xinjiang region sent ripples through the digital asset industry this week, but data from TheMinerMag suggests the actual impact was much smaller than early reports suggested.

According to the latest Miner Weekly report, the Bitcoin network initially experienced a short-term hashrate drop related to developments in Xinjiang. However, this decline coincided with electricity cuts in the United States.

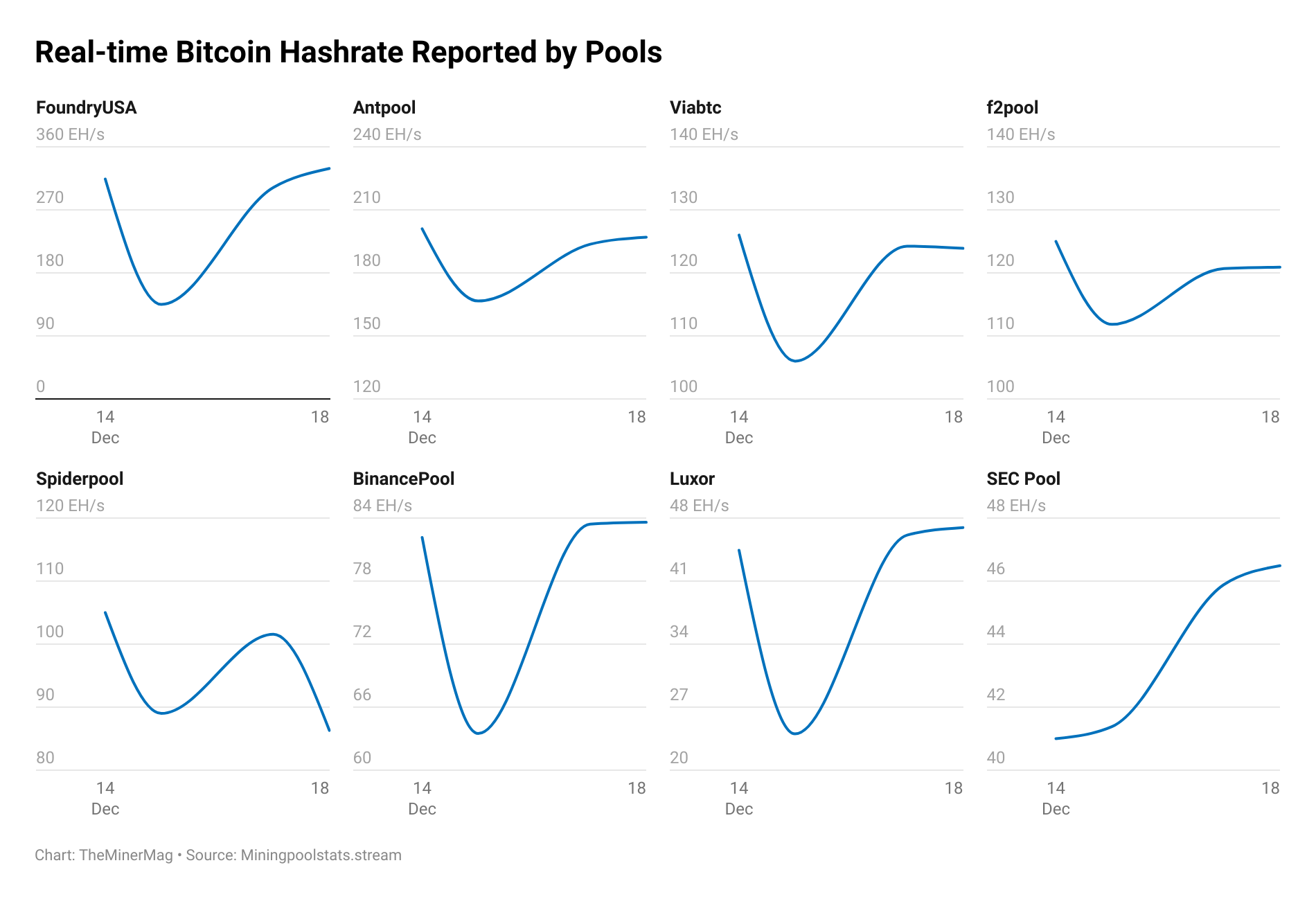

Most major mining pools recovered to near pre-dip levels within a few days, resulting in a net loss of around 20 exahashes per second, which is significantly lower than the losses of around 100 EH/s mentioned in early reports. “This is primarily indicative of a temporary disruption rather than a sustained shutdown endemic to the region,” the report said.

This distinction is meaningful for evaluating Bitcoin security and miner activity. While large and sustained declines in hashrate can impact block production and mining difficulty, exaggerating the role of single regional events risks distorting our view of global mining dynamics and exaggerating geopolitical exposure.

Mining pool data showed that the hashrate dropped sharply on Monday and then quickly recovered. Source: TheMinerMag

According to data from TheMinerMag, the biggest drop in pool levels during Monday's disruption was in North America, with Foundry USA alone reporting an estimated 180 EH/s hashrate drop.

China's mine pool recorded a combined decline of about 100 EH/s, but “it is unreasonable to attribute the entire decline to Xinjiang,” the report said.

Related: Texas grid is heating up again, but this time it's not Bitcoin miners but AI

So what happened in China?

Reports emerged this week that a crackdown on Bitcoin (BTC) mining is being resumed in China after Gong Jianping, a former executive at hardware maker Canaan, said some operations in the Xinjiang region had been shut down.

Early estimates circulating on social media suggested that as many as 400,000 to 500,000 mining machines may have gone offline.

sauce: kevin chan

However, subsequent reports and industry analysis indicated that the disruption was more likely related to compliance and operational issues rather than widespread, coordinated enforcement activity.

Beyond the temporary drop in hashrate, China-related Bitcoin mining activity has resurfaced in recent years, despite China's nationwide ban in 2021. According to data from CryptoQuant, China may account for approximately 15% to 20% of global Bitcoin mining activity.

Xinjiang in particular is attracting miners because of its abundant and relatively low-cost energy supplies. At the same time, local governments are investing heavily in data center infrastructure, with some facilities reportedly leasing excess capacity to Bitcoin miners to compensate for periodic declines in demand from other computing workloads.

Related: CryptoBiz: Mining weaknesses test Bitcoin market cycle