Bitcoin fell below $90,000 this week due to a combination of liquidation pressure, weak ETF demand, and macro uncertainty.

The decline erased gains from previous attempts to reclaim the $94,000-$95,000 zone, marking the second major decline this month.

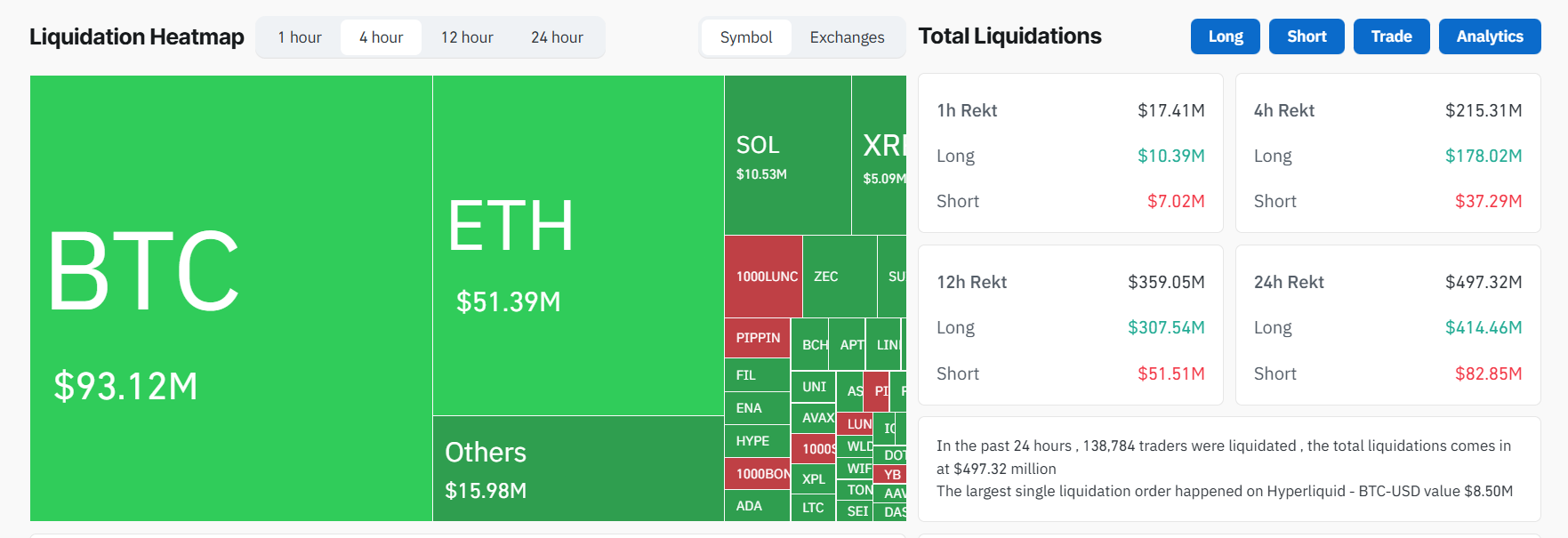

Market-wide forced liquidation

The trigger was a series of forced long-term liquidations. Approximately $500 million was wiped out across the exchange, including approximately $420 million in long positions, and more than 140,000 traders were liquidated within 24 hours.

Cryptocurrency clearing today. Source: Coin Glass

ETF flows were unable to absorb the selling. BlackRock's iShares Bitcoin Trust recorded six consecutive weeks of total outflows of more than $2.8 billion.

U.S. ETF inflows fell to just $59 million on Dec. 3, indicating less appetite from institutional investors.

The US Bitcoin ETF recorded an outflow of approximately $195 million on December 4, 2025. Source: SoSoValue

Macro pressure adds fuel to the drop

The macro background became hostile. The Bank of Japan has signaled the possibility of raising interest rates, threatening the liquidity of the carry trade that has kept the world's risky assets afloat.

Bitcoin fell into a cautious holding pattern between $91,000 and $95,000 as traders also avoided risk ahead of the US PCE inflation announcement.

BREAKING: Bitcoin soars above $1,500 after lower-than-expected PCE data. But then it crashed by -$3500 in 60 minutes.

This wiped out $155 million worth of long positions in the past hour.

There is no negative news or sudden FUD that can cause this kind of sudden dumping.

Apparently… pic.twitter.com/G3twQw0Yud

— Bull Theory (@Bull Theoryio) December 5, 2025

The latest U.S. PCE data was broadly in line with expectations, showing core inflation has declined but remains above the Fed's target.

Markets reacted cautiously, interpreting the print as evidence that inflation continues to ease, but not fast enough to warrant a rapid rate cut.

Corporate signals amplified fear. MicroStrategy warned that if its government bond valuation ratio falls, it could sell Bitcoin and cause its stock price to fall by 10%.

Energy costs rose, hashrate fell, and stress for miners increased as high-cost operators began liquidating BTC to stay solvent.

On-chain flows reflected divided sentiment. Matrixport has moved over 3,800 BTC from Binance to cold storage, suggesting there has been accumulation among long-term holders.

But analysts estimate that at current prices, a quarter of circulating supply remains underwater.

Matrixport withdrew 3,805 $BTC($352.5M) from #Binance in the last 24 hours. https://t.co/GLzqCvlogX pic.twitter.com/54whKSsISy

— Lookonchain (@lookonchain) December 5, 2025

Community sentiment shows fear – but also some optimism

Traders on social platforms debated whether the move was natural or manipulated. Market analysts primarily blamed excessive leverage, illiquidity and macro hedging rather than coordinated price intervention.

Some pointed to long-term optimism, citing JPMorgan's new 2026 pricing model of $170,000.

Bitcoin is currently trading near an important pivot. A liquidation cluster between $90,000 and $86,000 will leave the market vulnerable without new ETF inflows or easing of macro pressures.

For the recovery momentum to be confirmed, the pair needs to move back above $96,000-$106,000.

For now, the tape is dominated by volatility. Bitcoin fell, rallied, and broke again. And traders are keeping an eye on the next decisive move.

The post Why did Bitcoin drop below $90,000 again? A breakdown of the latest sell-offs appeared first on BeInCrypto.