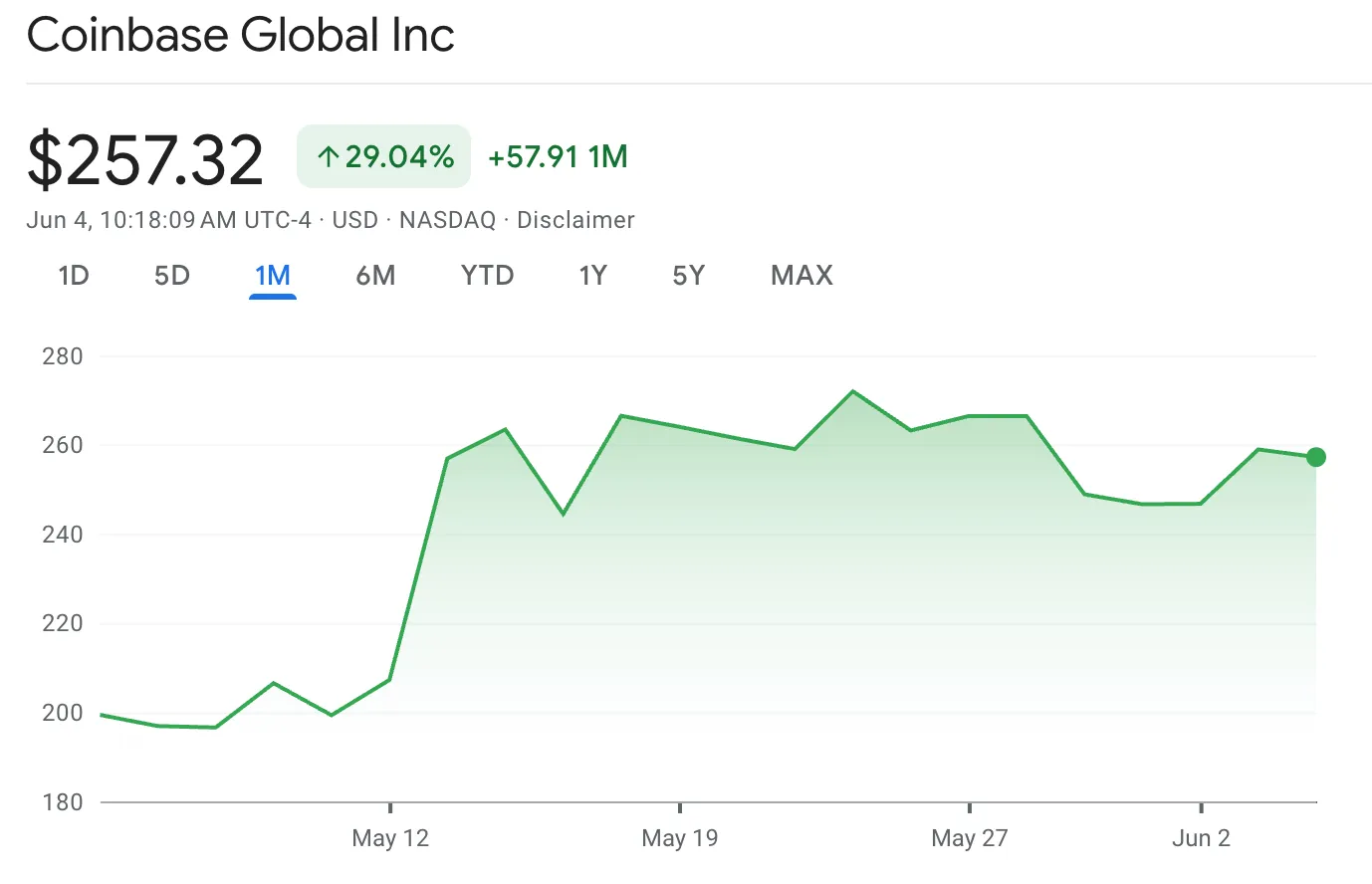

Coinbase (Coin) has increased 29.98% to $259.17 over the past 30 days. Contributing to a positive run, there was a revelation that Kevin Hassett, director of President Trump's National Economic Council, holds a significant stake in cryptocurrency exchanges worth between $10,000,000,000.

Trump's economy officials have revealed Coinbase stocks

Hassett has disclosed that he holds Coinbase stock worth between $1 million and $5 million, according to federal financial disclosures released by the Government Ethics Office.

The vested inventory position comes from Hassett's advice role on cryptocurrency exchanges before joining the Trump administration in January.

Hassett's financial disclosures show total assets worth at least $7.6 million, with Coinbase Holdings making up a significant portion of his investment portfolio. Disclosure documents remain in draft format.

Prior to her current role, Hassett served on the Academic and Regulatory Advisory Committee, which earned him a $50,001 salary from Coinbase.

This is a committee that includes other Trump-connected figures, such as Jay Clayton, a former SEC chair and current US lawyer for the Southern District of New York, and other Trump-related figures, such as Courtney Elwood, a former CIA legal counsel.

This disclosure does not indicate whether Hassett is necessary to sell Coinbase shares to avoid conflicts of interest.

Officials requesting confirmation of the Senate should detail the ethics agreement, but White House team members without verification requirements face different standards of disclosure.

Hassett's employment income was only $1.5 million more than a year before the appointment of the NEC.

This includes positions at Stanford University's Hoover Institution and the Milken Foundation, as well as $471,000 in speaking expenses from organizations including Goldman Sachs and Citigroup.

Increases by 30% in 30 days amid regulatory optimism

Coinbase Stock has announced strong performances over the past month. It rose by about 30%. The stock currently trades at $259.17, with its previous closing price of $258.91 and its daily trading range is between $257.00 and $261.56. Around the 2018 range, Coinbase has shown to fluctuate between $142.58 and $349.75.

Source: Coin Stock Performance, Google

In May 2025, Coinbase officially joined the S&P 500 Index and won the Discover Financial Services location. The stock price has skyrocketed sharply as a result of its inclusion.

Coinbase's positive trajectory is in contrast to the broader market situation that affects other cryptocurrency-related stocks.

The exchange's position as a major regulated crypto platform in the United States is to benefit from a more clear regulatory framework and trends in institutional adoption.

Despite facing exchanges due to customer data breach, coin stock is working relatively well. The data breaches were also linked to Indian customer data leaks.

Crypto Stocks See Mixed Performance

Coinbase's strong performance stands out among crypto stocks, which have shown mixed results in recent trading sessions.

According to Google Finance data, while Coinbase maintains its upward momentum, several major cryptocurrencies and blockchain adjacencies have posted declines.

Bitcoin mining company Mara Holdings (Mara) has seen challenges in the mining sector down 1.95% over the past 24 hours.

Block Inc., a payment company with cryptocurrency exposure, fell 0.72%, while MicroStrategy (MSTR), known for its substantial Bitcoin Treasury holdings, fell 1.46%. CME Group (CME), which offers cryptocurrency futures trading, also fell by 1.5%.

Source: Hood Stock Performance, Google

In contrast to these declines in crypto stock, Robinhood (Hood) managed a modest profit of 0.54%, which pales in comparison to the substantial advances of Coinbase.

The difference in performance of crypto stocks suggests that investors are making selective bets within the sector rather than accepting all cryptocurrency-related stocks widely.

This selective performance pattern indicates that not all crypto stocks benefit equally from positive regulatory developments and market sentiment.